Accountants and Auditors

People also viewed

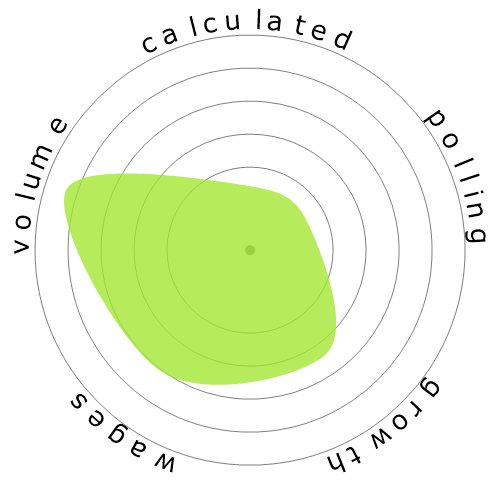

Calculated automation risk

High Risk (61-80%): Jobs in this category face a significant threat from automation, as many of their tasks can be easily automated using current or near-future technologies.

More information on what this score is, and how it is calculated is available here.

User poll

Our visitors have voted they are unsure if this occupation will be automated. However, the automation risk level we have generated suggests a much higher chance of automation: 69% chance of automation.

What do you think the risk of automation is?

What is the likelihood that Accountants and Auditors will be replaced by robots or artificial intelligence within the next 20 years?

Sentiment

The following graph is included wherever there is a substantial amount of votes to render meaningful data. These visual representations display user poll results over time, providing a significant indication of sentiment trends.

Sentiment over time (quarterly)

Sentiment over time (yearly)

Growth

The number of 'Accountants and Auditors' job openings is expected to rise 5.8% by 2033

Total employment, and estimated job openings

Updated projections are due 09-2025.

Wages

In 2023, the median annual wage for 'Accountants and Auditors' was $79,880, or $38 per hour

'Accountants and Auditors' were paid 66.2% higher than the national median wage, which stood at $48,060

Wages over time

Volume

As of 2023 there were 1,435,770 people employed as 'Accountants and Auditors' within the United States.

This represents around 0.9% of the employed workforce across the country

Put another way, around 1 in 105 people are employed as 'Accountants and Auditors'.

Job description

Examine, analyze, and interpret accounting records to prepare financial statements, give advice, or audit and evaluate statements prepared by others. Install or advise on systems of recording costs or other financial and budgetary data.

SOC Code: 13-2011.00

Comments

Leave a comment

The limitations of AI include that it cannot exercise judgment, creativity, and emotional intelligence, which make it certain that humans will continue to be required for complex problem-solving, regulatory oversight, and the instillation of trust in stakeholders. Instead of replacing them, AI will enhance the capability of humans; this will be a partnership where accountants use AI to enhance efficiency and concentrate on higher-value activities.

Upskilling in AI, data analytics, and strategic decision-making will be necessary for accountants to remain relevant in the future..

- my advice to current accountant or students of accounting : don't worry about the future.

- my advice for future of potential students of accounting : do not chose this field if you have the choice because it will be saturated and the demand will decrease.

it is difficult fot robbot to replace humans in preparing accounts,preparing an income statement,and solving proplems because it requires logical thinking,unlike what is found in a robot,as it is programmed and trained to execute commands

• Developing test strategies for AI-based accounting and financial systems

• Designing and overseeing the execution of test cases for AI-based accounting and financial systems

• Understanding the specific requirements for testing AI-based accounting and financial systems

To effectively perform these tasks, accountants and auditors must acquire new skills in analyzing algorithms and models from an accounting standpoint. This will enable them to establish and evaluate new controls for AI-generated financial data and ensure ongoing compliance with these controls.

While accountants and auditors are already skilled in managing the collection, cleaning, and validation of test data, they currently face challenges in performance and security testing. However, with the assistance of AI and further education, they will become adept at continuously verifying the accuracy of AI-based accounting and financial systems in real-time environments.

