Agenti prodeje pojištění

Kam byste chtěli jít dál?

Nebo prozkoumejte tuto profesi podrobněji...

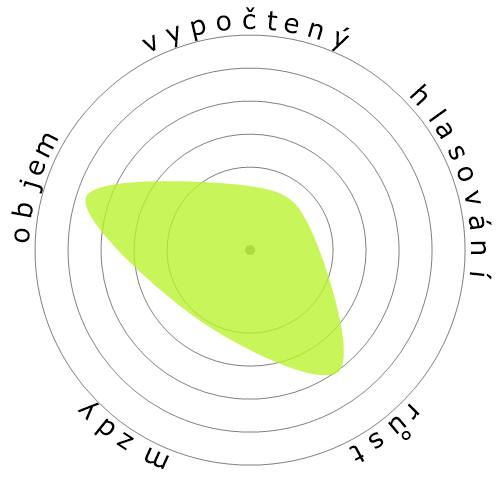

Co tato sněhová vločka ukazuje?

Co je to?

Práce hodnotíme podle čtyř faktorů. Jsou to:

- Pravděpodobnost automatizace

- Růst pracovních míst

- Mzdy

- Počet dostupných pozic

To jsou některé klíčové věci, o kterých byste měli přemýšlet při hledání práce.

Lidé také zobrazili

Vypočítané riziko automatizace

Bezprostřední riziko (81-100%): Profese na této úrovni mají extrémně vysokou pravděpodobnost automatizace v blízké budoucnosti. Tyto pracovní pozice se především skládají z opakujících se, předvídatelných úkolů, které vyžadují minimální lidské úsudky.

Další informace o tom, co tento skóre je a jak se vypočítává, jsou k dispozici zde.

Anketa uživatelů

Naši návštěvníci hlasovali, že si nejsou jisti, zda bude toto povolání automatizováno. Nicméně, úroveň rizika automatizace, kterou jsme vytvořili, naznačuje mnohem vyšší pravděpodobnost automatizace: 80% pravděpodobnost automatizace.

Jaký si myslíte, že je riziko automatizace?

Jaká je pravděpodobnost, že Agenti prodeje pojištění bude během příštích 20 let nahrazen roboty nebo umělou inteligencí?

Nálada

Následující graf je zobrazen tam, kde je dostatek hlasů k vytvoření smysluplných dat. Zobrazuje výsledky uživatelských anket v průběhu času a poskytuje jasný přehled o trendech nálad.

Nálada v průběhu času (ročně)

Růst

Počet pracovních míst pro 'Insurance Sales Agents' se očekává, že se zvýší o 6,1% do roku 2033

Celkové zaměstnanost a odhadované pracovní nabídky

Aktualizované projekce jsou splatné 09-2025.

Mzdy

V 2023 byla mediánová roční mzda pro 'Insurance Sales Agents' 59 080 $, což je 28 $ za hodinu.

'Insurance Sales Agents' byli placeni o 22,9% více než je národní mediánový plat, který činil 48 060 $

Mzdy v průběhu času

Objem

K 2023 bylo v Spojených státech zaměstnáno 457 510 lidí na pozici 'Insurance Sales Agents'.

Tohle představuje kolem 0,30% zaměstnané pracovní síly po celé zemi.

Jinými slovy, přibližně 1 z 331 lidí je zaměstnán jako 'Insurance Sales Agents'.

Popis práce

Prodávejte životní, majetkové, havarijní, zdravotní, automobilové nebo jiné typy pojištění. Můžete odkazovat klienty na nezávislé makléře, pracovat jako nezávislý makléř nebo být zaměstnancem pojišťovny.

SOC Code: 41-3021.00

Komentáře (25)

As for the insurance agent, AI can easily understand and sell a product. One could argue that using AI will increase the risk of E&O. That may be true, but 1) AI will improve and the E&O risk will greatly decrease and 2) The cost to use AI, and pay the salary of one or a team of specialists to maintain the AI will save so much on employee salaries (AI +3-5 people can easily replace 100+ agent departments) that the cost for E&O deductibles and possible E&O premium increase is outweighed. 100 agents making $60k/year = $6,000,000 saved.

An AI can do the same. Key in custom values and voila, a carefully crafted plan will be ready for you. And it may even analyse existing clients and suggest the most suitable plan for you. If you feel unsure about their decision and have more spare cash, you can raise the premium and decide to insure more.

Also, yes, you can buy insurance online, but I can't tell you how many times I had to go fix a problem or amend a policy because someone did it online and did not fully understand what they were doing.

Odpovědět na komentář