Účetní a revizoři

Kam byste chtěli jít dál?

Nebo prozkoumejte tuto profesi podrobněji...

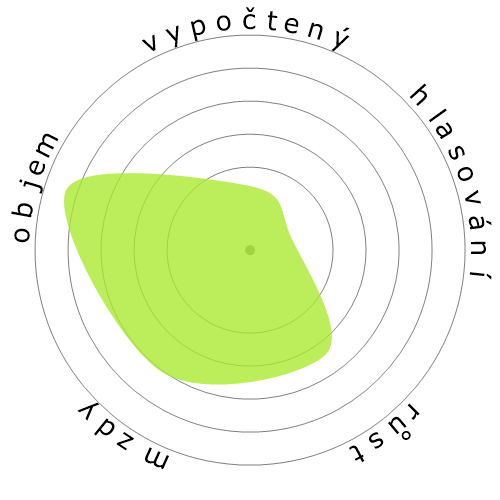

Co tato sněhová vločka ukazuje?

Co je to?

Práce hodnotíme podle čtyř faktorů. Jsou to:

- Pravděpodobnost automatizace

- Růst pracovních míst

- Mzdy

- Počet dostupných pozic

To jsou některé klíčové věci, o kterých byste měli přemýšlet při hledání práce.

Lidé také zobrazili

Vypočítané riziko automatizace

Vysoké riziko (61-80%): Práce v této kategorii čelí významné hrozbě z automatizace, protože mnoho jejich úkolů lze snadno automatizovat pomocí současných nebo blízkých budoucích technologií.

Další informace o tom, co tento skóre je a jak se vypočítává, jsou k dispozici zde.

Anketa uživatelů

Naši návštěvníci hlasovali, že je pravděpodobné, že tato profese bude automatizována. Toto hodnocení je dále podpořeno vypočítanou úrovní rizika automatizace, která odhaduje 69% šanci na automatizaci.

Jaký si myslíte, že je riziko automatizace?

Jaká je pravděpodobnost, že Účetní a revizoři bude během příštích 20 let nahrazen roboty nebo umělou inteligencí?

Nálada

Následující graf je zobrazen tam, kde je dostatek hlasů k vytvoření smysluplných dat. Zobrazuje výsledky uživatelských anket v průběhu času a poskytuje jasný přehled o trendech nálad.

Nálada v čase (čtvrtletně)

Nálada v průběhu času (ročně)

Růst

Počet pracovních míst pro 'Accountants and Auditors' se očekává, že se zvýší o 5,8% do roku 2033

Celkové zaměstnanost a odhadované pracovní nabídky

Aktualizované projekce jsou splatné 09-2025.

Mzdy

V 2023 byla mediánová roční mzda pro 'Accountants and Auditors' 79.880 $, což je 38 $ za hodinu.

'Accountants and Auditors' byli placeni o 66,2% více než je národní mediánový plat, který činil 48.060 $

Mzdy v průběhu času

Objem

K 2023 bylo v Spojených státech zaměstnáno 1 435 770 lidí na pozici 'Accountants and Auditors'.

Tohle představuje kolem 0,9% zaměstnané pracovní síly po celé zemi.

Jinými slovy, přibližně 1 z 105 lidí je zaměstnán jako 'Accountants and Auditors'.

Popis práce

Prověřujte, analyzujte a interpretujte účetní záznamy pro přípravu finančních výkazů, poskytujte rady nebo auditujte a vyhodnocujte výkazy připravené jinými. Instalujte nebo raděte ohledně systémů pro zaznamenávání nákladů nebo jiných finančních a rozpočtových dat.

SOC Code: 13-2011.00

Komentáře (167)

• Developing test strategies for AI-based accounting and financial systems

• Designing and overseeing the execution of test cases for AI-based accounting and financial systems

• Understanding the specific requirements for testing AI-based accounting and financial systems

To effectively perform these tasks, accountants and auditors must acquire new skills in analyzing algorithms and models from an accounting standpoint. This will enable them to establish and evaluate new controls for AI-generated financial data and ensure ongoing compliance with these controls.

While accountants and auditors are already skilled in managing the collection, cleaning, and validation of test data, they currently face challenges in performance and security testing. However, with the assistance of AI and further education, they will become adept at continuously verifying the accuracy of AI-based accounting and financial systems in real-time environments.

As a result, accountants and auditors will be increasingly relied upon to seamlessly integrate AI-based accounting and financial systems with real-time environments. They will need to continuously monitor and audit AI-generated financial data, ensuring error-free performance, and validating security measures to safeguard the system against cyber-attacks

The first accounting jobs to go the way of the dinosaur and telephone operator will be those that are repetitive and don’t require a significant level of judgment, such as bookkeepers and accounting clerks (AR, AP, payroll, purchasing, etc.). A lot of lower-level tax work (data entry, etc.) will likely be automated.

