مستشارو المال الشخصي

الأشخاص قاموا أيضاً بالمشاهدة

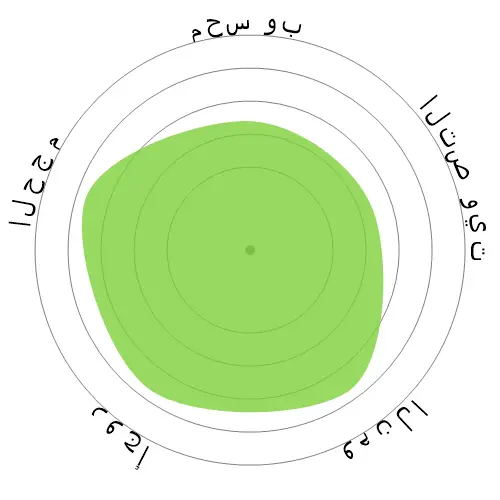

مخاطر الأتمتة المحسوبة

مخاطر متوسطة (41-60%): المهن التي تتضمن مخاطر متوسطة للأتمتة تتضمن عادة المهام الروتينية ولكنها ما زالت تتطلب بعض الحكم البشري والتفاعل.

مزيد من المعلومات حول ما هذه النتيجة، وكيف يتم حسابها متوفرة هنا.

استطلاع رأي المستخدمين

صوت زوارنا بأنهم غير متأكدين إذا كان سيتم أتمتة هذه المهنة. يدعم هذا التقييم أيضًا بواسطة مستوى خطر الأتمتة المحسوب، الذي يقدر بـ 43٪ فرصة للأتمتة.

ما هو رأيك في مخاطر الأتمتة؟

ما هي احتمالية أن يتم استبدال مستشارو المال الشخصي بالروبوتات أو الذكاء الاصطناعي في غضون العشرين سنة المقبلة؟

المشاعر

يتم تضمين الرسم البياني التالي في أي مكان يوجد فيه عدد كبير من الأصوات لتقديم بيانات ذات مغزى. تعرض هذه التمثيلات المرئية نتائج استطلاعات المستخدمين على مر الزمن، مما يوفر دلالة مهمة على اتجاهات المشاعر.

المشاعر على مر الزمن (سنوياً)

النمو

من المتوقع أن يزداد 17٫1٪ عدد فرص العمل المتاحة لـ 'Personal Financial Advisors' بحلول 2033

التوظيف الكلي، وفتحات الوظائف المقدرة

من المتوقع تحديث التوقعات في 09-2025.

أجور

في 2023، بلغ الأجر السنوي الوسيط لـ 'Personal Financial Advisors' 99٬580 $، أو 47 $ في الساعة

تم دفع "Personal Financial Advisors" بمقدار 107٫2٪ أعلى من الأجر الوسيط الوطني، الذي بلغ 48٬060 $

الأجور على مر الزمن

الحجم

بحلول 2023 كان هناك 272٬190 شخص يعملون كـ 'Personal Financial Advisors' داخل الولايات المتحدة.

هذا يمثل حوالي 0٫18٪ من القوى العاملة الموظفة في جميع أنحاء البلاد

بتعبير آخر، حوالي 1 من كل 557 أشخاص يعملون كـ 'Personal Financial Advisors'.

وصف الوظيفة

تقديم النصائح للعملاء حول الخطط المالية باستخدام المعرفة بالاستراتيجيات الضريبية والاستثمارية، والأوراق المالية، والتأمين، وخطط التقاعد، والعقارات. تتضمن المهام تقييم أصول العملاء، والالتزامات، وتدفق النقد، وتغطية التأمين، والحالة الضريبية، والأهداف المالية. قد يشتري ويبيع أيضًا الأصول المالية للعملاء.

SOC Code: 13-2052.00

تعليقات

Leave a comment

How can one relate to a line of code, or trust that the programmers inherent biases are not skewing the results?

I’m completely on the fence when it comes to which jobs and when AI will replace the human workforce. I don’t underestimate the ambitions of tech producers and the average human being's preference for the quick, easy, and cheaper option to bring about such a situation. And let’s not forget how far technology has come since the Internet, let alone the simple calculator.

All this said we shouldn’t think that the scenario where AI could replace the human workforce is one that’s predetermined. “We” (everyone single one of us) have the collective ability to cause or prevent such an eventuality. We must also consider how viable an AI-dominated society and economy would really be. Every government across the globe would have its hands cut out with a population whose majority is unemployable. Imagine the civil unrest? Another consideration is the damage this could do to the economy; if a massive portion of humanity isn’t working, and isn’t getting a wage like they used to, we would see an unprecedented reduction in the flow of money around the economy. And what happens to money when there is a lack of exchange taking place? Doesn’t the value of money decrease? The financial advisors in this forum would be the best to elaborate on this or to correct my statement.

In conclusion: while I have no doubt that the ambitious tech lords and their acolytes will do what they can to bring about an AI world, the question of whether humans from governments to ordinary citizens will allow it is another thing altogether.

For example, look at what services SoFi offers on their brokerage it's revolutionary. When you first heard "stonks always go up brrrrr" then that was the exact point the financial advisors and other various staff felt the chill up their spine of oncoming obsolescence.

Like Librarians in 2004 though, if you have the job now you won't even consider retirement for 15 years you're good. Are Advisors being used by Millennials and Gen Zoomer? I really am beginning to doubt it highly, they will just put all their money in SPY, QQQ, SOXL, REITs and move on with their lives.

Robots didn't kill Advisors but technology did and the ETF.

Lot of emotional intelligence in planning.

AI will just make planners better.

The staff are unhelpful and untrained, cannot answer simple questions and it seems the solution to a problem is to call the call centre which I could do from home.

A physical visit to the bank is deliberately discouraged by management - it is not possible to find a manager in a bank.

Not much fun and clearly a strong incentive by the bank owners to discourage visits which will reduce the number of staff required. I do not see 'brick and mortar' banking surviving.

Most questions are dealt with through the call centre and I see this as the future. This can be fairly easily changed to a 'press 1 for...' system which once again removes the requirement for staff.

The service industries such as banking are ripe for automation. I think Digital Banking will change the requirement for a visit to the bank. What do you think?

All the best,

Mr. Planner.

اترك ردا حول هذه المهنة