会计师和审计师

您接下来想去哪里?

或者,更深入地探索这个职业...

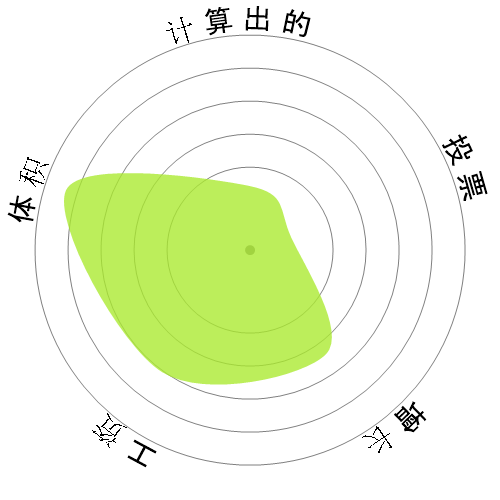

这个雪花图案展示了什么?

这是什么?

我们使用四个因素对工作进行评分。这些是:

- 被自动化的可能性

- 工作增长

- 工资

- 可用职位的数量

这些是求职时需要考虑的一些关键事项。

人们还浏览了

计算自动化风险

高风险(61-80%):这个类别的工作面临着来自自动化的重大威胁,因为他们的许多任务可以使用当前或近期的技术轻松自动化。

有关这个分数是什么以及如何计算的更多信息可在这里找到。

用户投票

我们的访客投票认为,这个职业很可能会被自动化。 这个评估进一步得到了通过计算得出的自动化风险等级的支持,该等级预计有69%的机会实现自动化。

你认为自动化的风险是什么?

会计师和审计师在未来20年内被机器人或人工智能取代的可能性有多大?

情感

以下图表显示了在有足够投票的情况下生成的有意义数据。它展示了用户投票结果随时间的变化,清晰地指示了情感趋势。

随着时间的推移的情绪(季度)

随着时间(每年)的情绪变化

增长

预计"Accountants and Auditors"的工作空缺数量将在2033内增长5.8%

总就业人数和预计的职位空缺

更新的预测将在09-2025到期.

工资

在2023,'Accountants and Auditors'的年度中位数工资为$79,880,或每小时$38。

'Accountants and Auditors'的薪资比全国中位工资高66.2%,全国中位工资为$48,060。

随着时间推移的工资

体积

截至2023,在美国有1,435,770人被雇佣为'Accountants and Auditors'。

这代表了全国就业劳动力的大约0.9%

换句话说,大约每105人中就有1人被雇佣为“Accountants and Auditors”。

工作描述

检查、分析并解读会计记录以准备财务报表,提供建议,或审计和评估他人准备的报表。安装或建议有关记录成本或其他财务和预算数据的系统。

SOC Code: 13-2011.00

评论 (172)

• Developing test strategies for AI-based accounting and financial systems

• Designing and overseeing the execution of test cases for AI-based accounting and financial systems

• Understanding the specific requirements for testing AI-based accounting and financial systems

To effectively perform these tasks, accountants and auditors must acquire new skills in analyzing algorithms and models from an accounting standpoint. This will enable them to establish and evaluate new controls for AI-generated financial data and ensure ongoing compliance with these controls.

While accountants and auditors are already skilled in managing the collection, cleaning, and validation of test data, they currently face challenges in performance and security testing. However, with the assistance of AI and further education, they will become adept at continuously verifying the accuracy of AI-based accounting and financial systems in real-time environments.

As a result, accountants and auditors will be increasingly relied upon to seamlessly integrate AI-based accounting and financial systems with real-time environments. They will need to continuously monitor and audit AI-generated financial data, ensuring error-free performance, and validating security measures to safeguard the system against cyber-attacks

The first accounting jobs to go the way of the dinosaur and telephone operator will be those that are repetitive and don’t require a significant level of judgment, such as bookkeepers and accounting clerks (AR, AP, payroll, purchasing, etc.). A lot of lower-level tax work (data entry, etc.) will likely be automated.

As for auditing, some aspects will likely be taken over by AI, and for the better. A significant amount of transaction-level testing and confirmations will likely be performed by AI, and AI will be a valuable assist for designing and performing analytical procedures.

This will in turn create the need to audit the AI systems and algorithms, like how outsourcing and automation led to the standards in SSAE 18 and framework for SOC reports. There will also be an increased demand for consulting and advisory roles as clients look to implement AI technologies.

