보험 판매 에이전트

사람들이 또한 조회했습니다

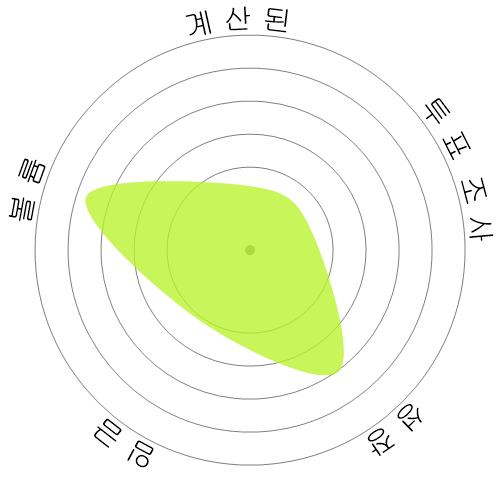

계산된 자동화 위험

임박한 위험 (81-100%): 이 수준의 직업은 가까운 미래에 자동화될 가능성이 매우 높습니다. 이러한 직업은 대부분 반복적이고 예측 가능한 작업으로, 인간의 판단이 거의 필요하지 않습니다.

이 점수가 무엇인지, 그리고 어떻게 계산되는지에 대한 자세한 정보는 여기에 있습니다.

사용자 설문조사

우리의 방문객들은 이 직업이 자동화될지 확신이 없다고 투표했습니다. 그러나 우리가 생성한 자동화 위험 수준은 훨씬 높은 자동화 가능성을 제안합니다: 자동화 가능성 80%%.

자동화의 위험성에 대해 어떻게 생각하십니까?

보험 판매 에이전트이 다음 20년 이내에 로봇이나 인공지능에 의해 대체될 가능성은 얼마나 됩니까?

감정

다음 그래프는 의미 있는 데이터를 제공할 수 있을 만큼 충분한 투표 수가 있을 때마다 포함됩니다. 이러한 시각적 표현은 시간 경과에 따른 사용자 투표 결과를 보여주며, 감정 추세에 대한 중요한 지표를 제공합니다.

시간별 감정 (연간)

성장

'Insurance Sales Agents' 직업 분야의 공석은 2033년까지 6.1% 증가할 것으로 예상됩니다.

총 고용량 및 예상 직업 공석

업데이트된 예상치가 09-2025에 제출될 예정입니다..

임금

2023년에 'Insurance Sales Agents'의 중앙값 연간 급여는 $59,080이며, 시간당 $28입니다.

'Insurance Sales Agents'은 전국 중위임금인 $48,060보다 22.9% 더 높은 금액을 지불받았습니다.

시간에 따른 임금

볼륨

2023년 현재, 미국 내에서 'Insurance Sales Agents'로 고용된 사람들의 수는 457,510명이었습니다.

이는 전국의 고용 노동력 중 약 0.30%를 대표합니다.

다시 말해, 약 331명 중 1명이 'Insurance Sales Agents'로 고용되어 있습니다.

직무 설명

생명, 재산, 사고, 건강, 자동차 등 다양한 종류의 보험을 판매합니다. 고객을 독립 중개인에게 소개할 수도 있고, 독립 중개인으로 일할 수도 있으며, 보험 회사에 고용될 수도 있습니다.

SOC Code: 41-3021.00

댓글

Leave a comment

As for the insurance agent, AI can easily understand and sell a product. One could argue that using AI will increase the risk of E&O. That may be true, but 1) AI will improve and the E&O risk will greatly decrease and 2) The cost to use AI, and pay the salary of one or a team of specialists to maintain the AI will save so much on employee salaries (AI +3-5 people can easily replace 100+ agent departments) that the cost for E&O deductibles and possible E&O premium increase is outweighed. 100 agents making $60k/year = $6,000,000 saved.

An AI can do the same. Key in custom values and voila, a carefully crafted plan will be ready for you. And it may even analyse existing clients and suggest the most suitable plan for you. If you feel unsure about their decision and have more spare cash, you can raise the premium and decide to insure more.

Also, yes, you can buy insurance online, but I can't tell you how many times I had to go fix a problem or amend a policy because someone did it online and did not fully understand what they were doing.

Claims are the product we sell. No claims, no need for an Agent or a company for that matter

Si nos quedan 20 años, me quedo contento, con eso. Los que amamos dicha actividad, cuando las empresas en este caso de Argentina, dan un paso para lo virtual, se encuentran con muchos problemas. (El fraude es uno de los principales costos) como tambien el costo operartivo (comisiones estructura de las empresas), pero si la ecuacion es bajar el costo, y esto hace subir los fraudes, no veo la ventaja.

And like another has said referring to Amazon, all Amazon has to do is optimize Alexa so she can talk back to you and ask you all the questions needed to properly underwrite and sell you your policy.

Another company to take a look at is Spixii

https://www.spixii.com/infobot

As a client who has unlimited access to information and reviews online, I can spend an hour's time myself comparing 10+ different companies from my couch and never have to step into an insurance office (which face it is extremely dull no matter who you are).

Big players like TD are disrupting the market in Canada with their self serve online P&C products and another of the big ones in Canada, The Co-operators, is pushing their group plans which are completely self serve and offer steep discounts compared to their regular products (I've seen less than half price). Which they can do because they cut out the middle man.

Amazon has also been speculated to start dabbling in the insurance business. Bezos is a conqueror and once he comes for you, it is only a matter of time.

When companies stand to save millions of dollars per year, it will happen. And it will happen quicker than you think.

Have you worked with AI and algorithms and machine learning before? I can tell you that personal insurance, with as many different factors that there can be, there certainly are solutions for all of the coverage requirements and options. If an insurance company can build in redundancy-proof errors, it wouldn't be a stretch at all to implement those redundancy-proofs to an online, automated, customer-driven platform to purchase insurance.

As soon as a client enters their license number, we can extract their license history, claims history, insurance history and conviction history. AI could easily take out the important information and calculate accordingly.

Who cares if they choose the insurance that isn't the best for them? Is that your personal responsibility to worry about what everyone chooses for every aspect of their life? Caveat emptor. Google it. Read it. Understand it.

There are many, many industries that take advantage of general ignorance. You've made a straw man argument that does not stand up to actual scrutiny. Brokers are on the way out. It is a matter of time, not opinion.

이 직업에 대한 답글을 남겨주세요.