As a result, accountants and auditors will be increasingly relied upon to seamlessly integrate AI-based accounting and financial systems with real-time environments. They will need to continuously monitor and audit AI-generated financial data, ensuring error-free performance, and validating security measures to safeguard the system against cyber-attacks

Similarly, in fields like law, people are reluctant to trust machines to draft legal documents or represent them in court because of the financial stakes involved. There's a fear that mistakes could be costly. Additionally, companies are wary of outsourcing these tasks offshore due to concerns about the security of their financial data.

In essence, the reluctance to automate accounting and legal processes stems from the inherent risks and the sensitivity of financial transactions, as well as concerns about maintaining control and data security.

In order to offer the most valuable and timely advice on any AI system used in finance, both accountants and auditors will need to consistently monitor the inputs and outputs of the installed software. To do this, they will have to explore innovative methods to establish new controls for AI-generated financial data. They will be responsible for developing new systems to assess the efficacy of these controls, in addition to being the ones tasked with consistently ensuring compliance with these new controls.

Unlike other professions, Accounting and Auditing require specialized skills that most individuals in an organization lack without rigorous training. The level of training needed to certify Accounting AI outputs is comparable to becoming an accountant. Given accountants' proficiency in analyzing financial records, they are the most qualified to verify the accuracy and reliability of AI-generated financial data. Neglecting monitoring by accountants and auditors will expose companies to increased scrutiny from investors and regulators.

As the digital landscape expands and virtual transactions become increasingly prevalent, companies will need to expand their hiring of Accountants and Auditors to ensure that every transaction processed by their AI Accounting software meets set performance standards. Accountants will play a growing role in setting up, adhering to, and evaluating controls for auditing AI-generated data. The responsibilities of Accountants and Auditors will include conducting thorough assessments to verify the integrity of operations and reports within these organizations.

While accountants are already required to complete continuous education requirements annually, their curriculums will now need to be updated to place a greater emphasis on the management of AI and quality assurance processes to ensure that these systems are performing at a level that meets International Accounting Standards.

Without accountants' oversight, AI-generated results cannot be reliably verified for accuracy, completeness, reliability, and relevance. With the increasing volume of financial data, the demand for accountants will rise to validate datasets used by AI models for decision-making. Furthermore, there will be an increased need for accountants to evaluate the reliability of outputs produced by AI models.

Our society cannot rely solely on the elites' technologies to determine whether they are paying their fair share of taxes. The government will always have to pursue the wealthy to ensure they pay their fair share of taxes, while individuals will always seek legal ways to avoid paying taxes. Advanced technologies such as blockchain and artificial intelligence will enable individuals to find more innovative ways to evade taxes, making it difficult for authorities to prosecute those who are guilty of tax evasion.

For this reason, accountants and auditors will always be required to verify whether the technologies that are being used to evaluate whether individuals and entities are tax compliant are accurate.

Society cannot solely rely on Big Tech to evaluate financial statements, as they have proven themselves to be untrustworthy in many situations. For example, numerous antitrust investigations have been launched against them, revealing unscrupulous behavior. It is questionable whether society would be willing to place all their confidence in the hands of a few Tech billionaires, who will be willing to prioritize their political, corporate, and financial interests over society's well-being.

In conclusion, relying solely on Tech Billionaires and other elites to pay their fair share of taxes and evaluate financial statements poses significant perils. It is crucial to have independent human auditors to ensure accuracy and reliability and prevent conflicts of interest that may arise if the elites desire to further enrich themselves at society's expense.

2. The AI everyone is familiar with right now will get worse over time as they pull bad information, and produce more bad information, which becomes a self-reinforcing cycle. Lazy people producing bad articles by using lazy methods (AI) to write for them, will put out more bad information for the ChatGPT's to train on, making the next most likely word the system pulls up the bad information rather than the good. Frankly, it seems more likely that these systems were as good as they'd ever be before people started abusing them. These companies aren't going to pay experts to identify between good and bad medical or legal information. They're not going to pay to identify good and bad accounting either.

Sorry, future enthusiast tech bros.

Leave a reply about this occupation