As for auditing, some aspects will likely be taken over by AI, and for the better. A significant amount of transaction-level testing and confirmations will likely be performed by AI, and AI will be a valuable assist for designing and performing analytical procedures.

This will in turn create the need to audit the AI systems and algorithms, like how outsourcing and automation led to the standards in SSAE 18 and framework for SOC reports. There will also be an increased demand for consulting and advisory roles as clients look to implement AI technologies.

AI will help auditors be more efficient by spending less time on rote tasks. It will help auditors design stronger audit procedures, obtain better audit evidence, and improve realization. It will also free up more time to build client relationships and improve the busy season work-life balance. This will translate to more meaningful and fulfilling work and less burnout.

I’m old enough to remember the Y2K hysteria and fearmongering about computers taking everyone’s job. All of this “AI is going to take everyone’s job” strikes the same pessimistic tone.

The limitations of AI include that it cannot exercise judgment, creativity, and emotional intelligence, which make it certain that humans will continue to be required for complex problem-solving, regulatory oversight, and the instillation of trust in stakeholders. Instead of replacing them, AI will enhance the capability of humans; this will be a partnership where accountants use AI to enhance efficiency and concentrate on higher-value activities.

Upskilling in AI, data analytics, and strategic decision-making will be necessary for accountants to remain relevant in the future..

Society cannot solely rely on Big Tech to evaluate financial statements, as they have proven themselves to be untrustworthy in many situations. For example, numerous antitrust investigations have been launched against them, revealing unscrupulous behavior. It is questionable whether society would be willing to place all their confidence in the hands of a few Tech billionaires, who will be willing to prioritize their political, corporate, and financial interests over society's well-being.

In conclusion, relying solely on Tech Billionaires and other elites to pay their fair share of taxes and evaluate financial statements poses significant perils. It is crucial to have independent human auditors to ensure accuracy and reliability and prevent conflicts of interest that may arise if the elites desire to further enrich themselves at society's expense.

In order to offer the most valuable and timely advice on any AI system used in finance, both accountants and auditors will need to consistently monitor the inputs and outputs of the installed software. To do this, they will have to explore innovative methods to establish new controls for AI-generated financial data. They will be responsible for developing new systems to assess the efficacy of these controls, in addition to being the ones tasked with consistently ensuring compliance with these new controls.

Similarly, in fields like law, people are reluctant to trust machines to draft legal documents or represent them in court because of the financial stakes involved. There's a fear that mistakes could be costly. Additionally, companies are wary of outsourcing these tasks offshore due to concerns about the security of their financial data.

In essence, the reluctance to automate accounting and legal processes stems from the inherent risks and the sensitivity of financial transactions, as well as concerns about maintaining control and data security.

Our society cannot rely solely on the elites' technologies to determine whether they are paying their fair share of taxes. The government will always have to pursue the wealthy to ensure they pay their fair share of taxes, while individuals will always seek legal ways to avoid paying taxes. Advanced technologies such as blockchain and artificial intelligence will enable individuals to find more innovative ways to evade taxes, making it difficult for authorities to prosecute those who are guilty of tax evasion.

For this reason, accountants and auditors will always be required to verify whether the technologies that are being used to evaluate whether individuals and entities are tax compliant are accurate.

Unlike other professions, Accounting and Auditing require specialized skills that most individuals in an organization lack without rigorous training. The level of training needed to certify Accounting AI outputs is comparable to becoming an accountant. Given accountants' proficiency in analyzing financial records, they are the most qualified to verify the accuracy and reliability of AI-generated financial data. Neglecting monitoring by accountants and auditors will expose companies to increased scrutiny from investors and regulators.

As the digital landscape expands and virtual transactions become increasingly prevalent, companies will need to expand their hiring of Accountants and Auditors to ensure that every transaction processed by their AI Accounting software meets set performance standards. Accountants will play a growing role in setting up, adhering to, and evaluating controls for auditing AI-generated data. The responsibilities of Accountants and Auditors will include conducting thorough assessments to verify the integrity of operations and reports within these organizations.

While accountants are already required to complete continuous education requirements annually, their curriculums will now need to be updated to place a greater emphasis on the management of AI and quality assurance processes to ensure that these systems are performing at a level that meets International Accounting Standards.

Without accountants' oversight, AI-generated results cannot be reliably verified for accuracy, completeness, reliability, and relevance. With the increasing volume of financial data, the demand for accountants will rise to validate datasets used by AI models for decision-making. Furthermore, there will be an increased need for accountants to evaluate the reliability of outputs produced by AI models.

Auditing is fully automated using CAAT (Computer Assisted Aided Technics). I experienced it in Dubai in 2021

Odpovědět na komentář