محاسبين ومراجعين الحسابات

الأشخاص قاموا أيضاً بالمشاهدة

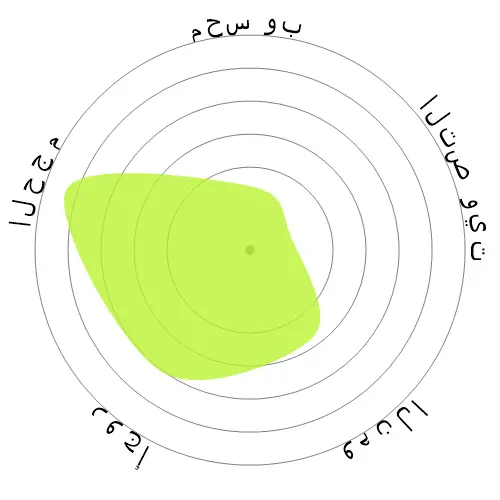

مخاطر الأتمتة المحسوبة

مخاطرة عالية (61-80%): الوظائف في هذه الفئة تواجه تهديدًا كبيرًا من التحول الى الأتمتة، حيث يمكن أتمتة العديد من مهامها بسهولة باستخدام التكنولوجيا الحالية أو التكنولوجيا المستقبلية القريبة.

مزيد من المعلومات حول ما هذه النتيجة، وكيف يتم حسابها متوفرة هنا.

استطلاع رأي المستخدمين

صوت زوارنا بأنه من المحتمل أن يتم أتمتة هذه المهنة. يدعم هذا التقييم أيضًا بواسطة مستوى خطر الأتمتة المحسوب، الذي يقدر بـ 69٪ فرصة للأتمتة.

ما هو رأيك في مخاطر الأتمتة؟

ما هي احتمالية أن يتم استبدال محاسبين ومراجعين الحسابات بالروبوتات أو الذكاء الاصطناعي في غضون العشرين سنة المقبلة؟

المشاعر

يتم تضمين الرسم البياني التالي في أي مكان يوجد فيه عدد كبير من الأصوات لتقديم بيانات ذات مغزى. تعرض هذه التمثيلات المرئية نتائج استطلاعات المستخدمين على مر الزمن، مما يوفر دلالة مهمة على اتجاهات المشاعر.

المشاعر على مر الزمن (ربع سنوي)

المشاعر على مر الزمن (سنوياً)

النمو

من المتوقع أن يزداد 5٫8٪ عدد فرص العمل المتاحة لـ 'Accountants and Auditors' بحلول 2033

التوظيف الكلي، وفتحات الوظائف المقدرة

من المتوقع تحديث التوقعات في 09-2025.

أجور

في 2023، بلغ الأجر السنوي الوسيط لـ 'Accountants and Auditors' 79٬880 $، أو 38 $ في الساعة

تم دفع "Accountants and Auditors" بمقدار 66٫2٪ أعلى من الأجر الوسيط الوطني، الذي بلغ 48٬060 $

الأجور على مر الزمن

الحجم

بحلول 2023 كان هناك 1٬435٬770 شخص يعملون كـ 'Accountants and Auditors' داخل الولايات المتحدة.

هذا يمثل حوالي 0٫9٪ من القوى العاملة الموظفة في جميع أنحاء البلاد

بتعبير آخر، حوالي 1 من كل 105 أشخاص يعملون كـ 'Accountants and Auditors'.

وصف الوظيفة

افحص وحلل وفسر سجلات المحاسبة لإعداد البيانات المالية، وقدم النصائح، أو قم بتدقيق وتقييم البيانات التي أعدها الآخرون. قم بتثبيت أو تقديم المشورة بشأن أنظمة تسجيل التكاليف أو البيانات المالية والميزانية الأخرى.

SOC Code: 13-2011.00

تعليقات

Leave a comment

Auditing will take longer = Juniors are considered to have more responsibilities than a entry level accountant. But AI will catch up. Middle and higher will be harder though as even middle auditors need to interpreter "human" input. Which will take much longer to replicate.

All higher up positions are safe.

Conclusion:

Accounting = Risky, try Auditing

Auditing = Middle risk

Auditing is fully automated using CAAT (Computer Assisted Aided Technics). I experienced it in Dubai in 2021

The first accounting jobs to go the way of the dinosaur and telephone operator will be those that are repetitive and don’t require a significant level of judgment, such as bookkeepers and accounting clerks (AR, AP, payroll, purchasing, etc.). A lot of lower-level tax work (data entry, etc.) will likely be automated.

