Souscripteurs d'assurance

Où souhaitez-vous aller ensuite ?

Ou, explorez cette profession en détail...

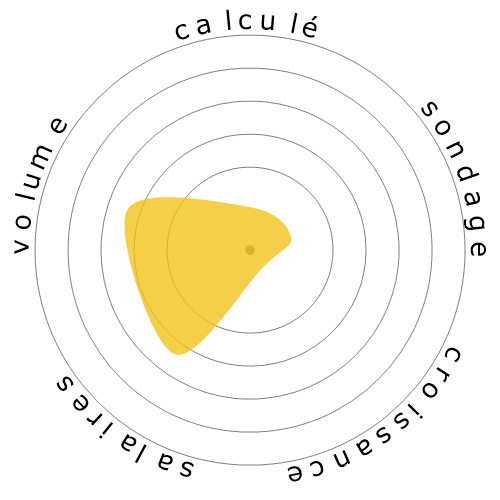

Que montre ce flocon de neige ?

Qu'est-ce que c'est ?

Nous évaluons les emplois en utilisant quatre facteurs. Ceux-ci sont :

- Risque d'automatisation

- Croissance de l'emploi

- Salaires

- Volume de postes disponibles

Ce sont quelques points clés à prendre en compte lors de la recherche d'un emploi.

Les gens ont également vu

Risque d'automatisation calculé

Risque Imminent (81-100%) : Les professions à ce niveau ont une probabilité extrêmement élevée d'être automatisées dans un avenir proche. Ces emplois consistent principalement en des tâches répétitives et prévisibles, nécessitant peu de jugement humain.

Plus d'informations sur ce que représente ce score et comment il est calculé sont disponibles ici.

Sondage utilisateur

Nos visiteurs ont voté qu'il est probable que cette profession sera automatisée. Cette évaluation est davantage soutenue par le niveau de risque d'automatisation calculé, qui estime 83% de chances d'automatisation.

Que pensez-vous du risque de l'automatisation?

Quelle est la probabilité que Souscripteurs d'assurance soit remplacé par des robots ou l'intelligence artificielle dans les 20 prochaines années ?

Sentiment

Le graphique suivant est affiché là où il y a suffisamment de votes pour produire des données significatives. Il présente les résultats des sondages utilisateurs au fil du temps, offrant une indication claire des tendances de sentiment.

Sentiment au fil du temps (annuellement)

Croissance

On s'attend à ce que le nombre d'offres d'emploi pour 'Insurance Underwriters' diminue 4,0% d'ici 2033

Emploi total, et estimations des offres d'emploi

Les prévisions mises à jour sont attendues 09-2025.

Salaires

En 2023, le salaire annuel médian pour 'Insurance Underwriters' était de 77 860 $, soit 37 $ par heure.

'Insurance Underwriters' ont été payés 62,0% de plus que le salaire médian national, qui était de 48 060 $

Salaires au fil du temps

Volume

À partir de 2023, il y avait 101 310 personnes employées en tant que 'Insurance Underwriters' aux États-Unis.

Cela représente environ 0,07% de la main-d'œuvre employée à travers le pays

Autrement dit, environ 1 personne sur 1 mille est employée en tant que 'Insurance Underwriters'.

Description du poste

Examiner les demandes d'assurance individuelles pour évaluer le degré de risque impliqué et déterminer l'acceptation des demandes.

SOC Code: 13-2053.00

Commentaires (8)

I am considering entering insurance underwriting because claims were very bad, I must say.

Would you say that computer automation is taking over all areas of underwriting (commercial underwriting, property & casualty underwriting, etc.)? I do hear that it is taking personal insurance by storm.

Also, I am REALLY trying hard to find similar jobs to underwriting/insurance in case underwriting doesn't work out.

I'm looking at cost estimating (outside of construction), property assessment, and budget analysis. According to the Bureau of Labor Statistics, you don't necessarily need a business or finance degree to go into these fields (I took several traditional/core business classes in school, and I also majored in a field much like "business psychology" - organizational development, which was in the business school).

Do you have any alternatives that you plan to explore in case you have to leave underwriting? Do you think any of the ones that I mentioned are feasible alternatives?

Thank you,

Carl Daniel

Do you mean to say that this definition removes the need for an underwriter? - "Review individual applications for insurance to evaluate the degree of risk involved and determine the acceptance of applications."

Oh, sorry, I just realized that you mentioned that this definition only applies to line underwriting, and that automation will decrease the need for line underwriters.

Thank you for clarifying that there are two types of underwriting - I wasn't aware of that. Underwriting is the only field in insurance that interests me, but I'm not into sales. I've been working in claims (and subrogation) for years, but it's not my cup of tea.

Since I don't have the educational background to be an actuary, underwriting is pretty much the only option left for me.

I've never heard of staff underwriting before - unfortunately, working in claims didn't teach me much about underwriting.

It seems like staff underwriting is the future of employment in underwriting.

You mentioned that commercial insurance/underwriting is hard to predict due to the constantly evolving and complex nature of insurance.

I'm considering getting my Associates in Commercial Underwriting while I search for a job in underwriting.

What do you think about the future of employment in commercial underwriting? Do you think there's any hope for cautious optimism, especially for staff underwriters in commercial underwriting?

Thank you,

Carl Daniel

Répondre au commentaire