Doradcy finansowi personalni

Dokąd chciałbyś się udać dalej?

Lub, zbadaj ten zawód bardziej szczegółowo...

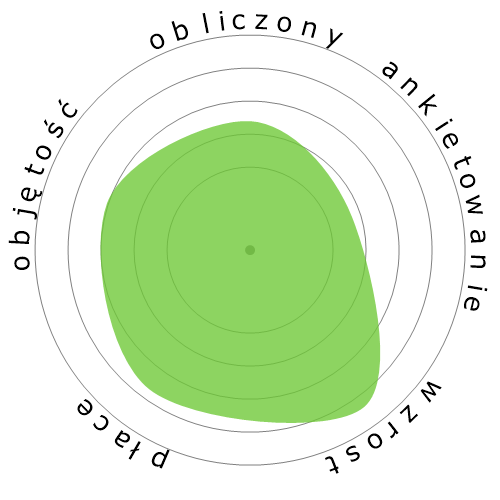

Co przedstawia ten płatek śniegu?

Co to jest?

Oceniamy prace, biorąc pod uwagę cztery czynniki. Są to:

- Szansa na automatyzację

- Wzrost zatrudnienia

- Wynagrodzenie

- Liczba dostępnych stanowisk

Są to kluczowe rzeczy, o których warto pomyśleć podczas poszukiwania pracy.

Ludzie również oglądali

Obliczone ryzyko automatyzacji

Umiarkowane ryzyko (41-60%): Zawody z umiarkowanym ryzykiem automatyzacji zwykle obejmują rutynowe zadania, ale nadal wymagają pewnego ludzkiego osądu i interakcji.

Więcej informacji na temat tego, czym jest ten wynik i jak jest obliczany, jest dostępne tutaj.

Ankieta użytkownika

Nasi goście głosowali, że nie są pewni, czy to zawód zostanie zautomatyzowany. To ocena jest dodatkowo wspierana przez obliczony poziom ryzyka automatyzacji, który szacuje 43% szansę na automatyzację.

Jakie są Twoje zdanie na temat ryzyka automatyzacji?

Jakie jest prawdopodobieństwo, że Doradcy finansowi personalni zostanie zastąpione przez roboty lub sztuczną inteligencję w ciągu najbliższych 20 lat?

Nastroje

Poniższy wykres jest wyświetlany tam, gdzie jest wystarczająca liczba głosów, aby uzyskać znaczące dane. Przedstawia wyniki ankiet użytkowników w czasie, dając wyraźny obraz trendów nastrojów.

Nastroje w czasie (rocznie)

Wzrost

Liczba ofert pracy na stanowisku 'Personal Financial Advisors' ma wzrosnąć 17,1% do 2033

Całkowite zatrudnienie oraz szacowane oferty pracy

Zaktualizowane prognozy mają być dostępne 09-2025.

Płace

W 2023, mediana rocznej pensji dla 'Personal Financial Advisors' wynosiła 99 580 $, czyli 48 $ za godzinę.

'Personal Financial Advisors' otrzymali wynagrodzenie wyższe o 107,2% od średniej krajowej, która wynosiła 48 060 $

Płace z biegiem czasu

Objętość

Od 2023 roku zatrudnionych było 272 190 osób na stanowisku 'Personal Financial Advisors' w Stanach Zjednoczonych.

To oznacza około 0,18% zatrudnionej siły roboczej w całym kraju.

Inaczej mówiąc, około 1 na 557 osób jest zatrudnionych jako 'Personal Financial Advisors'.

Opis stanowiska pracy

Doradzaj klientom w zakresie planów finansowych, wykorzystując wiedzę na temat strategii podatkowych i inwestycyjnych, papierów wartościowych, ubezpieczeń, planów emerytalnych i nieruchomości. Obowiązki obejmują ocenę aktywów klientów, zobowiązań, przepływu środków pieniężnych, pokrycia ubezpieczeniowego, statusu podatkowego i celów finansowych. Może również kupować i sprzedawać aktywa finansowe dla klientów.

SOC Code: 13-2052.00

Komentarze (30)

How can one relate to a line of code, or trust that the programmers inherent biases are not skewing the results?

I’m completely on the fence when it comes to which jobs and when AI will replace the human workforce. I don’t underestimate the ambitions of tech producers and the average human being's preference for the quick, easy, and cheaper option to bring about such a situation. And let’s not forget how far technology has come since the Internet, let alone the simple calculator.

All this said we shouldn’t think that the scenario where AI could replace the human workforce is one that’s predetermined. “We” (everyone single one of us) have the collective ability to cause or prevent such an eventuality. We must also consider how viable an AI-dominated society and economy would really be. Every government across the globe would have its hands cut out with a population whose majority is unemployable. Imagine the civil unrest? Another consideration is the damage this could do to the economy; if a massive portion of humanity isn’t working, and isn’t getting a wage like they used to, we would see an unprecedented reduction in the flow of money around the economy. And what happens to money when there is a lack of exchange taking place? Doesn’t the value of money decrease? The financial advisors in this forum would be the best to elaborate on this or to correct my statement.

In conclusion: while I have no doubt that the ambitious tech lords and their acolytes will do what they can to bring about an AI world, the question of whether humans from governments to ordinary citizens will allow it is another thing altogether.

Odpowiedz na komentarz