Conseillers Financiers Personnels

Où souhaitez-vous aller ensuite ?

Ou, explorez cette profession en détail...

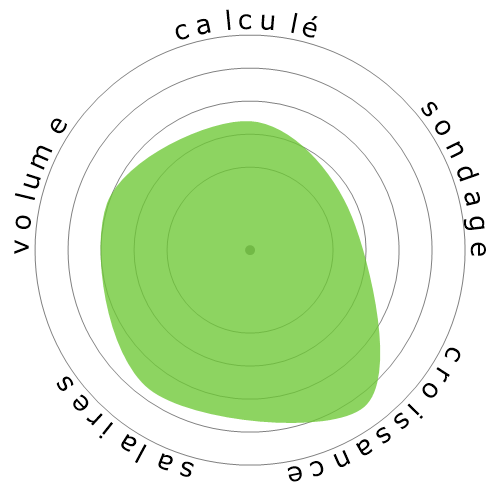

Que montre ce flocon de neige ?

Qu'est-ce que c'est ?

Nous évaluons les emplois en utilisant quatre facteurs. Ceux-ci sont :

- Risque d'automatisation

- Croissance de l'emploi

- Salaires

- Volume de postes disponibles

Ce sont quelques points clés à prendre en compte lors de la recherche d'un emploi.

Les gens ont également vu

Risque d'automatisation calculé

Risque Modéré (41-60%) : Les professions présentant un risque modéré d'automatisation impliquent généralement des tâches routinières mais nécessitent toujours un certain jugement et interaction humains.

Plus d'informations sur ce que représente ce score et comment il est calculé sont disponibles ici.

Sondage utilisateur

Nos visiteurs ont voté qu'ils ne sont pas sûrs si cette profession sera automatisée. Cette évaluation est davantage soutenue par le niveau de risque d'automatisation calculé, qui estime 43% de chances d'automatisation.

Que pensez-vous du risque de l'automatisation?

Quelle est la probabilité que Conseillers Financiers Personnels soit remplacé par des robots ou l'intelligence artificielle dans les 20 prochaines années ?

Sentiment

Le graphique suivant est affiché là où il y a suffisamment de votes pour produire des données significatives. Il présente les résultats des sondages utilisateurs au fil du temps, offrant une indication claire des tendances de sentiment.

Sentiment au fil du temps (annuellement)

Croissance

On s'attend à ce que le nombre de postes vacants pour 'Personal Financial Advisors' augmente 17,1% d'ici 2033

Emploi total, et estimations des offres d'emploi

Les prévisions mises à jour sont attendues 09-2025.

Salaires

En 2023, le salaire annuel médian pour 'Personal Financial Advisors' était de 99 580 $, soit 48 $ par heure.

'Personal Financial Advisors' ont été payés 107,2% de plus que le salaire médian national, qui était de 48 060 $

Salaires au fil du temps

Volume

À partir de 2023, il y avait 272 190 personnes employées en tant que 'Personal Financial Advisors' aux États-Unis.

Cela représente environ 0,18% de la main-d'œuvre employée à travers le pays

Autrement dit, environ 1 personne sur 557 est employée en tant que 'Personal Financial Advisors'.

Description du poste

Conseillez les clients sur les plans financiers en utilisant les connaissances en matière de fiscalité et de stratégies d'investissement, de valeurs mobilières, d'assurances, de plans de retraite et d'immobilier. Les tâches comprennent l'évaluation des actifs, des passifs, des flux de trésorerie, de la couverture d'assurance, du statut fiscal et des objectifs financiers des clients. Peut également acheter et vendre des actifs financiers pour les clients.

SOC Code: 13-2052.00

Commentaires (30)

How can one relate to a line of code, or trust that the programmers inherent biases are not skewing the results?

I’m completely on the fence when it comes to which jobs and when AI will replace the human workforce. I don’t underestimate the ambitions of tech producers and the average human being's preference for the quick, easy, and cheaper option to bring about such a situation. And let’s not forget how far technology has come since the Internet, let alone the simple calculator.

All this said we shouldn’t think that the scenario where AI could replace the human workforce is one that’s predetermined. “We” (everyone single one of us) have the collective ability to cause or prevent such an eventuality. We must also consider how viable an AI-dominated society and economy would really be. Every government across the globe would have its hands cut out with a population whose majority is unemployable. Imagine the civil unrest? Another consideration is the damage this could do to the economy; if a massive portion of humanity isn’t working, and isn’t getting a wage like they used to, we would see an unprecedented reduction in the flow of money around the economy. And what happens to money when there is a lack of exchange taking place? Doesn’t the value of money decrease? The financial advisors in this forum would be the best to elaborate on this or to correct my statement.

In conclusion: while I have no doubt that the ambitious tech lords and their acolytes will do what they can to bring about an AI world, the question of whether humans from governments to ordinary citizens will allow it is another thing altogether.

Répondre au commentaire