Försäkringsunderwriters

Personer tittade också på

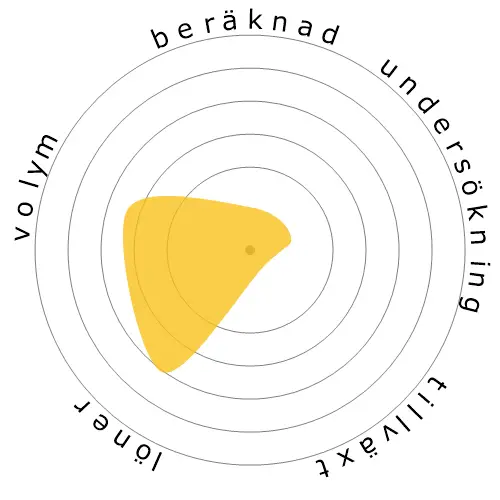

Beräknad automatiseringsrisk

Omedelbar risk (81-100%): Yrken på denna nivå har en extremt hög sannolikhet att automatiseras inom den närmaste framtiden. Dessa jobb består huvudsakligen av repetitiva, förutsägbara uppgifter med litet behov av mänskligt omdöme.

Mer information om vad detta betyg är, och hur det beräknas finns tillgängligt här.

Användarundersökning

Våra besökare har röstat för att det är troligt att detta yrke kommer att automatiseras. Detta bedömning stöds ytterligare av den beräknade automationsrisknivån, som uppskattar 83% chans för automation.

Vad tror du är risken med automatisering?

Vad är sannolikheten att Försäkringsunderwriters kommer att ersättas av robotar eller artificiell intelligens inom de närmaste 20 åren?

Känsla

Följande graf inkluderas där det finns en betydande mängd röster för att ge meningsfull data. Dessa visuella representationer visar användaromröstningsresultat över tid och ger en viktig indikation på sentimenttrender.

Känslor över tid (årligen)

Tillväxt

Antalet 'Insurance Underwriters' jobböppningar förväntas att minska med 4,0% fram till 2033

Total sysselsättning och uppskattade jobböppningar

Uppdaterade prognoser beräknas 09-2025.

Löner

I 2023 var den medianårliga lönen för 'Insurance Underwriters' 77 860 $, eller 37 $ per timme.

'Insurance Underwriters' betalades 62,0% högre än den nationella medianlönen, som låg på 48 060 $

Löner över tid

Volym

Från och med 2023 var det 101 310 personer anställda som 'Insurance Underwriters' inom USA.

Detta representerar cirka 0,07% av den anställda arbetskraften i hela landet

Sagt på ett annat sätt, runt 1 av 1 tusen personer är anställda som 'Insurance Underwriters'.

Arbetsbeskrivning

Granska enskilda ansökningar om försäkring för att utvärdera graden av risk som är involverad och avgöra acceptans av ansökningar.

SOC Code: 13-2053.00

Kommentarer

I am considering entering insurance underwriting because claims were very bad, I must say.

Would you say that computer automation is taking over all areas of underwriting (commercial underwriting, property & casualty underwriting, etc.)? I do hear that it is taking personal insurance by storm.

Also, I am REALLY trying hard to find similar jobs to underwriting/insurance in case underwriting doesn't work out.

I'm looking at cost estimating (outside of construction), property assessment, and budget analysis. According to the Bureau of Labor Statistics, you don't necessarily need a business or finance degree to go into these fields (I took several traditional/core business classes in school, and I also majored in a field much like "business psychology" - organizational development, which was in the business school).

Do you have any alternatives that you plan to explore in case you have to leave underwriting? Do you think any of the ones that I mentioned are feasible alternatives?

Thank you,

Carl Daniel

There is no doubt automation will transform this job and remove the need for the underwriter defined above. There are two different types of underwriting, staff and line underwriting. Line underwriting is what is defined above, an employee who reviews applications and degree of risk on accounts on an individual basis. Staff underwriters develop guidelines and initiatives to help drive the changes in product performance . Line underwriters then follow these guidelines and initiatives.

Staff underwriting will adapt to automation and use the tools made available by it to make better decisions. You will see some reduction in this field due to ease of decision making and some of these functions will likely transfer to automation.

Another thing to consider is that is the complexity of insurance. Insurance is ever evolving based on the ever changing ways of the world. Especially in commercial insurance, there are way too many unique situations that occur on a daily basis that there is no true basic answer to based on past history, but instead require an instinctive decision by an experienced underwriter. It is highly unlikely automation will be able to adapt to these daily situations. This is how some line underwriting will survive.

Do you mean to say that this definition removes the need for an underwriter? - "Review individual applications for insurance to evaluate the degree of risk involved and determine the acceptance of applications."

Oh, sorry, I just realized that you mentioned that this definition only applies to line underwriting, and that automation will decrease the need for line underwriters.

Thank you for clarifying that there are two types of underwriting - I wasn't aware of that. Underwriting is the only field in insurance that interests me, but I'm not into sales. I've been working in claims (and subrogation) for years, but it's not my cup of tea.

Since I don't have the educational background to be an actuary, underwriting is pretty much the only option left for me.

I've never heard of staff underwriting before - unfortunately, working in claims didn't teach me much about underwriting.

It seems like staff underwriting is the future of employment in underwriting.

You mentioned that commercial insurance/underwriting is hard to predict due to the constantly evolving and complex nature of insurance.

I'm considering getting my Associates in Commercial Underwriting while I search for a job in underwriting.

What do you think about the future of employment in commercial underwriting? Do you think there's any hope for cautious optimism, especially for staff underwriters in commercial underwriting?

Thank you,

Carl Daniel

Lämna ett svar om detta yrke