Finansal ve Yatırım Analistleri

Sıradaki Gitmek İstediğiniz Yer Neresi?

Veya, Bu Mesleği Daha Ayrıntılı Keşfedin...

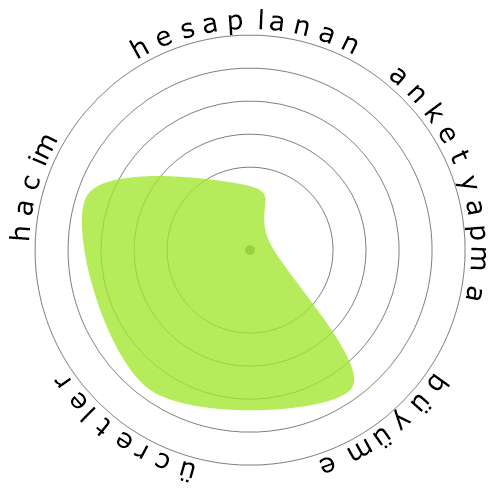

Bu kar tanesi neyi gösteriyor?

Bu nedir?

İşleri dört faktör kullanarak değerlendiriyoruz. Bunlar:

- Otomatikleştirilme olasılığı

- İş büyümesi

- Ücretler

- Mevcut pozisyonların hacmi

İş ararken düşünülmesi gereken bazı önemli noktalar bunlardır.

İnsanlar ayrıca inceledi

Hesaplanmış otomasyon riski

Yüksek Risk (61-80%): Bu kategorideki işler, görevlerinin çoğu mevcut veya yakın gelecekteki teknolojiler kullanılarak kolayca otomatikleştirilebileceği için otomasyondan önemli bir tehditle karşı karşıyadır.

Bu puanın ne olduğu ve nasıl hesaplandığına dair daha fazla bilgi burada 'da mevcuttur.

Kullanıcı anketi

Ziyaretçilerimiz, bu mesleğin otomatikleştirilmesinin çok muhtemel olduğunu belirtmişlerdir. Bu değerlendirme, otomasyon risk seviyesinin hesaplanması ile daha da desteklenmektedir, bu da otomasyonun %77% olasılığını tahmin eder.

Otomasyonun riski hakkında ne düşünüyorsunuz?

Finansal ve Yatırım Analistleriın önümüzdeki 20 yıl içinde robotlar veya yapay zeka tarafından değiştirilme olasılığı nedir?

Duygu

Aşağıdaki grafik, anlamlı veriler üretmek için yeterli oy olduğunda gösterilir. Kullanıcı anket sonuçlarını zaman içinde göstererek, duygu eğilimlerinin net bir göstergesini sağlar.

Zaman içindeki duygu durumu (üç aylık)

Zaman içindeki duygu durumu (yıllık)

Büyüme

'Financial and Investment Analysts' iş ilanlarının sayısının 2033 yılına kadar 9,5% artması bekleniyor.

Toplam istihdam ve tahmini iş açılışları

Güncellenmiş projeksiyonlar 09-2025 tarihinde teslim edilmelidir..

Ücretler

2023 yılında, 'Financial and Investment Analysts' için medyan yıllık ücret $99.010 idi, yani saat başına $48.

'Financial and Investment Analysts' ulusal medyan ücretin, $48.060 olduğu yerde, %106,0% daha yüksek bir ücret aldılar.

Zaman içindeki ücretler

Hacim

2023 itibariyle Amerika Birleşik Devletleri'nde 325.220 kişi 'Financial and Investment Analysts' olarak istihdam edilmiştir.

Bu, ülke genelindeki istihdam edilen iş gücünün yaklaşık olarak %0,21%'ını temsil eder.

Başka bir deyişle, her 466 kişiden biri 'Financial and Investment Analysts' olarak istihdam edilmektedir.

İş tanımı

Kamu veya özel kurumların yatırım programları veya finansal verileri hakkında bilgi içeren nicel analizler yapın, işletmelerin değerlemesini de içerir.

SOC Code: 13-2051.00

Yorumlar (34)

It's already been attempted for decades to automate wall street most well known example being Blackrock's Aladdin

Then there's the technical work done by hedge funds most notably Medallion.

Even if the stock market truly was fully automated it would already be priced in and become worthless

A good trading strategy actually requires some subjectivity specifically for preventing arbitrage by quants.

I really don't think AI is going to change much, the innovation that's needed to generate Alpha can't be done by AI

TL;DR it can't be fully automated, if it could it already would have been

Reporting activities are done by Python robots and so on.

Investment activities are being replaced by robots and AI, but we still have the issue of emotions involved. However, since companies don't usually take aggressive approaches to investments, they typically invest in fixed income.

Operational tasks are a thing of the past.

Yorumu yanıtla