Personal Financial Advisors

Where Would You Like to Go Next?

Or, Explore This Profession in Greater Detail...

What does this snowflake show?

What's this?

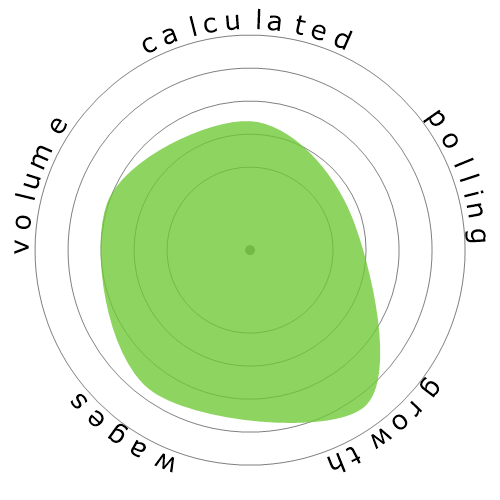

We rate jobs using four factors. These are:

- Chance of being automated

- Job growth

- Wages

- Volume of available positions

These are some key things to think about when job hunting.

People also viewed

Calculated automation risk

Moderate Risk (41-60%): Occupations with a moderate risk of automation usually involve routine tasks but still require some human judgment and interaction.

More information on what this score is, and how it is calculated is available here.

User poll

Our visitors have voted they are unsure if this occupation will be automated. This assessment is further supported by the calculated automation risk level, which estimates 43% chance of automation.

What do you think the risk of automation is?

What is the likelihood that Personal Financial Advisors will be replaced by robots or artificial intelligence within the next 20 years?

Sentiment

The following graph is shown where there are enough votes to produce meaningful data. It displays user poll results over time, providing a clear indication of sentiment trends.

Sentiment over time (yearly)

Growth

The number of 'Personal Financial Advisors' job openings is expected to rise 17.1% by 2033

Total employment, and estimated job openings

Updated projections are due 09-2025.

Wages

In 2023, the median annual wage for 'Personal Financial Advisors' was $99,580, or $48 per hour

'Personal Financial Advisors' were paid 107.2% higher than the national median wage, which stood at $48,060

Wages over time

Volume

As of 2023 there were 272,190 people employed as 'Personal Financial Advisors' within the United States.

This represents around 0.18% of the employed workforce across the country

Put another way, around 1 in 557 people are employed as 'Personal Financial Advisors'.

Job description

Advise clients on financial plans using knowledge of tax and investment strategies, securities, insurance, pension plans, and real estate. Duties include assessing clients' assets, liabilities, cash flow, insurance coverage, tax status, and financial objectives. May also buy and sell financial assets for clients.

SOC Code: 13-2052.00

Comments (30)

How can one relate to a line of code, or trust that the programmers inherent biases are not skewing the results?

I’m completely on the fence when it comes to which jobs and when AI will replace the human workforce. I don’t underestimate the ambitions of tech producers and the average human being's preference for the quick, easy, and cheaper option to bring about such a situation. And let’s not forget how far technology has come since the Internet, let alone the simple calculator.

All this said we shouldn’t think that the scenario where AI could replace the human workforce is one that’s predetermined. “We” (everyone single one of us) have the collective ability to cause or prevent such an eventuality. We must also consider how viable an AI-dominated society and economy would really be. Every government across the globe would have its hands cut out with a population whose majority is unemployable. Imagine the civil unrest? Another consideration is the damage this could do to the economy; if a massive portion of humanity isn’t working, and isn’t getting a wage like they used to, we would see an unprecedented reduction in the flow of money around the economy. And what happens to money when there is a lack of exchange taking place? Doesn’t the value of money decrease? The financial advisors in this forum would be the best to elaborate on this or to correct my statement.

In conclusion: while I have no doubt that the ambitious tech lords and their acolytes will do what they can to bring about an AI world, the question of whether humans from governments to ordinary citizens will allow it is another thing altogether.

Reply to comment