Financial and Investment Analysts

People also viewed

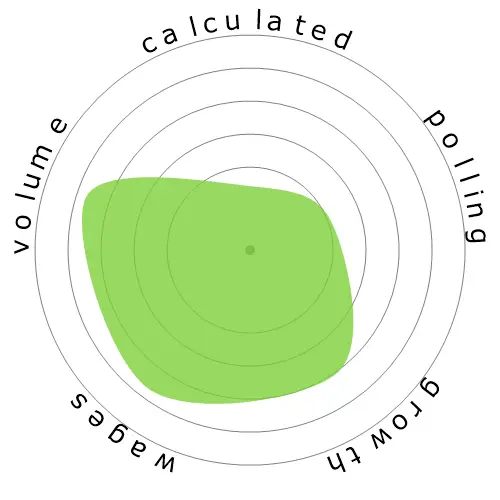

Calculated automation risk

High Risk (61-80%): Jobs in this category face a significant threat from automation, as many of their tasks can be easily automated using current or near-future technologies.

More information on what this score is, and how it is calculated is available here.

User poll

Our visitors have voted that it's probable this occupation will be automated. This assessment is further supported by the calculated automation risk level, which estimates 77% chance of automation.

What do you think the risk of automation is?

What is the likelihood that Financial and Investment Analysts will be replaced by robots or artificial intelligence within the next 20 years?

Sentiment

The following graph is included wherever there is a substantial amount of votes to render meaningful data. These visual representations display user poll results over time, providing a significant indication of sentiment trends.

Sentiment over time (quarterly)

Sentiment over time (yearly)

Growth

The number of 'Financial and Investment Analysts' job openings is expected to rise 9.5% by 2033

Total employment, and estimated job openings

Updated projections are due 09-2025.

Wages

In 2023, the median annual wage for 'Financial and Investment Analysts' was $99,010, or $47 per hour

'Financial and Investment Analysts' were paid 106.0% higher than the national median wage, which stood at $48,060

Wages over time

Volume

As of 2023 there were 325,220 people employed as 'Financial and Investment Analysts' within the United States.

This represents around 0.21% of the employed workforce across the country

Put another way, around 1 in 466 people are employed as 'Financial and Investment Analysts'.

Job description

Conduct quantitative analyses of information involving investment programs or financial data of public or private institutions, including valuation of businesses.

SOC Code: 13-2051.00

Comments

Leave a comment

Reporting activities are done by Python robots and so on.

Investment activities are being replaced by robots and AI, but we still have the issue of emotions involved. However, since companies don't usually take aggressive approaches to investments, they typically invest in fixed income.

Operational tasks are a thing of the past.

Entry-level it's pretty much just data entry, things that can easily be automated.

On higher levels, it requires decision making, data analysis, and other skills that will be out of any computer's reach for quite some time still.

Overall it's fairly safe from automation as of now. The human brain is still the single best pattern recognition system that we know of and pattern recognition is a large part of Financial Analysis.

However, the Finance Industry requires analysis in association with human bias and understanding, so the very nature of financial analysts is likely not replicable by automation or AI easily.

Unless, everything is automated. But that would mean a large majority of jobs would be gone in every industry.

The machine learning algorithms already can identify data insights and generate data visualizations based on the information.

Financial Analysts work will shift away from data flattening to asking questions about the data.

In the next decade, rather than the CFO asking questions for the lines of business to bring back information, they can text chat a bot to serve up in the information across the entire enterprise. This has implications on existing organizational hierarchies. I would expect a reduction in growth rate of this industry.

a machine can be fed information, divide it based on rules you've set for it, but it cannot make decisions or influence others because of political and socioeconomic trends.

Further more, the statement 'rules you've set for it' is an admission of your own ignorance, since it is through

development of artificial intelligence and machine learning that the likelihood of replacement through automation is even a threat to any industry.

Tldr, robots are becoming better financial analysts every single day.

Leave a reply about this occupation