个人财务顾问

您接下来想去哪里?

或者,更深入地探索这个职业...

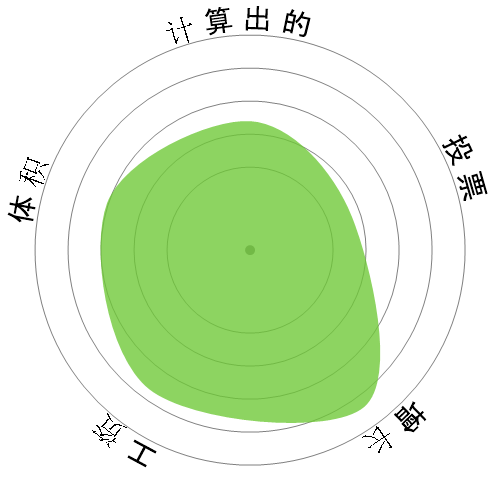

这个雪花图案展示了什么?

这是什么?

我们使用四个因素对工作进行评分。这些是:

- 被自动化的可能性

- 工作增长

- 工资

- 可用职位的数量

这些是求职时需要考虑的一些关键事项。

人们还浏览了

计算自动化风险

中等风险(41-60%):中等风险的职业通常涉及常规任务,但仍需要一些人类的判断和交互。

有关这个分数是什么以及如何计算的更多信息可在这里找到。

用户投票

我们的访客投票表示,他们不确定这个职业是否会被自动化。 这个评估进一步得到了通过计算得出的自动化风险等级的支持,该等级预计有43%的机会实现自动化。

你认为自动化的风险是什么?

个人财务顾问在未来20年内被机器人或人工智能取代的可能性有多大?

情感

以下图表显示了在有足够投票的情况下生成的有意义数据。它展示了用户投票结果随时间的变化,清晰地指示了情感趋势。

随着时间(每年)的情绪变化

增长

预计"Personal Financial Advisors"的工作空缺数量将在2033内增长17.1%

总就业人数和预计的职位空缺

更新的预测将在09-2025到期.

工资

在2023,'Personal Financial Advisors'的年度中位数工资为$99,580,或每小时$48。

'Personal Financial Advisors'的薪资比全国中位工资高107.2%,全国中位工资为$48,060。

随着时间推移的工资

体积

截至2023,在美国有272,190人被雇佣为'Personal Financial Advisors'。

这代表了全国就业劳动力的大约0.18%

换句话说,大约每557人中就有1人被雇佣为“Personal Financial Advisors”。

工作描述

使用税务和投资策略、证券、保险、养老计划和房地产的知识为客户提供财务规划建议。职责包括评估客户的资产、负债、现金流、保险覆盖范围、税务状况和财务目标。也可能为客户买卖财务资产。

SOC Code: 13-2052.00

评论 (30)

How can one relate to a line of code, or trust that the programmers inherent biases are not skewing the results?

I’m completely on the fence when it comes to which jobs and when AI will replace the human workforce. I don’t underestimate the ambitions of tech producers and the average human being's preference for the quick, easy, and cheaper option to bring about such a situation. And let’s not forget how far technology has come since the Internet, let alone the simple calculator.

All this said we shouldn’t think that the scenario where AI could replace the human workforce is one that’s predetermined. “We” (everyone single one of us) have the collective ability to cause or prevent such an eventuality. We must also consider how viable an AI-dominated society and economy would really be. Every government across the globe would have its hands cut out with a population whose majority is unemployable. Imagine the civil unrest? Another consideration is the damage this could do to the economy; if a massive portion of humanity isn’t working, and isn’t getting a wage like they used to, we would see an unprecedented reduction in the flow of money around the economy. And what happens to money when there is a lack of exchange taking place? Doesn’t the value of money decrease? The financial advisors in this forum would be the best to elaborate on this or to correct my statement.

In conclusion: while I have no doubt that the ambitious tech lords and their acolytes will do what they can to bring about an AI world, the question of whether humans from governments to ordinary citizens will allow it is another thing altogether.

回复评论