保险销售代理人

人们还浏览了

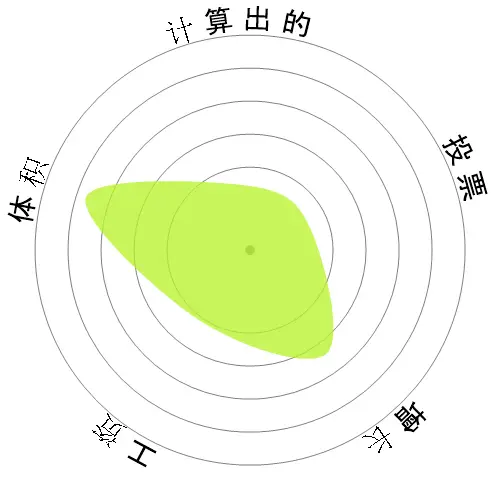

计算自动化风险

迫在眉睫的风险(81-100%):这个等级的职业在不久的将来有极高的可能被自动化。这些工作主要包括重复性高、可预测的任务,几乎不需要人类的判断。

有关这个分数是什么以及如何计算的更多信息可在这里找到。

用户投票

我们的访客投票表示,他们不确定这个职业是否会被自动化。 然而,我们生成的自动化风险等级表明自动化的可能性要高得多:有80%的机会会被自动化。

你认为自动化的风险是什么?

保险销售代理人在未来20年内被机器人或人工智能取代的可能性有多大?

情感

以下图表在有大量投票数据时会显示。这些可视化图表展示了用户投票结果随时间的变化,提供了情感趋势的重要指示。

随着时间(每年)的情绪变化

增长

预计"Insurance Sales Agents"的工作空缺数量将在2033内增长6.1%

总就业人数和预计的职位空缺

更新的预测将在09-2025到期.

工资

在2023,'Insurance Sales Agents'的年度中位数工资为$59,080,或每小时$28。

'Insurance Sales Agents'的薪资比全国中位工资高22.9%,全国中位工资为$48,060。

随着时间推移的工资

体积

截至2023,在美国有457,510人被雇佣为'Insurance Sales Agents'。

这代表了全国就业劳动力的大约0.30%

换句话说,大约每331人中就有1人被雇佣为“Insurance Sales Agents”。

工作描述

销售人寿、财产、意外、健康、汽车或其他类型的保险。可能会将客户推荐给独立经纪人,作为独立经纪人工作,或被保险公司雇佣。

SOC Code: 41-3021.00

评论

Leave a comment

As for the insurance agent, AI can easily understand and sell a product. One could argue that using AI will increase the risk of E&O. That may be true, but 1) AI will improve and the E&O risk will greatly decrease and 2) The cost to use AI, and pay the salary of one or a team of specialists to maintain the AI will save so much on employee salaries (AI +3-5 people can easily replace 100+ agent departments) that the cost for E&O deductibles and possible E&O premium increase is outweighed. 100 agents making $60k/year = $6,000,000 saved.

An AI can do the same. Key in custom values and voila, a carefully crafted plan will be ready for you. And it may even analyse existing clients and suggest the most suitable plan for you. If you feel unsure about their decision and have more spare cash, you can raise the premium and decide to insure more.

Also, yes, you can buy insurance online, but I can't tell you how many times I had to go fix a problem or amend a policy because someone did it online and did not fully understand what they were doing.

Claims are the product we sell. No claims, no need for an Agent or a company for that matter

Si nos quedan 20 años, me quedo contento, con eso. Los que amamos dicha actividad, cuando las empresas en este caso de Argentina, dan un paso para lo virtual, se encuentran con muchos problemas. (El fraude es uno de los principales costos) como tambien el costo operartivo (comisiones estructura de las empresas), pero si la ecuacion es bajar el costo, y esto hace subir los fraudes, no veo la ventaja.

And like another has said referring to Amazon, all Amazon has to do is optimize Alexa so she can talk back to you and ask you all the questions needed to properly underwrite and sell you your policy.

Another company to take a look at is Spixii

https://www.spixii.com/infobot

As a client who has unlimited access to information and reviews online, I can spend an hour's time myself comparing 10+ different companies from my couch and never have to step into an insurance office (which face it is extremely dull no matter who you are).

Big players like TD are disrupting the market in Canada with their self serve online P&C products and another of the big ones in Canada, The Co-operators, is pushing their group plans which are completely self serve and offer steep discounts compared to their regular products (I've seen less than half price). Which they can do because they cut out the middle man.

Amazon has also been speculated to start dabbling in the insurance business. Bezos is a conqueror and once he comes for you, it is only a matter of time.

When companies stand to save millions of dollars per year, it will happen. And it will happen quicker than you think.

Have you worked with AI and algorithms and machine learning before? I can tell you that personal insurance, with as many different factors that there can be, there certainly are solutions for all of the coverage requirements and options. If an insurance company can build in redundancy-proof errors, it wouldn't be a stretch at all to implement those redundancy-proofs to an online, automated, customer-driven platform to purchase insurance.

As soon as a client enters their license number, we can extract their license history, claims history, insurance history and conviction history. AI could easily take out the important information and calculate accordingly.

Who cares if they choose the insurance that isn't the best for them? Is that your personal responsibility to worry about what everyone chooses for every aspect of their life? Caveat emptor. Google it. Read it. Understand it.

There are many, many industries that take advantage of general ignorance. You've made a straw man argument that does not stand up to actual scrutiny. Brokers are on the way out. It is a matter of time, not opinion.

关于这个职业请留下您的评论