Insurance Sales Agents

Where Would You Like to Go Next?

Or, Explore This Profession in Greater Detail...

What does this snowflake show?

What's this?

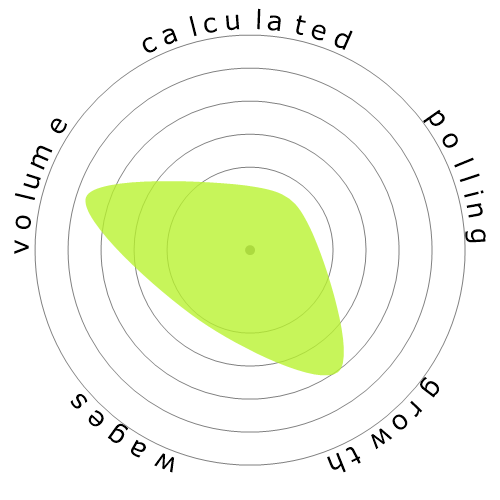

We rate jobs using four factors. These are:

- Chance of being automated

- Job growth

- Wages

- Volume of available positions

These are some key things to think about when job hunting.

People also viewed

Calculated automation risk

Imminent Risk (81-100%): Occupations in this level have an extremely high likelihood of being automated in the near future. These jobs consist primarily of repetitive, predictable tasks with little need for human judgment.

More information on what this score is, and how it is calculated is available here.

User poll

Our visitors have voted they are unsure if this occupation will be automated. However, the automation risk level we have generated suggests a much higher chance of automation: 80% chance of automation.

What do you think the risk of automation is?

What is the likelihood that Insurance Sales Agents will be replaced by robots or artificial intelligence within the next 20 years?

Sentiment

The following graph is shown where there are enough votes to produce meaningful data. It displays user poll results over time, providing a clear indication of sentiment trends.

Sentiment over time (yearly)

Growth

The number of 'Insurance Sales Agents' job openings is expected to rise 6.1% by 2033

Total employment, and estimated job openings

Updated projections are due 09-2025.

Wages

In 2023, the median annual wage for 'Insurance Sales Agents' was $59,080, or $28 per hour

'Insurance Sales Agents' were paid 22.9% higher than the national median wage, which stood at $48,060

Wages over time

Volume

As of 2023 there were 457,510 people employed as 'Insurance Sales Agents' within the United States.

This represents around 0.30% of the employed workforce across the country

Put another way, around 1 in 331 people are employed as 'Insurance Sales Agents'.

Job description

Sell life, property, casualty, health, automotive, or other types of insurance. May refer clients to independent brokers, work as an independent broker, or be employed by an insurance company.

SOC Code: 41-3021.00

Comments (25)

As for the insurance agent, AI can easily understand and sell a product. One could argue that using AI will increase the risk of E&O. That may be true, but 1) AI will improve and the E&O risk will greatly decrease and 2) The cost to use AI, and pay the salary of one or a team of specialists to maintain the AI will save so much on employee salaries (AI +3-5 people can easily replace 100+ agent departments) that the cost for E&O deductibles and possible E&O premium increase is outweighed. 100 agents making $60k/year = $6,000,000 saved.

An AI can do the same. Key in custom values and voila, a carefully crafted plan will be ready for you. And it may even analyse existing clients and suggest the most suitable plan for you. If you feel unsure about their decision and have more spare cash, you can raise the premium and decide to insure more.

Also, yes, you can buy insurance online, but I can't tell you how many times I had to go fix a problem or amend a policy because someone did it online and did not fully understand what they were doing.

Reply to comment