AI will help auditors be more efficient by spending less time on rote tasks. It will help auditors design stronger audit procedures, obtain better audit evidence, and improve realization. It will also free up more time to build client relationships and improve the busy season work-life balance. This will translate to more meaningful and fulfilling work and less burnout.

I’m old enough to remember the Y2K hysteria and fearmongering about computers taking everyone’s job. All of this “AI is going to take everyone’s job” strikes the same pessimistic tone.

The limitations of AI include that it cannot exercise judgment, creativity, and emotional intelligence, which make it certain that humans will continue to be required for complex problem-solving, regulatory oversight, and the instillation of trust in stakeholders. Instead of replacing them, AI will enhance the capability of humans; this will be a partnership where accountants use AI to enhance efficiency and concentrate on higher-value activities.

Upskilling in AI, data analytics, and strategic decision-making will be necessary for accountants to remain relevant in the future..

Society cannot solely rely on Big Tech to evaluate financial statements, as they have proven themselves to be untrustworthy in many situations. For example, numerous antitrust investigations have been launched against them, revealing unscrupulous behavior. It is questionable whether society would be willing to place all their confidence in the hands of a few Tech billionaires, who will be willing to prioritize their political, corporate, and financial interests over society's well-being.

In conclusion, relying solely on Tech Billionaires and other elites to pay their fair share of taxes and evaluate financial statements poses significant perils. It is crucial to have independent human auditors to ensure accuracy and reliability and prevent conflicts of interest that may arise if the elites desire to further enrich themselves at society's expense.

In order to offer the most valuable and timely advice on any AI system used in finance, both accountants and auditors will need to consistently monitor the inputs and outputs of the installed software. To do this, they will have to explore innovative methods to establish new controls for AI-generated financial data. They will be responsible for developing new systems to assess the efficacy of these controls, in addition to being the ones tasked with consistently ensuring compliance with these new controls.

Our society cannot rely solely on the elites' technologies to determine whether they are paying their fair share of taxes. The government will always have to pursue the wealthy to ensure they pay their fair share of taxes, while individuals will always seek legal ways to avoid paying taxes. Advanced technologies such as blockchain and artificial intelligence will enable individuals to find more innovative ways to evade taxes, making it difficult for authorities to prosecute those who are guilty of tax evasion.

For this reason, accountants and auditors will always be required to verify whether the technologies that are being used to evaluate whether individuals and entities are tax compliant are accurate.

Similarly, in fields like law, people are reluctant to trust machines to draft legal documents or represent them in court because of the financial stakes involved. There's a fear that mistakes could be costly. Additionally, companies are wary of outsourcing these tasks offshore due to concerns about the security of their financial data.

In essence, the reluctance to automate accounting and legal processes stems from the inherent risks and the sensitivity of financial transactions, as well as concerns about maintaining control and data security.

Unlike other professions, Accounting and Auditing require specialized skills that most individuals in an organization lack without rigorous training. The level of training needed to certify Accounting AI outputs is comparable to becoming an accountant. Given accountants' proficiency in analyzing financial records, they are the most qualified to verify the accuracy and reliability of AI-generated financial data. Neglecting monitoring by accountants and auditors will expose companies to increased scrutiny from investors and regulators.

As the digital landscape expands and virtual transactions become increasingly prevalent, companies will need to expand their hiring of Accountants and Auditors to ensure that every transaction processed by their AI Accounting software meets set performance standards. Accountants will play a growing role in setting up, adhering to, and evaluating controls for auditing AI-generated data. The responsibilities of Accountants and Auditors will include conducting thorough assessments to verify the integrity of operations and reports within these organizations.

While accountants are already required to complete continuous education requirements annually, their curriculums will now need to be updated to place a greater emphasis on the management of AI and quality assurance processes to ensure that these systems are performing at a level that meets International Accounting Standards.

Auditing is fully automated using CAAT (Computer Assisted Aided Technics). I experienced it in Dubai in 2021

Without accountants' oversight, AI-generated results cannot be reliably verified for accuracy, completeness, reliability, and relevance. With the increasing volume of financial data, the demand for accountants will rise to validate datasets used by AI models for decision-making. Furthermore, there will be an increased need for accountants to evaluate the reliability of outputs produced by AI models.

回复评论