Asesores Financieros Personales

¿A dónde te gustaría ir a continuación?

O, Explora Esta Profesión en Mayor Detalle...

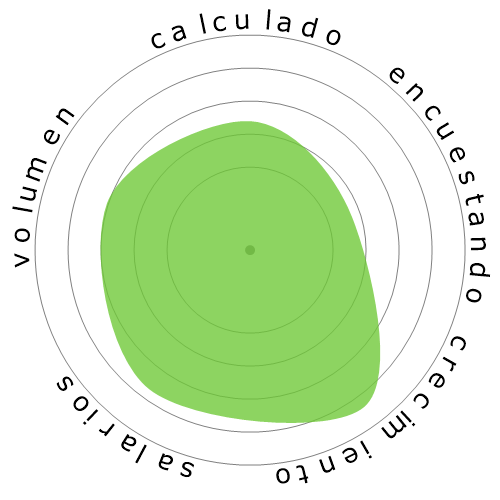

¿Qué muestra este copo de nieve?

¿Qué es esto?

Calificamos los trabajos usando cuatro factores. Estos son:

- Probabilidad de ser automatizado

- Crecimiento laboral

- Salarios

- Volumen de posiciones disponibles

Estos son algunos puntos clave a considerar cuando se busca empleo.

Las personas también vieron

Riesgo de automatización calculado

Riesgo Moderado (41-60%): Las ocupaciones con un riesgo moderado de automatización generalmente implican tareas rutinarias pero aún requieren cierto juicio e interacción humanos.

Más información sobre qué es esta puntuación y cómo se calcula está disponible aquí.

Encuesta de usuarios

Nuestros visitantes han votado que no están seguros si esta ocupación será automatizada. Esta evaluación se ve respaldada por el nivel de riesgo de automatización calculado, que estima una posibilidad del 43% de automatización.

¿Cuál crees que es el riesgo de la automatización?

¿Cuál es la probabilidad de que Asesores Financieros Personales sea reemplazado por robots o inteligencia artificial en los próximos 20 años?

Sentimiento

El siguiente gráfico se muestra donde hay suficientes votos para producir datos significativos. Muestra los resultados de las encuestas de usuarios a lo largo del tiempo, proporcionando una clara indicación de las tendencias de sentimiento.

Sentimiento a lo largo del tiempo (anualmente)

Crecimiento

Se espera que el número de ofertas de trabajo para 'Personal Financial Advisors' aumente 17,1% para 2033

Empleo total y estimaciones de vacantes laborales

Las proyecciones actualizadas se deben 09-2025.

Salarios

En 2023, el salario anual mediano para 'Personal Financial Advisors' fue de 99.580 $, o 48 $ por hora.

'Personal Financial Advisors' recibieron un salario 107,2% más alto que el salario medio nacional, que se situó en 48.060 $

Salarios a lo largo del tiempo

Volumen

A partir de 2023, había 272.190 personas empleadas como 'Personal Financial Advisors' dentro de los Estados Unidos.

Esto representa alrededor del 0,18% de la fuerza laboral empleada en todo el país.

Dicho de otra manera, alrededor de 1 de cada 557 personas están empleadas como 'Personal Financial Advisors'.

Descripción del trabajo

Asesore a los clientes sobre planes financieros utilizando conocimientos de estrategias de impuestos e inversiones, valores, seguros, planes de pensiones y bienes raíces. Las responsabilidades incluyen evaluar los activos, pasivos, flujo de efectivo, cobertura de seguro, estado fiscal y objetivos financieros de los clientes. También puede comprar y vender activos financieros para los clientes.

SOC Code: 13-2052.00

Comentarios (30)

How can one relate to a line of code, or trust that the programmers inherent biases are not skewing the results?

I’m completely on the fence when it comes to which jobs and when AI will replace the human workforce. I don’t underestimate the ambitions of tech producers and the average human being's preference for the quick, easy, and cheaper option to bring about such a situation. And let’s not forget how far technology has come since the Internet, let alone the simple calculator.

All this said we shouldn’t think that the scenario where AI could replace the human workforce is one that’s predetermined. “We” (everyone single one of us) have the collective ability to cause or prevent such an eventuality. We must also consider how viable an AI-dominated society and economy would really be. Every government across the globe would have its hands cut out with a population whose majority is unemployable. Imagine the civil unrest? Another consideration is the damage this could do to the economy; if a massive portion of humanity isn’t working, and isn’t getting a wage like they used to, we would see an unprecedented reduction in the flow of money around the economy. And what happens to money when there is a lack of exchange taking place? Doesn’t the value of money decrease? The financial advisors in this forum would be the best to elaborate on this or to correct my statement.

In conclusion: while I have no doubt that the ambitious tech lords and their acolytes will do what they can to bring about an AI world, the question of whether humans from governments to ordinary citizens will allow it is another thing altogether.

Responder al comentario