Analystes financiers et en investissement

Où souhaitez-vous aller ensuite ?

Ou, explorez cette profession en détail...

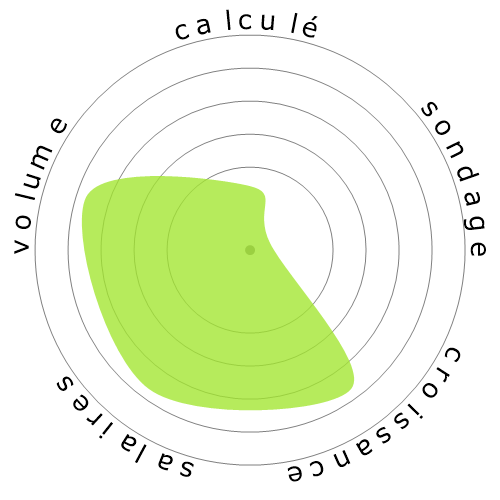

Que montre ce flocon de neige ?

Qu'est-ce que c'est ?

Nous évaluons les emplois en utilisant quatre facteurs. Ceux-ci sont :

- Risque d'automatisation

- Croissance de l'emploi

- Salaires

- Volume de postes disponibles

Ce sont quelques points clés à prendre en compte lors de la recherche d'un emploi.

Les gens ont également vu

Risque d'automatisation calculé

Risque Élevé (61-80%) : Les emplois dans cette catégorie font face à une menace significative de l'automatisation, car beaucoup de leurs tâches peuvent être facilement automatisées en utilisant les technologies actuelles ou proches du futur.

Plus d'informations sur ce que représente ce score et comment il est calculé sont disponibles ici.

Sondage utilisateur

Nos visiteurs ont voté que c'est très probable que cette profession sera automatisée. Cette évaluation est davantage soutenue par le niveau de risque d'automatisation calculé, qui estime 77% de chances d'automatisation.

Que pensez-vous du risque de l'automatisation?

Quelle est la probabilité que Analystes financiers et en investissement soit remplacé par des robots ou l'intelligence artificielle dans les 20 prochaines années ?

Sentiment

Le graphique suivant est affiché là où il y a suffisamment de votes pour produire des données significatives. Il présente les résultats des sondages utilisateurs au fil du temps, offrant une indication claire des tendances de sentiment.

Sentiment au fil du temps (trimestriel)

Sentiment au fil du temps (annuellement)

Croissance

On s'attend à ce que le nombre de postes vacants pour 'Financial and Investment Analysts' augmente 9,5% d'ici 2033

Emploi total, et estimations des offres d'emploi

Les prévisions mises à jour sont attendues 09-2025.

Salaires

En 2023, le salaire annuel médian pour 'Financial and Investment Analysts' était de 99 010 $, soit 48 $ par heure.

'Financial and Investment Analysts' ont été payés 106,0% de plus que le salaire médian national, qui était de 48 060 $

Salaires au fil du temps

Volume

À partir de 2023, il y avait 325 220 personnes employées en tant que 'Financial and Investment Analysts' aux États-Unis.

Cela représente environ 0,21% de la main-d'œuvre employée à travers le pays

Autrement dit, environ 1 personne sur 466 est employée en tant que 'Financial and Investment Analysts'.

Description du poste

Effectuez des analyses quantitatives d'informations impliquant des programmes d'investissement ou des données financières d'institutions publiques ou privées, y compris l'évaluation des entreprises.

SOC Code: 13-2051.00

Commentaires (34)

It's already been attempted for decades to automate wall street most well known example being Blackrock's Aladdin

Then there's the technical work done by hedge funds most notably Medallion.

Even if the stock market truly was fully automated it would already be priced in and become worthless

A good trading strategy actually requires some subjectivity specifically for preventing arbitrage by quants.

I really don't think AI is going to change much, the innovation that's needed to generate Alpha can't be done by AI

TL;DR it can't be fully automated, if it could it already would have been

Reporting activities are done by Python robots and so on.

Investment activities are being replaced by robots and AI, but we still have the issue of emotions involved. However, since companies don't usually take aggressive approaches to investments, they typically invest in fixed income.

Operational tasks are a thing of the past.

Répondre au commentaire