保险承保人

您接下来想去哪里?

或者,更深入地探索这个职业...

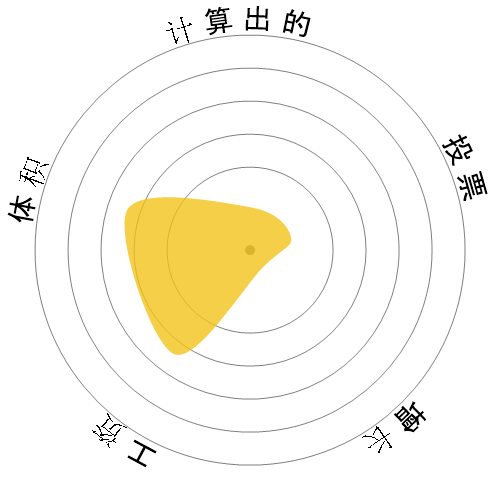

这个雪花图案展示了什么?

这是什么?

我们使用四个因素对工作进行评分。这些是:

- 被自动化的可能性

- 工作增长

- 工资

- 可用职位的数量

这些是求职时需要考虑的一些关键事项。

人们还浏览了

计算自动化风险

迫在眉睫的风险(81-100%):这个等级的职业在不久的将来有极高的可能被自动化。这些工作主要包括重复性高、可预测的任务,几乎不需要人类的判断。

有关这个分数是什么以及如何计算的更多信息可在这里找到。

用户投票

我们的访客投票认为,这个职业很可能会被自动化。 这个评估进一步得到了通过计算得出的自动化风险等级的支持,该等级预计有83%的机会实现自动化。

你认为自动化的风险是什么?

保险承保人在未来20年内被机器人或人工智能取代的可能性有多大?

情感

以下图表显示了在有足够投票的情况下生成的有意义数据。它展示了用户投票结果随时间的变化,清晰地指示了情感趋势。

随着时间(每年)的情绪变化

增长

预计到2033,"Insurance Underwriters"职位的空缺数量将减少4.0%。

总就业人数和预计的职位空缺

更新的预测将在09-2025到期.

工资

在2023,'Insurance Underwriters'的年度中位数工资为$77,860,或每小时$37。

'Insurance Underwriters'的薪资比全国中位工资高62.0%,全国中位工资为$48,060。

随着时间推移的工资

体积

截至2023,在美国有101,310人被雇佣为'Insurance Underwriters'。

这代表了全国就业劳动力的大约0.07%

换句话说,大约每1 千人中就有1人被雇佣为“Insurance Underwriters”。

工作描述

审查个人保险申请,以评估所涉及的风险程度并确定是否接受申请。

SOC Code: 13-2053.00

评论 (8)

I am considering entering insurance underwriting because claims were very bad, I must say.

Would you say that computer automation is taking over all areas of underwriting (commercial underwriting, property & casualty underwriting, etc.)? I do hear that it is taking personal insurance by storm.

Also, I am REALLY trying hard to find similar jobs to underwriting/insurance in case underwriting doesn't work out.

I'm looking at cost estimating (outside of construction), property assessment, and budget analysis. According to the Bureau of Labor Statistics, you don't necessarily need a business or finance degree to go into these fields (I took several traditional/core business classes in school, and I also majored in a field much like "business psychology" - organizational development, which was in the business school).

Do you have any alternatives that you plan to explore in case you have to leave underwriting? Do you think any of the ones that I mentioned are feasible alternatives?

Thank you,

Carl Daniel

Do you mean to say that this definition removes the need for an underwriter? - "Review individual applications for insurance to evaluate the degree of risk involved and determine the acceptance of applications."

Oh, sorry, I just realized that you mentioned that this definition only applies to line underwriting, and that automation will decrease the need for line underwriters.

Thank you for clarifying that there are two types of underwriting - I wasn't aware of that. Underwriting is the only field in insurance that interests me, but I'm not into sales. I've been working in claims (and subrogation) for years, but it's not my cup of tea.

Since I don't have the educational background to be an actuary, underwriting is pretty much the only option left for me.

I've never heard of staff underwriting before - unfortunately, working in claims didn't teach me much about underwriting.

It seems like staff underwriting is the future of employment in underwriting.

You mentioned that commercial insurance/underwriting is hard to predict due to the constantly evolving and complex nature of insurance.

I'm considering getting my Associates in Commercial Underwriting while I search for a job in underwriting.

What do you think about the future of employment in commercial underwriting? Do you think there's any hope for cautious optimism, especially for staff underwriters in commercial underwriting?

Thank you,

Carl Daniel

回复评论