Finanz- und Investmentanalysten

Wohin möchten Sie als Nächstes gehen?

Oder erkunden Sie diesen Beruf ausführlicher...

Was zeigt diese Schneeflocke?

Was ist das?

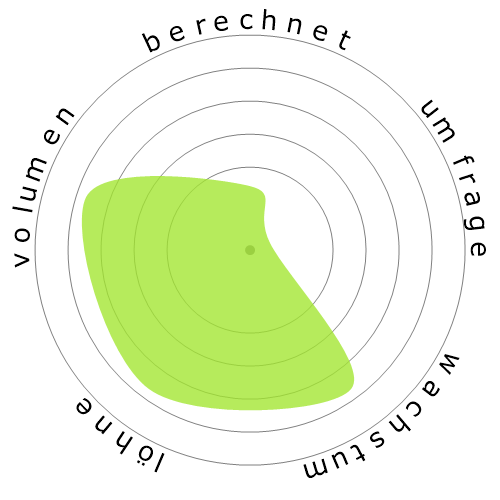

Wir bewerten Jobs anhand von vier Faktoren. Diese sind:

- Chance der Automatisierung

- Jobwachstum

- Löhne

- Anzahl der verfügbaren Stellen

Dies sind einige wichtige Punkte, über die man beim Jobsuchen nachdenken sollte.

Personen haben sich auch angesehen

Berechnetes Automatisierungsrisiko

Hohes Risiko (61-80%): Arbeitsplätze in dieser Kategorie sind einer erheblichen Bedrohung durch Automatisierung ausgesetzt, da viele ihrer Aufgaben mit aktuellen oder nahen zukünftigen Technologien leicht automatisiert werden können.

Weitere Informationen darüber, was dieser Wert ist und wie er berechnet wird, sind verfügbar hier.

Benutzerumfrage

Unsere Besucher haben abgestimmt, dass es sehr wahrscheinlich ist, dass dieser Beruf automatisiert wird. Diese Einschätzung wird weiterhin durch das berechnete Automatisierungsrisiko unterstützt, welches eine 77% Chance der Automatisierung schätzt.

Was denken Sie, ist das Risiko der Automatisierung?

Wie hoch ist die Wahrscheinlichkeit, dass Finanz- und Investmentanalysten in den nächsten 20 Jahren durch Roboter oder künstliche Intelligenz ersetzt wird?

Gefühl

Das folgende Diagramm wird angezeigt, wenn genügend Stimmen vorhanden sind, um aussagekräftige Daten zu erzeugen. Es zeigt die Ergebnisse von Nutzerumfragen im Laufe der Zeit und bietet einen klaren Hinweis auf Stimmungstrends.

Gefühlslage über die Zeit (vierteljährlich)

Gefühlslage über die Zeit (jährlich)

Wachstum

Die Anzahl der 'Financial and Investment Analysts' Stellenangebote wird voraussichtlich um 9,5% bis 2033 steigen.

Gesamtbeschäftigung und geschätzte Stellenangebote

Aktualisierte Prognosen sind fällig 09-2025.

Löhne

Im Jahr 2023 betrug das mittlere Jahresgehalt für 'Financial and Investment Analysts' 99.010 $, oder 48 $ pro Stunde.

'Financial and Investment Analysts' wurden 106,0% höher bezahlt als der nationale Medianlohn, der bei 48.060 $ lag.

Löhne über die Zeit

Volumen

Ab dem 2023 waren 325.220 Personen als 'Financial and Investment Analysts' in den Vereinigten Staaten beschäftigt.

Dies entspricht etwa 0,21% der erwerbstätigen Bevölkerung im ganzen Land.

Anders ausgedrückt, ist etwa 1 von 466 Personen als 'Financial and Investment Analysts' beschäftigt.

Stellenbeschreibung

Führen Sie quantitative Analysen von Informationen durch, die sich auf Anlageprogramme oder Finanzdaten öffentlicher oder privater Institutionen beziehen, einschließlich der Bewertung von Unternehmen.

SOC Code: 13-2051.00

Kommentare (34)

It's already been attempted for decades to automate wall street most well known example being Blackrock's Aladdin

Then there's the technical work done by hedge funds most notably Medallion.

Even if the stock market truly was fully automated it would already be priced in and become worthless

A good trading strategy actually requires some subjectivity specifically for preventing arbitrage by quants.

I really don't think AI is going to change much, the innovation that's needed to generate Alpha can't be done by AI

TL;DR it can't be fully automated, if it could it already would have been

Reporting activities are done by Python robots and so on.

Investment activities are being replaced by robots and AI, but we still have the issue of emotions involved. However, since companies don't usually take aggressive approaches to investments, they typically invest in fixed income.

Operational tasks are a thing of the past.

Auf Kommentar antworten