Kişisel Finansal Danışmanlar

İnsanlar ayrıca inceledi

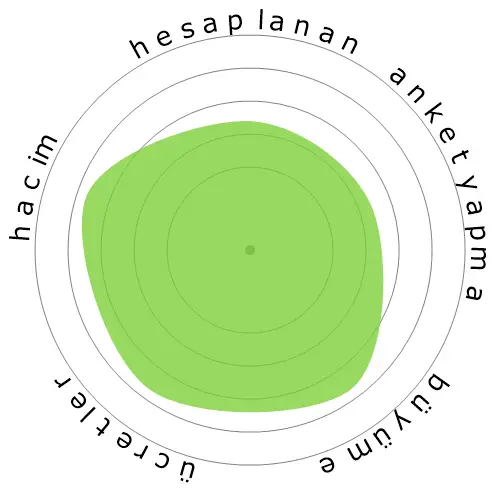

Hesaplanmış otomasyon riski

Orta Risk (41-60%): Otomasyon riski orta olan meslekler genellikle rutin görevleri içerir ancak hala bir miktar insan muhakemesi ve etkileşimi gerektirir.

Bu puanın ne olduğu ve nasıl hesaplandığına dair daha fazla bilgi burada 'da mevcuttur.

Kullanıcı anketi

Ziyaretçilerimiz, bu mesleğin otomatikleştirilip otomatikleştirilmeyeceğinden emin olmadıklarını belirtmişler. Bu değerlendirme, otomasyon risk seviyesinin hesaplanması ile daha da desteklenmektedir, bu da otomasyonun %43% olasılığını tahmin eder.

Otomasyonun riski hakkında ne düşünüyorsunuz?

Kişisel Finansal Danışmanların önümüzdeki 20 yıl içinde robotlar veya yapay zeka tarafından değiştirilme olasılığı nedir?

Duygu

Aşağıdaki grafik, anlamlı veriler sunmak için yeterli miktarda oy bulunduğunda eklenir. Bu görsel temsiller, kullanıcı anket sonuçlarını zaman içinde göstererek duygu eğilimlerine dair önemli bir gösterge sağlar.

Zaman içindeki duygu durumu (yıllık)

Büyüme

'Personal Financial Advisors' iş ilanlarının sayısının 2033 yılına kadar 17,1% artması bekleniyor.

Toplam istihdam ve tahmini iş açılışları

Güncellenmiş projeksiyonlar 09-2025 tarihinde teslim edilmelidir..

Ücretler

2023 yılında, 'Personal Financial Advisors' için medyan yıllık ücret $99.580 idi, yani saat başına $47.

'Personal Financial Advisors' ulusal medyan ücretin, $48.060 olduğu yerde, %107,2% daha yüksek bir ücret aldılar.

Zaman içindeki ücretler

Hacim

2023 itibariyle Amerika Birleşik Devletleri'nde 272.190 kişi 'Personal Financial Advisors' olarak istihdam edilmiştir.

Bu, ülke genelindeki istihdam edilen iş gücünün yaklaşık olarak %0,18%'ını temsil eder.

Başka bir deyişle, her 557 kişiden biri 'Personal Financial Advisors' olarak istihdam edilmektedir.

İş tanımı

Müşterilere, vergi ve yatırım stratejileri, menkul kıymetler, sigorta, emeklilik planları ve gayrimenkul konusundaki bilgileri kullanarak finansal planlar konusunda tavsiyede bulunun. Görevler arasında müşterilerin varlıklarını, borçlarını, nakit akışını, sigorta kapsamını, vergi durumunu ve finansal hedeflerini değerlendirmek yer alır. Ayrıca müşteriler için finansal varlıkları satın alabilir ve satabilir.

SOC Code: 13-2052.00

Yorumlar

Leave a comment

How can one relate to a line of code, or trust that the programmers inherent biases are not skewing the results?

I’m completely on the fence when it comes to which jobs and when AI will replace the human workforce. I don’t underestimate the ambitions of tech producers and the average human being's preference for the quick, easy, and cheaper option to bring about such a situation. And let’s not forget how far technology has come since the Internet, let alone the simple calculator.

All this said we shouldn’t think that the scenario where AI could replace the human workforce is one that’s predetermined. “We” (everyone single one of us) have the collective ability to cause or prevent such an eventuality. We must also consider how viable an AI-dominated society and economy would really be. Every government across the globe would have its hands cut out with a population whose majority is unemployable. Imagine the civil unrest? Another consideration is the damage this could do to the economy; if a massive portion of humanity isn’t working, and isn’t getting a wage like they used to, we would see an unprecedented reduction in the flow of money around the economy. And what happens to money when there is a lack of exchange taking place? Doesn’t the value of money decrease? The financial advisors in this forum would be the best to elaborate on this or to correct my statement.

In conclusion: while I have no doubt that the ambitious tech lords and their acolytes will do what they can to bring about an AI world, the question of whether humans from governments to ordinary citizens will allow it is another thing altogether.

For example, look at what services SoFi offers on their brokerage it's revolutionary. When you first heard "stonks always go up brrrrr" then that was the exact point the financial advisors and other various staff felt the chill up their spine of oncoming obsolescence.

Like Librarians in 2004 though, if you have the job now you won't even consider retirement for 15 years you're good. Are Advisors being used by Millennials and Gen Zoomer? I really am beginning to doubt it highly, they will just put all their money in SPY, QQQ, SOXL, REITs and move on with their lives.

Robots didn't kill Advisors but technology did and the ETF.

Lot of emotional intelligence in planning.

AI will just make planners better.

The staff are unhelpful and untrained, cannot answer simple questions and it seems the solution to a problem is to call the call centre which I could do from home.

A physical visit to the bank is deliberately discouraged by management - it is not possible to find a manager in a bank.

Not much fun and clearly a strong incentive by the bank owners to discourage visits which will reduce the number of staff required. I do not see 'brick and mortar' banking surviving.

Most questions are dealt with through the call centre and I see this as the future. This can be fairly easily changed to a 'press 1 for...' system which once again removes the requirement for staff.

The service industries such as banking are ripe for automation. I think Digital Banking will change the requirement for a visit to the bank. What do you think?

All the best,

Mr. Planner.

Bu meslek hakkında bir yanıt bırakın