As for auditing, some aspects will likely be taken over by AI, and for the better. A significant amount of transaction-level testing and confirmations will likely be performed by AI, and AI will be a valuable assist for designing and performing analytical procedures.

This will in turn create the need to audit the AI systems and algorithms, like how outsourcing and automation led to the standards in SSAE 18 and framework for SOC reports. There will also be an increased demand for consulting and advisory roles as clients look to implement AI technologies.

AI will help auditors be more efficient by spending less time on rote tasks. It will help auditors design stronger audit procedures, obtain better audit evidence, and improve realization. It will also free up more time to build client relationships and improve the busy season work-life balance. This will translate to more meaningful and fulfilling work and less burnout.

I’m old enough to remember the Y2K hysteria and fearmongering about computers taking everyone’s job. All of this “AI is going to take everyone’s job” strikes the same pessimistic tone.

The limitations of AI include that it cannot exercise judgment, creativity, and emotional intelligence, which make it certain that humans will continue to be required for complex problem-solving, regulatory oversight, and the instillation of trust in stakeholders. Instead of replacing them, AI will enhance the capability of humans; this will be a partnership where accountants use AI to enhance efficiency and concentrate on higher-value activities.

Upskilling in AI, data analytics, and strategic decision-making will be necessary for accountants to remain relevant in the future..

- my advice to current accountant or students of accounting : don't worry about the future.

- my advice for future of potential students of accounting : do not chose this field if you have the choice because it will be saturated and the demand will decrease.

it is difficult fot robbot to replace humans in preparing accounts,preparing an income statement,and solving proplems because it requires logical thinking,unlike what is found in a robot,as it is programmed and trained to execute commands

• Developing test strategies for AI-based accounting and financial systems

• Designing and overseeing the execution of test cases for AI-based accounting and financial systems

• Understanding the specific requirements for testing AI-based accounting and financial systems

To effectively perform these tasks, accountants and auditors must acquire new skills in analyzing algorithms and models from an accounting standpoint. This will enable them to establish and evaluate new controls for AI-generated financial data and ensure ongoing compliance with these controls.

While accountants and auditors are already skilled in managing the collection, cleaning, and validation of test data, they currently face challenges in performance and security testing. However, with the assistance of AI and further education, they will become adept at continuously verifying the accuracy of AI-based accounting and financial systems in real-time environments.

As a result, accountants and auditors will be increasingly relied upon to seamlessly integrate AI-based accounting and financial systems with real-time environments. They will need to continuously monitor and audit AI-generated financial data, ensuring error-free performance, and validating security measures to safeguard the system against cyber-attacks

Similarly, in fields like law, people are reluctant to trust machines to draft legal documents or represent them in court because of the financial stakes involved. There's a fear that mistakes could be costly. Additionally, companies are wary of outsourcing these tasks offshore due to concerns about the security of their financial data.

In essence, the reluctance to automate accounting and legal processes stems from the inherent risks and the sensitivity of financial transactions, as well as concerns about maintaining control and data security.

In order to offer the most valuable and timely advice on any AI system used in finance, both accountants and auditors will need to consistently monitor the inputs and outputs of the installed software. To do this, they will have to explore innovative methods to establish new controls for AI-generated financial data. They will be responsible for developing new systems to assess the efficacy of these controls, in addition to being the ones tasked with consistently ensuring compliance with these new controls.

Unlike other professions, Accounting and Auditing require specialized skills that most individuals in an organization lack without rigorous training. The level of training needed to certify Accounting AI outputs is comparable to becoming an accountant. Given accountants' proficiency in analyzing financial records, they are the most qualified to verify the accuracy and reliability of AI-generated financial data. Neglecting monitoring by accountants and auditors will expose companies to increased scrutiny from investors and regulators.

As the digital landscape expands and virtual transactions become increasingly prevalent, companies will need to expand their hiring of Accountants and Auditors to ensure that every transaction processed by their AI Accounting software meets set performance standards. Accountants will play a growing role in setting up, adhering to, and evaluating controls for auditing AI-generated data. The responsibilities of Accountants and Auditors will include conducting thorough assessments to verify the integrity of operations and reports within these organizations.

While accountants are already required to complete continuous education requirements annually, their curriculums will now need to be updated to place a greater emphasis on the management of AI and quality assurance processes to ensure that these systems are performing at a level that meets International Accounting Standards.

Without accountants' oversight, AI-generated results cannot be reliably verified for accuracy, completeness, reliability, and relevance. With the increasing volume of financial data, the demand for accountants will rise to validate datasets used by AI models for decision-making. Furthermore, there will be an increased need for accountants to evaluate the reliability of outputs produced by AI models.

اترك ردا حول هذه المهنة