Analistas Financieros y de Inversiones

¿A dónde te gustaría ir a continuación?

O, Explora Esta Profesión en Mayor Detalle...

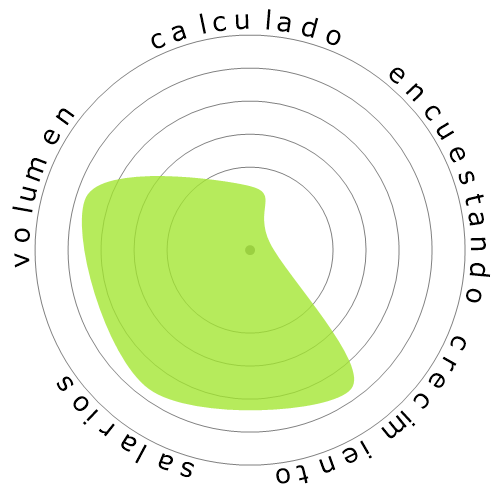

¿Qué muestra este copo de nieve?

¿Qué es esto?

Calificamos los trabajos usando cuatro factores. Estos son:

- Probabilidad de ser automatizado

- Crecimiento laboral

- Salarios

- Volumen de posiciones disponibles

Estos son algunos puntos clave a considerar cuando se busca empleo.

Las personas también vieron

Riesgo de automatización calculado

Alto Riesgo (61-80%): Los trabajos en esta categoría enfrentan una amenaza significativa por la automatización, ya que muchas de sus tareas pueden ser fácilmente automatizadas utilizando tecnologías actuales o de un futuro cercano.

Más información sobre qué es esta puntuación y cómo se calcula está disponible aquí.

Encuesta de usuarios

Nuestros visitantes han votado que es muy probable que esta ocupación sea automatizada. Esta evaluación se ve respaldada por el nivel de riesgo de automatización calculado, que estima una posibilidad del 77% de automatización.

¿Cuál crees que es el riesgo de la automatización?

¿Cuál es la probabilidad de que Analistas Financieros y de Inversiones sea reemplazado por robots o inteligencia artificial en los próximos 20 años?

Sentimiento

El siguiente gráfico se muestra donde hay suficientes votos para producir datos significativos. Muestra los resultados de las encuestas de usuarios a lo largo del tiempo, proporcionando una clara indicación de las tendencias de sentimiento.

Sentimiento a lo largo del tiempo (trimestralmente)

Sentimiento a lo largo del tiempo (anualmente)

Crecimiento

Se espera que el número de ofertas de trabajo para 'Financial and Investment Analysts' aumente 9,5% para 2033

Empleo total y estimaciones de vacantes laborales

Las proyecciones actualizadas se deben 09-2025.

Salarios

En 2023, el salario anual mediano para 'Financial and Investment Analysts' fue de 99.010 $, o 48 $ por hora.

'Financial and Investment Analysts' recibieron un salario 106,0% más alto que el salario medio nacional, que se situó en 48.060 $

Salarios a lo largo del tiempo

Volumen

A partir de 2023, había 325.220 personas empleadas como 'Financial and Investment Analysts' dentro de los Estados Unidos.

Esto representa alrededor del 0,21% de la fuerza laboral empleada en todo el país.

Dicho de otra manera, alrededor de 1 de cada 466 personas están empleadas como 'Financial and Investment Analysts'.

Descripción del trabajo

Realice análisis cuantitativos de información relacionada con programas de inversión o datos financieros de instituciones públicas o privadas, incluyendo la valoración de empresas.

SOC Code: 13-2051.00

Comentarios (34)

It's already been attempted for decades to automate wall street most well known example being Blackrock's Aladdin

Then there's the technical work done by hedge funds most notably Medallion.

Even if the stock market truly was fully automated it would already be priced in and become worthless

A good trading strategy actually requires some subjectivity specifically for preventing arbitrage by quants.

I really don't think AI is going to change much, the innovation that's needed to generate Alpha can't be done by AI

TL;DR it can't be fully automated, if it could it already would have been

Reporting activities are done by Python robots and so on.

Investment activities are being replaced by robots and AI, but we still have the issue of emotions involved. However, since companies don't usually take aggressive approaches to investments, they typically invest in fixed income.

Operational tasks are a thing of the past.

Responder al comentario