Actuaries

People also viewed

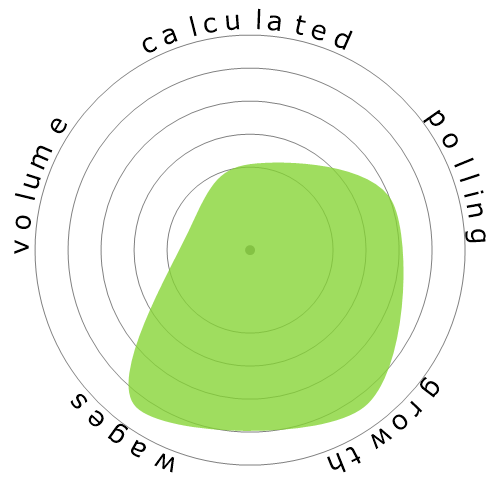

Calculated automation risk

High Risk (61-80%): Jobs in this category face a significant threat from automation, as many of their tasks can be easily automated using current or near-future technologies.

More information on what this score is, and how it is calculated is available here.

User poll

Our visitors have voted they are unsure if this occupation will be automated. However, the automation risk level we have generated suggests a much higher chance of automation: 61% chance of automation.

What do you think the risk of automation is?

What is the likelihood that Actuaries will be replaced by robots or artificial intelligence within the next 20 years?

Sentiment

The following graph is included wherever there is a substantial amount of votes to render meaningful data. These visual representations display user poll results over time, providing a significant indication of sentiment trends.

Sentiment over time (yearly)

Growth

The number of 'Actuaries' job openings is expected to rise 21.8% by 2033

Total employment, and estimated job openings

Updated projections are due 09-2025.

Wages

In 2023, the median annual wage for 'Actuaries' was $120,000, or $57 per hour

'Actuaries' were paid 149.7% higher than the national median wage, which stood at $48,060

Wages over time

Volume

As of 2023 there were 25,470 people employed as 'Actuaries' within the United States.

This represents around < 0.001% of the employed workforce across the country

Put another way, around 1 in 5 thousand people are employed as 'Actuaries'.

Job description

Analyze statistical data, such as mortality, accident, sickness, disability, and retirement rates and construct probability tables to forecast risk and liability for payment of future benefits. May ascertain insurance rates required and cash reserves necessary to ensure payment of future benefits.

SOC Code: 15-2011.00

Comments

Leave a comment

If AI will be able to determine the outcome of lawsuits, actuaries might be at greater risk

Because more data is being generated and analysis tools are improving constantly, the practice of improving actuarial models will be profitable for employers of actuaries. As long as actuaries continue to study and update actuarial assumptions and modeling techniques they will have a very important and well-compensated role in the workforce.

Regarding your second paragraph, I see no reason why a sufficiently advanced AI couldn't update actuarial assumptions based on new data, and it seems possible that an advanced AGI might be able to actually develop better models than humans.

There is no job ai cannot replace. Imagine an AI that models the human brain inside a perfect humanoid body. Why couldn't it do job x? Or are you convinced such a simulacrum could never be achieved?

101010101000110001110001001001-100101001001001010101010

Leave a reply about this occupation