Financial and Investment Analysts

Where Would You Like to Go Next?

Or, Explore This Profession in Greater Detail...

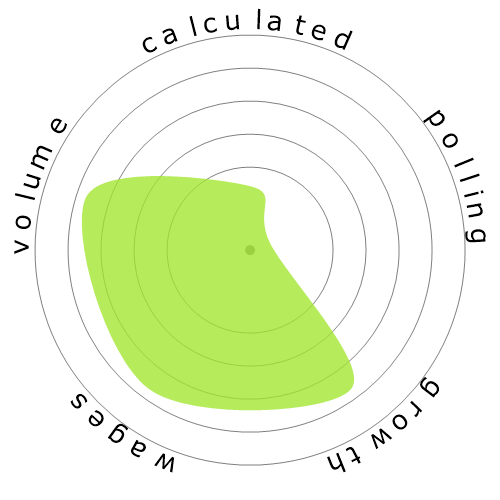

What does this snowflake show?

What's this?

We rate jobs using four factors. These are:

- Chance of being automated

- Job growth

- Wages

- Volume of available positions

These are some key things to think about when job hunting.

People also viewed

Calculated automation risk

High Risk (61-80%): Jobs in this category face a significant threat from automation, as many of their tasks can be easily automated using current or near-future technologies.

More information on what this score is, and how it is calculated is available here.

User poll

Our visitors have voted that it's very probable this occupation will be automated. This assessment is further supported by the calculated automation risk level, which estimates 77% chance of automation.

What do you think the risk of automation is?

What is the likelihood that Financial and Investment Analysts will be replaced by robots or artificial intelligence within the next 20 years?

Sentiment

The following graph is shown where there are enough votes to produce meaningful data. It displays user poll results over time, providing a clear indication of sentiment trends.

Sentiment over time (quarterly)

Sentiment over time (yearly)

Growth

The number of 'Financial and Investment Analysts' job openings is expected to rise 9.5% by 2033

Total employment, and estimated job openings

Updated projections are due 09-2025.

Wages

In 2023, the median annual wage for 'Financial and Investment Analysts' was 99.010 $, or 48 $ per hour

'Financial and Investment Analysts' were paid 106.0% higher than the national median wage, which stood at 48.060 $

Wages over time

Volume

As of 2023 there were 325,220 people employed as 'Financial and Investment Analysts' within the United States.

This represents around 0.21% of the employed workforce across the country

Put another way, around 1 in 466 people are employed as 'Financial and Investment Analysts'.

Job description

Conduct quantitative analyses of information involving investment programs or financial data of public or private institutions, including valuation of businesses.

SOC Code: 13-2051.00

Comments (34)

It's already been attempted for decades to automate wall street most well known example being Blackrock's Aladdin

Then there's the technical work done by hedge funds most notably Medallion.

Even if the stock market truly was fully automated it would already be priced in and become worthless

A good trading strategy actually requires some subjectivity specifically for preventing arbitrage by quants.

I really don't think AI is going to change much, the innovation that's needed to generate Alpha can't be done by AI

TL;DR it can't be fully automated, if it could it already would have been

Reporting activities are done by Python robots and so on.

Investment activities are being replaced by robots and AI, but we still have the issue of emotions involved. However, since companies don't usually take aggressive approaches to investments, they typically invest in fixed income.

Operational tasks are a thing of the past.

Reply to comment