Osobní finanční poradci

Kam byste chtěli jít dál?

Nebo prozkoumejte tuto profesi podrobněji...

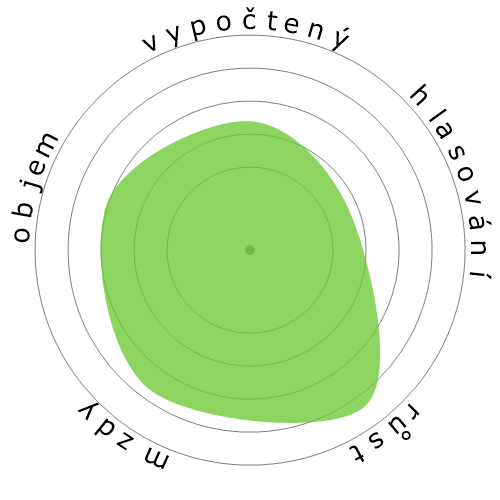

Co tato sněhová vločka ukazuje?

Co je to?

Práce hodnotíme podle čtyř faktorů. Jsou to:

- Pravděpodobnost automatizace

- Růst pracovních míst

- Mzdy

- Počet dostupných pozic

To jsou některé klíčové věci, o kterých byste měli přemýšlet při hledání práce.

Lidé také zobrazili

Vypočítané riziko automatizace

Střední riziko (41-60%): Profese se středním rizikem automatizace obvykle zahrnují rutinní úkoly, ale stále vyžadují určité lidské úsudky a interakci.

Další informace o tom, co tento skóre je a jak se vypočítává, jsou k dispozici zde.

Anketa uživatelů

Naši návštěvníci hlasovali, že si nejsou jisti, zda bude toto povolání automatizováno. Toto hodnocení je dále podpořeno vypočítanou úrovní rizika automatizace, která odhaduje 43% šanci na automatizaci.

Jaký si myslíte, že je riziko automatizace?

Jaká je pravděpodobnost, že Osobní finanční poradci bude během příštích 20 let nahrazen roboty nebo umělou inteligencí?

Nálada

Následující graf je zobrazen tam, kde je dostatek hlasů k vytvoření smysluplných dat. Zobrazuje výsledky uživatelských anket v průběhu času a poskytuje jasný přehled o trendech nálad.

Nálada v průběhu času (ročně)

Růst

Počet pracovních míst pro 'Personal Financial Advisors' se očekává, že se zvýší o 17,1% do roku 2033

Celkové zaměstnanost a odhadované pracovní nabídky

Aktualizované projekce jsou splatné 09-2025.

Mzdy

V 2023 byla mediánová roční mzda pro 'Personal Financial Advisors' 99 580 $, což je 48 $ za hodinu.

'Personal Financial Advisors' byli placeni o 107,2% více než je národní mediánový plat, který činil 48 060 $

Mzdy v průběhu času

Objem

K 2023 bylo v Spojených státech zaměstnáno 272 190 lidí na pozici 'Personal Financial Advisors'.

Tohle představuje kolem 0,18% zaměstnané pracovní síly po celé zemi.

Jinými slovy, přibližně 1 z 557 lidí je zaměstnán jako 'Personal Financial Advisors'.

Popis práce

Poradíme klientům ohledně finančních plánů s využitím znalostí daňových a investičních strategií, cenných papírů, pojištění, penzijních plánů a nemovitostí. Naše povinnosti zahrnují posouzení klientových aktiv, závazků, peněžního toku, pojištění, daňového statusu a finančních cílů. Můžeme také nakupovat a prodávat finanční aktiva pro klienty.

SOC Code: 13-2052.00

Komentáře (30)

How can one relate to a line of code, or trust that the programmers inherent biases are not skewing the results?

I’m completely on the fence when it comes to which jobs and when AI will replace the human workforce. I don’t underestimate the ambitions of tech producers and the average human being's preference for the quick, easy, and cheaper option to bring about such a situation. And let’s not forget how far technology has come since the Internet, let alone the simple calculator.

All this said we shouldn’t think that the scenario where AI could replace the human workforce is one that’s predetermined. “We” (everyone single one of us) have the collective ability to cause or prevent such an eventuality. We must also consider how viable an AI-dominated society and economy would really be. Every government across the globe would have its hands cut out with a population whose majority is unemployable. Imagine the civil unrest? Another consideration is the damage this could do to the economy; if a massive portion of humanity isn’t working, and isn’t getting a wage like they used to, we would see an unprecedented reduction in the flow of money around the economy. And what happens to money when there is a lack of exchange taking place? Doesn’t the value of money decrease? The financial advisors in this forum would be the best to elaborate on this or to correct my statement.

In conclusion: while I have no doubt that the ambitious tech lords and their acolytes will do what they can to bring about an AI world, the question of whether humans from governments to ordinary citizens will allow it is another thing altogether.

Odpovědět na komentář