财务和投资分析师

您接下来想去哪里?

或者,更深入地探索这个职业...

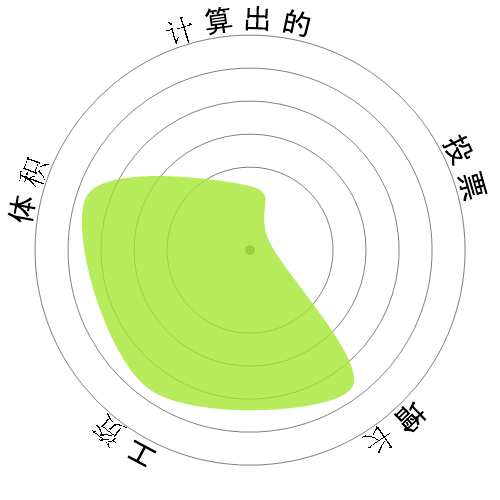

这个雪花图案展示了什么?

这是什么?

我们使用四个因素对工作进行评分。这些是:

- 被自动化的可能性

- 工作增长

- 工资

- 可用职位的数量

这些是求职时需要考虑的一些关键事项。

人们还浏览了

计算自动化风险

高风险(61-80%):这个类别的工作面临着来自自动化的重大威胁,因为他们的许多任务可以使用当前或近期的技术轻松自动化。

有关这个分数是什么以及如何计算的更多信息可在这里找到。

用户投票

我们的访客投票认为,这个职业很可能会被自动化。 这个评估进一步得到了通过计算得出的自动化风险等级的支持,该等级预计有77%的机会实现自动化。

你认为自动化的风险是什么?

财务和投资分析师在未来20年内被机器人或人工智能取代的可能性有多大?

情感

以下图表显示了在有足够投票的情况下生成的有意义数据。它展示了用户投票结果随时间的变化,清晰地指示了情感趋势。

随着时间的推移的情绪(季度)

随着时间(每年)的情绪变化

增长

预计"Financial and Investment Analysts"的工作空缺数量将在2033内增长9.5%

总就业人数和预计的职位空缺

更新的预测将在09-2025到期.

工资

在2023,'Financial and Investment Analysts'的年度中位数工资为$99,010,或每小时$48。

'Financial and Investment Analysts'的薪资比全国中位工资高106.0%,全国中位工资为$48,060。

随着时间推移的工资

体积

截至2023,在美国有325,220人被雇佣为'Financial and Investment Analysts'。

这代表了全国就业劳动力的大约0.21%

换句话说,大约每466人中就有1人被雇佣为“Financial and Investment Analysts”。

工作描述

进行定量分析,涉及公共或私人机构的投资计划或财务数据,包括对企业的估值。

SOC Code: 13-2051.00

评论 (34)

It's already been attempted for decades to automate wall street most well known example being Blackrock's Aladdin

Then there's the technical work done by hedge funds most notably Medallion.

Even if the stock market truly was fully automated it would already be priced in and become worthless

A good trading strategy actually requires some subjectivity specifically for preventing arbitrage by quants.

I really don't think AI is going to change much, the innovation that's needed to generate Alpha can't be done by AI

TL;DR it can't be fully automated, if it could it already would have been

Reporting activities are done by Python robots and so on.

Investment activities are being replaced by robots and AI, but we still have the issue of emotions involved. However, since companies don't usually take aggressive approaches to investments, they typically invest in fixed income.

Operational tasks are a thing of the past.

回复评论