Finanzberater für Privatkunden

Wohin möchten Sie als Nächstes gehen?

Oder erkunden Sie diesen Beruf ausführlicher...

Was zeigt diese Schneeflocke?

Was ist das?

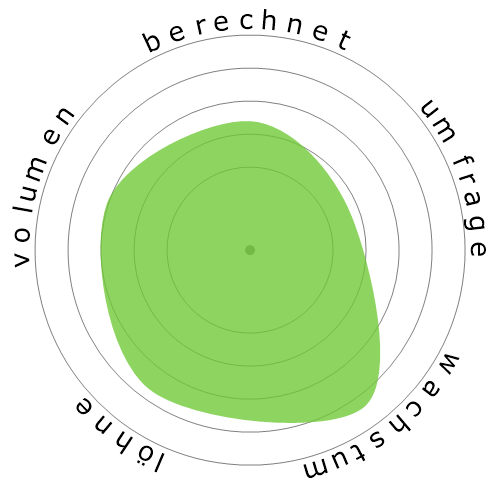

Wir bewerten Jobs anhand von vier Faktoren. Diese sind:

- Chance der Automatisierung

- Jobwachstum

- Löhne

- Anzahl der verfügbaren Stellen

Dies sind einige wichtige Punkte, über die man beim Jobsuchen nachdenken sollte.

Personen haben sich auch angesehen

Berechnetes Automatisierungsrisiko

Mäßiges Risiko (41-60%): Berufe mit einem mäßigen Automatisierungsrisiko beinhalten in der Regel Routineaufgaben, erfordern jedoch immer noch ein gewisses menschliches Urteilsvermögen und Interaktion.

Weitere Informationen darüber, was dieser Wert ist und wie er berechnet wird, sind verfügbar hier.

Benutzerumfrage

Unsere Besucher haben abgestimmt, dass sie unsicher sind, ob dieser Beruf automatisiert wird. Diese Einschätzung wird weiterhin durch das berechnete Automatisierungsrisiko unterstützt, welches eine 43% Chance der Automatisierung schätzt.

Was denken Sie, ist das Risiko der Automatisierung?

Wie hoch ist die Wahrscheinlichkeit, dass Finanzberater für Privatkunden in den nächsten 20 Jahren durch Roboter oder künstliche Intelligenz ersetzt wird?

Gefühl

Das folgende Diagramm wird angezeigt, wenn genügend Stimmen vorhanden sind, um aussagekräftige Daten zu erzeugen. Es zeigt die Ergebnisse von Nutzerumfragen im Laufe der Zeit und bietet einen klaren Hinweis auf Stimmungstrends.

Gefühlslage über die Zeit (jährlich)

Wachstum

Die Anzahl der 'Personal Financial Advisors' Stellenangebote wird voraussichtlich um 17,1% bis 2033 steigen.

Gesamtbeschäftigung und geschätzte Stellenangebote

Aktualisierte Prognosen sind fällig 09-2025.

Löhne

Im Jahr 2023 betrug das mittlere Jahresgehalt für 'Personal Financial Advisors' 99.580 $, oder 48 $ pro Stunde.

'Personal Financial Advisors' wurden 107,2% höher bezahlt als der nationale Medianlohn, der bei 48.060 $ lag.

Löhne über die Zeit

Volumen

Ab dem 2023 waren 272.190 Personen als 'Personal Financial Advisors' in den Vereinigten Staaten beschäftigt.

Dies entspricht etwa 0,18% der erwerbstätigen Bevölkerung im ganzen Land.

Anders ausgedrückt, ist etwa 1 von 557 Personen als 'Personal Financial Advisors' beschäftigt.

Stellenbeschreibung

Beraten Sie Kunden bei Finanzplänen unter Verwendung von Kenntnissen über Steuer- und Anlagestrategien, Wertpapiere, Versicherungen, Rentenpläne und Immobilien. Zu den Aufgaben gehören die Bewertung von Kundenvermögen, Verbindlichkeiten, Cashflow, Versicherungsschutz, Steuerstatus und finanziellen Zielen. Kann auch Finanzanlagen für Kunden kaufen und verkaufen.

SOC Code: 13-2052.00

Kommentare (30)

How can one relate to a line of code, or trust that the programmers inherent biases are not skewing the results?

I’m completely on the fence when it comes to which jobs and when AI will replace the human workforce. I don’t underestimate the ambitions of tech producers and the average human being's preference for the quick, easy, and cheaper option to bring about such a situation. And let’s not forget how far technology has come since the Internet, let alone the simple calculator.

All this said we shouldn’t think that the scenario where AI could replace the human workforce is one that’s predetermined. “We” (everyone single one of us) have the collective ability to cause or prevent such an eventuality. We must also consider how viable an AI-dominated society and economy would really be. Every government across the globe would have its hands cut out with a population whose majority is unemployable. Imagine the civil unrest? Another consideration is the damage this could do to the economy; if a massive portion of humanity isn’t working, and isn’t getting a wage like they used to, we would see an unprecedented reduction in the flow of money around the economy. And what happens to money when there is a lack of exchange taking place? Doesn’t the value of money decrease? The financial advisors in this forum would be the best to elaborate on this or to correct my statement.

In conclusion: while I have no doubt that the ambitious tech lords and their acolytes will do what they can to bring about an AI world, the question of whether humans from governments to ordinary citizens will allow it is another thing altogether.

Auf Kommentar antworten