Sottoscrittori di assicurazioni

Le persone hanno anche visualizzato

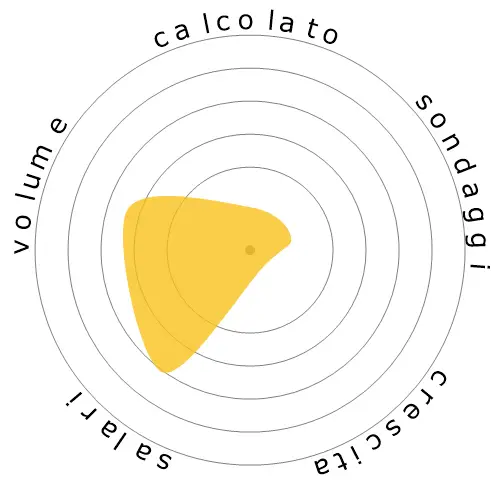

Rischio di automazione calcolato

Rischio Imminente (81-100%): Le professioni in questo livello hanno un'altissima probabilità di essere automatizzate nel prossimo futuro. Questi lavori consistono principalmente in compiti ripetitivi e prevedibili con scarsa necessità di giudizio umano.

Ulteriori informazioni su cosa sia questo punteggio e su come viene calcolato sono disponibili qui.

Sondaggio degli utenti

I nostri visitatori hanno votato che è probabile che questa professione sarà automatizzata. Questa valutazione è ulteriormente supportata dal livello di rischio di automazione calcolato, che stima una possibilità di automazione del 83%.

Cosa pensi sia il rischio dell'automazione?

Qual è la probabilità che Sottoscrittori di assicurazioni venga sostituito da robot o intelligenza artificiale nei prossimi 20 anni?

Sentimento

Il seguente grafico è incluso ovunque ci sia una quantità sostanziale di voti per rendere i dati significativi. Queste rappresentazioni visive mostrano i risultati dei sondaggi degli utenti nel tempo, fornendo un'indicazione significativa delle tendenze di sentimento.

Sentimento nel tempo (annuale)

Crescita

Si prevede che il numero di offerte di lavoro per 'Insurance Underwriters' diminuirà 4,0% entro il 2033

Occupazione totale e stime delle offerte di lavoro

Le previsioni aggiornate sono previste per 09-2025.

Salari

Nel 2023, il salario annuo mediano per 'Insurance Underwriters' era di 77.860 $, o 37 $ all'ora.

'Insurance Underwriters' hanno ricevuto un salario 62,0% superiore al salario mediano nazionale, che si attestava a 48.060 $

Salari nel tempo

Volume

A partire dal 2023 c'erano 101.310 persone impiegate come 'Insurance Underwriters' negli Stati Uniti.

Questo rappresenta circa il 0,07% della forza lavoro impiegata in tutto il paese

In altre parole, circa 1 su 1 mille persone sono impiegate come 'Insurance Underwriters'.

Descrizione del lavoro

Esaminare singole domande di assicurazione per valutare il grado di rischio coinvolto e determinare l'accettazione delle domande.

SOC Code: 13-2053.00

Commenti

I am considering entering insurance underwriting because claims were very bad, I must say.

Would you say that computer automation is taking over all areas of underwriting (commercial underwriting, property & casualty underwriting, etc.)? I do hear that it is taking personal insurance by storm.

Also, I am REALLY trying hard to find similar jobs to underwriting/insurance in case underwriting doesn't work out.

I'm looking at cost estimating (outside of construction), property assessment, and budget analysis. According to the Bureau of Labor Statistics, you don't necessarily need a business or finance degree to go into these fields (I took several traditional/core business classes in school, and I also majored in a field much like "business psychology" - organizational development, which was in the business school).

Do you have any alternatives that you plan to explore in case you have to leave underwriting? Do you think any of the ones that I mentioned are feasible alternatives?

Thank you,

Carl Daniel

There is no doubt automation will transform this job and remove the need for the underwriter defined above. There are two different types of underwriting, staff and line underwriting. Line underwriting is what is defined above, an employee who reviews applications and degree of risk on accounts on an individual basis. Staff underwriters develop guidelines and initiatives to help drive the changes in product performance . Line underwriters then follow these guidelines and initiatives.

Staff underwriting will adapt to automation and use the tools made available by it to make better decisions. You will see some reduction in this field due to ease of decision making and some of these functions will likely transfer to automation.

Another thing to consider is that is the complexity of insurance. Insurance is ever evolving based on the ever changing ways of the world. Especially in commercial insurance, there are way too many unique situations that occur on a daily basis that there is no true basic answer to based on past history, but instead require an instinctive decision by an experienced underwriter. It is highly unlikely automation will be able to adapt to these daily situations. This is how some line underwriting will survive.

Do you mean to say that this definition removes the need for an underwriter? - "Review individual applications for insurance to evaluate the degree of risk involved and determine the acceptance of applications."

Oh, sorry, I just realized that you mentioned that this definition only applies to line underwriting, and that automation will decrease the need for line underwriters.

Thank you for clarifying that there are two types of underwriting - I wasn't aware of that. Underwriting is the only field in insurance that interests me, but I'm not into sales. I've been working in claims (and subrogation) for years, but it's not my cup of tea.

Since I don't have the educational background to be an actuary, underwriting is pretty much the only option left for me.

I've never heard of staff underwriting before - unfortunately, working in claims didn't teach me much about underwriting.

It seems like staff underwriting is the future of employment in underwriting.

You mentioned that commercial insurance/underwriting is hard to predict due to the constantly evolving and complex nature of insurance.

I'm considering getting my Associates in Commercial Underwriting while I search for a job in underwriting.

What do you think about the future of employment in commercial underwriting? Do you think there's any hope for cautious optimism, especially for staff underwriters in commercial underwriting?

Thank you,

Carl Daniel

Lascia un commento su questa professione