재무 및 투자 분석가

사람들이 또한 조회했습니다

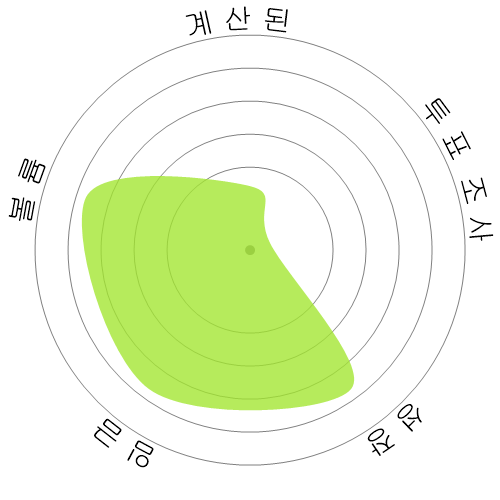

계산된 자동화 위험

고위험 (61-80%): 이 범주에 속하는 직업은 현재 또는 가까운 미래의 기술을 사용하여 쉽게 자동화될 수 있는 많은 업무를 수행하므로 자동화로부터 중대한 위협을 받고 있습니다.

이 점수가 무엇인지, 그리고 어떻게 계산되는지에 대한 자세한 정보는 여기에 있습니다.

사용자 설문조사

우리의 방문자들은 이 직업이 자동화될 가능성이 매우 높다고 투표했습니다. 이 평가는 계산된 자동화 위험 수준에 의해 더욱 지지받고 있으며, 이는 자동화의 77% 확률을 추정합니다.

자동화의 위험성에 대해 어떻게 생각하십니까?

재무 및 투자 분석가이 다음 20년 이내에 로봇이나 인공지능에 의해 대체될 가능성은 얼마나 됩니까?

감정

다음 그래프는 의미 있는 데이터를 제공할 수 있을 만큼 충분한 투표 수가 있을 때마다 포함됩니다. 이러한 시각적 표현은 시간 경과에 따른 사용자 투표 결과를 보여주며, 감정 추세에 대한 중요한 지표를 제공합니다.

시간에 따른 감정 (분기별)

시간별 감정 (연간)

성장

'Financial and Investment Analysts' 직업 분야의 공석은 2033년까지 9.5% 증가할 것으로 예상됩니다.

총 고용량 및 예상 직업 공석

업데이트된 예상치가 09-2025에 제출될 예정입니다..

임금

2023년에 'Financial and Investment Analysts'의 중앙값 연간 급여는 $99,010이며, 시간당 $47입니다.

'Financial and Investment Analysts'은 전국 중위임금인 $48,060보다 106.0% 더 높은 금액을 지불받았습니다.

시간에 따른 임금

볼륨

2023년 현재, 미국 내에서 'Financial and Investment Analysts'로 고용된 사람들의 수는 325,220명이었습니다.

이는 전국의 고용 노동력 중 약 0.21%를 대표합니다.

다시 말해, 약 466명 중 1명이 'Financial and Investment Analysts'로 고용되어 있습니다.

직무 설명

투자 프로그램이나 공공 또는 민간 기관의 재무 데이터와 관련된 정보에 대한 정량적 분석을 수행하며, 이에는 기업 가치 평가가 포함됩니다.

SOC Code: 13-2051.00

댓글

Leave a comment

It's already been attempted for decades to automate wall street most well known example being Blackrock's Aladdin

Then there's the technical work done by hedge funds most notably Medallion.

Even if the stock market truly was fully automated it would already be priced in and become worthless

A good trading strategy actually requires some subjectivity specifically for preventing arbitrage by quants.

I really don't think AI is going to change much, the innovation that's needed to generate Alpha can't be done by AI

TL;DR it can't be fully automated, if it could it already would have been

Reporting activities are done by Python robots and so on.

Investment activities are being replaced by robots and AI, but we still have the issue of emotions involved. However, since companies don't usually take aggressive approaches to investments, they typically invest in fixed income.

Operational tasks are a thing of the past.

Entry-level it's pretty much just data entry, things that can easily be automated.

On higher levels, it requires decision making, data analysis, and other skills that will be out of any computer's reach for quite some time still.

Overall it's fairly safe from automation as of now. The human brain is still the single best pattern recognition system that we know of and pattern recognition is a large part of Financial Analysis.

However, the Finance Industry requires analysis in association with human bias and understanding, so the very nature of financial analysts is likely not replicable by automation or AI easily.

Unless, everything is automated. But that would mean a large majority of jobs would be gone in every industry.

The machine learning algorithms already can identify data insights and generate data visualizations based on the information.

Financial Analysts work will shift away from data flattening to asking questions about the data.

In the next decade, rather than the CFO asking questions for the lines of business to bring back information, they can text chat a bot to serve up in the information across the entire enterprise. This has implications on existing organizational hierarchies. I would expect a reduction in growth rate of this industry.

이 직업에 대한 답글을 남겨주세요.