贷款主管

您接下来想去哪里?

或者,更深入地探索这个职业...

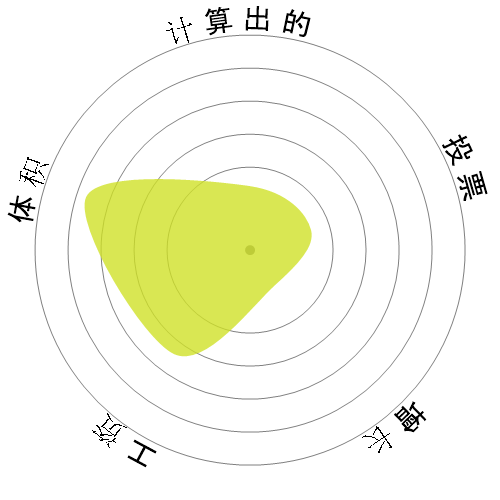

这个雪花图案展示了什么?

这是什么?

我们使用四个因素对工作进行评分。这些是:

- 被自动化的可能性

- 工作增长

- 工资

- 可用职位的数量

这些是求职时需要考虑的一些关键事项。

人们还浏览了

计算自动化风险

高风险(61-80%):这个类别的工作面临着来自自动化的重大威胁,因为他们的许多任务可以使用当前或近期的技术轻松自动化。

有关这个分数是什么以及如何计算的更多信息可在这里找到。

用户投票

我们的访客投票认为,这个职业很可能会被自动化。 这个评估进一步得到了通过计算得出的自动化风险等级的支持,该等级预计有79%的机会实现自动化。

你认为自动化的风险是什么?

贷款主管在未来20年内被机器人或人工智能取代的可能性有多大?

情感

以下图表显示了在有足够投票的情况下生成的有意义数据。它展示了用户投票结果随时间的变化,清晰地指示了情感趋势。

随着时间(每年)的情绪变化

增长

预计"Loan Officers"的工作空缺数量将在2033内增长1.4%

总就业人数和预计的职位空缺

更新的预测将在09-2025到期.

工资

在2023,'Loan Officers'的年度中位数工资为$69,990,或每小时$34。

'Loan Officers'的薪资比全国中位工资高45.6%,全国中位工资为$48,060。

随着时间推移的工资

体积

截至2023,在美国有321,090人被雇佣为'Loan Officers'。

这代表了全国就业劳动力的大约0.21%

换句话说,大约每472人中就有1人被雇佣为“Loan Officers”。

工作描述

评估,授权,或推荐批准商业,房地产或信贷贷款。就财务状况和付款方式向借款人提供建议。包括抵押贷款人员和代理商,催收分析师,贷款服务人员,贷款承保人,以及发薪日贷款人员。

SOC Code: 13-2072.00

评论 (15)

回复评论