Analitycy Finansowi i Inwestycyjni

Dokąd chciałbyś się udać dalej?

Lub, zbadaj ten zawód bardziej szczegółowo...

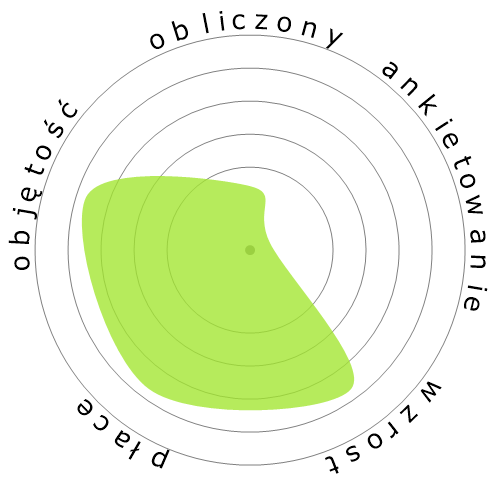

Co przedstawia ten płatek śniegu?

Co to jest?

Oceniamy prace, biorąc pod uwagę cztery czynniki. Są to:

- Szansa na automatyzację

- Wzrost zatrudnienia

- Wynagrodzenie

- Liczba dostępnych stanowisk

Są to kluczowe rzeczy, o których warto pomyśleć podczas poszukiwania pracy.

Ludzie również oglądali

Obliczone ryzyko automatyzacji

Wysokie ryzyko (61-80%): Zawody w tej kategorii stoją przed znaczącym zagrożeniem ze strony automatyzacji, ponieważ wiele z ich zadań może być łatwo zautomatyzowanych przy użyciu obecnych lub bliskich przyszłości technologii.

Więcej informacji na temat tego, czym jest ten wynik i jak jest obliczany, jest dostępne tutaj.

Ankieta użytkownika

Nasi goście głosowali, że jest bardzo prawdopodobne, iż to zawód zostanie zautomatyzowany. To ocena jest dodatkowo wspierana przez obliczony poziom ryzyka automatyzacji, który szacuje 77% szansę na automatyzację.

Jakie są Twoje zdanie na temat ryzyka automatyzacji?

Jakie jest prawdopodobieństwo, że Analitycy Finansowi i Inwestycyjni zostanie zastąpione przez roboty lub sztuczną inteligencję w ciągu najbliższych 20 lat?

Nastroje

Poniższy wykres jest wyświetlany tam, gdzie jest wystarczająca liczba głosów, aby uzyskać znaczące dane. Przedstawia wyniki ankiet użytkowników w czasie, dając wyraźny obraz trendów nastrojów.

Nastroje w czasie (kwartalnie)

Nastroje w czasie (rocznie)

Wzrost

Liczba ofert pracy na stanowisku 'Financial and Investment Analysts' ma wzrosnąć 9,5% do 2033

Całkowite zatrudnienie oraz szacowane oferty pracy

Zaktualizowane prognozy mają być dostępne 09-2025.

Płace

W 2023, mediana rocznej pensji dla 'Financial and Investment Analysts' wynosiła 99 010 $, czyli 48 $ za godzinę.

'Financial and Investment Analysts' otrzymali wynagrodzenie wyższe o 106,0% od średniej krajowej, która wynosiła 48 060 $

Płace z biegiem czasu

Objętość

Od 2023 roku zatrudnionych było 325 220 osób na stanowisku 'Financial and Investment Analysts' w Stanach Zjednoczonych.

To oznacza około 0,21% zatrudnionej siły roboczej w całym kraju.

Inaczej mówiąc, około 1 na 466 osób jest zatrudnionych jako 'Financial and Investment Analysts'.

Opis stanowiska pracy

Przeprowadź analizy ilościowe informacji dotyczących programów inwestycyjnych lub danych finansowych instytucji publicznych lub prywatnych, w tym wyceny przedsiębiorstw.

SOC Code: 13-2051.00

Komentarze (34)

It's already been attempted for decades to automate wall street most well known example being Blackrock's Aladdin

Then there's the technical work done by hedge funds most notably Medallion.

Even if the stock market truly was fully automated it would already be priced in and become worthless

A good trading strategy actually requires some subjectivity specifically for preventing arbitrage by quants.

I really don't think AI is going to change much, the innovation that's needed to generate Alpha can't be done by AI

TL;DR it can't be fully automated, if it could it already would have been

Reporting activities are done by Python robots and so on.

Investment activities are being replaced by robots and AI, but we still have the issue of emotions involved. However, since companies don't usually take aggressive approaches to investments, they typically invest in fixed income.

Operational tasks are a thing of the past.

Odpowiedz na komentarz