精算师

中等风险

54%

您接下来想去哪里?

或者,更深入地探索这个职业...

自动化风险

计算出的

61%

(高风险)

投票

48%

(中等风险, 根据 885 票的投票结果)

Average: 54%

劳动力需求

增长

21.8%

到2033年

工资

$120,000

或每小时 $57.69

体积

25,470

截至 2023

摘要

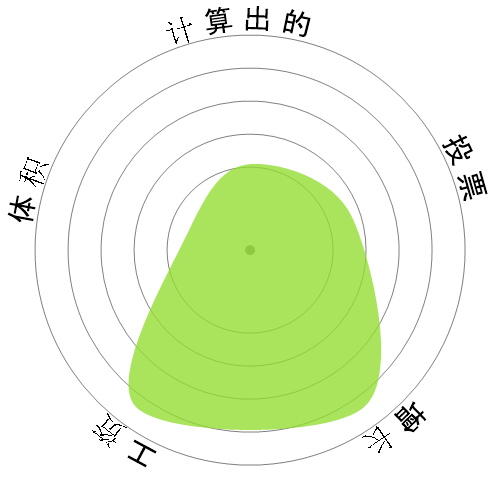

这个雪花图案展示了什么?

雪花是五个徽章的视觉总结:自动化风险(计算得出)、风险(投票得出)、增长、工资和体积。它为你提供了一个职业概况的即时快照。雪花的颜色与其大小有关。与其他职业相比,某个职业的得分越好,雪花就会变得越大且越绿。

工作评分

6.4/10

这是什么?

工作评分(越高越好):

我们使用四个因素对工作进行评分。这些是:

- 被自动化的可能性

- 工作增长

- 工资

- 可用职位的数量

这些是求职时需要考虑的一些关键事项。

我们使用四个因素对工作进行评分。这些是:

- 被自动化的可能性

- 工作增长

- 工资

- 可用职位的数量

这些是求职时需要考虑的一些关键事项。

人们还浏览了

计算自动化风险

高风险(61-80%):这个类别的工作面临着来自自动化的重大威胁,因为他们的许多任务可以使用当前或近期的技术轻松自动化。

有关这个分数是什么以及如何计算的更多信息可在这里找到。

用户投票

我们的访客投票表示,他们不确定这个职业是否会被自动化。 然而,我们生成的自动化风险等级表明自动化的可能性要高得多:有61%的机会会被自动化。

你认为自动化的风险是什么?

精算师在未来20年内被机器人或人工智能取代的可能性有多大?

情感

以下图表显示了在有足够投票的情况下生成的有意义数据。它展示了用户投票结果随时间的变化,清晰地指示了情感趋势。

随着时间(每年)的情绪变化

增长

预计"Actuaries"的工作空缺数量将在2033内增长21.8%

总就业人数和预计的职位空缺

* 根据劳工统计局的数据,该数据涵盖了从2023到2033的期间。

更新的预测将在09-2025到期.

更新的预测将在09-2025到期.

工资

在2023,'Actuaries'的年度中位数工资为120.000 $,或每小时58 $。

'Actuaries'的薪资比全国中位工资高149.7%,全国中位工资为48.060 $。

随着时间推移的工资

* 来自美国劳工统计局的数据

体积

截至2023,在美国有25,470人被雇佣为'Actuaries'。

这代表了全国就业劳动力的大约< 0.001%

换句话说,大约每5 千人中就有1人被雇佣为“Actuaries”。

工作描述

分析统计数据,如死亡率、事故率、疾病率、残疾率和退休率,并构建概率表以预测未来福利支付的风险和责任。可能需要确定保险费率和确保未来福利支付所需的现金储备。

SOC Code: 15-2011.00

评论 (21)

If AI will be able to determine the outcome of lawsuits, actuaries might be at greater risk

Regarding your second paragraph, I see no reason why a sufficiently advanced AI couldn't update actuarial assumptions based on new data, and it seems possible that an advanced AGI might be able to actually develop better models than humans.

回复评论