개인 재무 상담사

다음으로 어디로 가고 싶으신가요?

또는, 이 직업을 더 자세히 탐구해보세요...

이 눈송이는 무엇을 나타내나요?

이것은 무엇인가요?

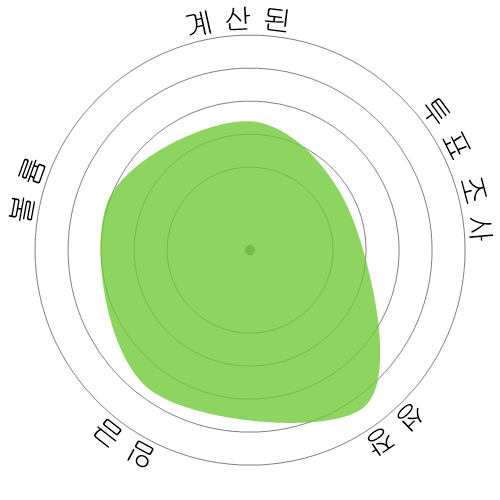

우리는 네 가지 요소를 사용하여 직업을 평가합니다. 이들은 다음과 같습니다:

- 자동화 될 확률

- 직업 성장률

- 임금

- 사용 가능한 직위의 양

이것들은 직업을 찾을 때 고려해야 할 중요한 사항들입니다.

사람들이 또한 조회했습니다

계산된 자동화 위험

중간 위험 (41-60%): 자동화의 중간 위험을 가진 직업은 보통 루틴적인 작업을 포함하지만, 여전히 일부 인간의 판단력과 상호작용이 필요합니다.

이 점수가 무엇인지, 그리고 어떻게 계산되는지에 대한 자세한 정보는 여기에 있습니다.

사용자 설문조사

우리의 방문객들은 이 직업이 자동화될지 확신이 없다고 투표했습니다. 이 평가는 계산된 자동화 위험 수준에 의해 더욱 지지받고 있으며, 이는 자동화의 43% 확률을 추정합니다.

자동화의 위험성에 대해 어떻게 생각하십니까?

개인 재무 상담사이 다음 20년 이내에 로봇이나 인공지능에 의해 대체될 가능성은 얼마나 됩니까?

감정

다음 그래프는 의미 있는 데이터를 생성할 수 있을 만큼 충분한 투표가 있을 때 표시됩니다. 이는 시간에 따른 사용자 설문 조사 결과를 보여주며, 감정 추세에 대한 명확한 지표를 제공합니다.

시간별 감정 (연간)

성장

'Personal Financial Advisors' 직업 분야의 공석은 2033년까지 17.1% 증가할 것으로 예상됩니다.

총 고용량 및 예상 직업 공석

업데이트된 예상치가 09-2025에 제출될 예정입니다..

임금

2023년에 'Personal Financial Advisors'의 중앙값 연간 급여는 99.580 $이며, 시간당 48 $입니다.

'Personal Financial Advisors'은 전국 중위임금인 48.060 $보다 107.2% 더 높은 금액을 지불받았습니다.

시간에 따른 임금

볼륨

2023년 현재, 미국 내에서 'Personal Financial Advisors'로 고용된 사람들의 수는 272,190명이었습니다.

이는 전국의 고용 노동력 중 약 0.18%를 대표합니다.

다시 말해, 약 557명 중 1명이 'Personal Financial Advisors'로 고용되어 있습니다.

직무 설명

세금 및 투자 전략, 유가 증권, 보험, 연금 계획, 부동산에 대한 지식을 활용하여 고객에게 재무 계획에 대한 조언을 제공합니다. 업무에는 고객의 자산, 부채, 현금 흐름, 보험 보장, 세금 상태 및 재무 목표를 평가하는 것이 포함됩니다. 또한 고객을 대신하여 재무 자산을 매입하거나 매도할 수도 있습니다.

SOC Code: 13-2052.00

댓글 (30)

How can one relate to a line of code, or trust that the programmers inherent biases are not skewing the results?

I’m completely on the fence when it comes to which jobs and when AI will replace the human workforce. I don’t underestimate the ambitions of tech producers and the average human being's preference for the quick, easy, and cheaper option to bring about such a situation. And let’s not forget how far technology has come since the Internet, let alone the simple calculator.

All this said we shouldn’t think that the scenario where AI could replace the human workforce is one that’s predetermined. “We” (everyone single one of us) have the collective ability to cause or prevent such an eventuality. We must also consider how viable an AI-dominated society and economy would really be. Every government across the globe would have its hands cut out with a population whose majority is unemployable. Imagine the civil unrest? Another consideration is the damage this could do to the economy; if a massive portion of humanity isn’t working, and isn’t getting a wage like they used to, we would see an unprecedented reduction in the flow of money around the economy. And what happens to money when there is a lack of exchange taking place? Doesn’t the value of money decrease? The financial advisors in this forum would be the best to elaborate on this or to correct my statement.

In conclusion: while I have no doubt that the ambitious tech lords and their acolytes will do what they can to bring about an AI world, the question of whether humans from governments to ordinary citizens will allow it is another thing altogether.

댓글에 답글 달기