كتّاب التأمين

الأشخاص قاموا أيضاً بالمشاهدة

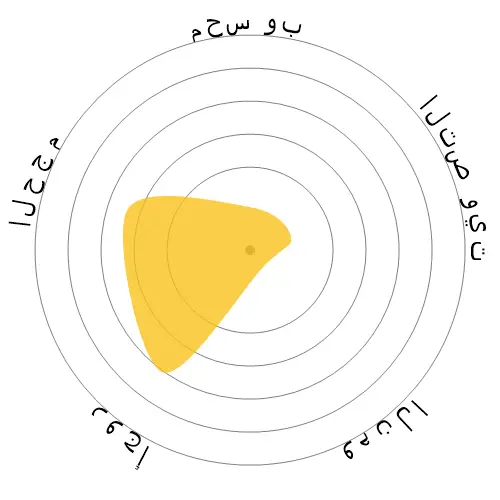

مخاطر الأتمتة المحسوبة

الخطر الوشيك (81-100%): المهن في هذا المستوى لديها احتمالية عالية جدا للتحول إلى الأتمتة في المستقبل القريب. تتألف هذه الوظائف في المقام الأول من المهام المتكررة والمتوقعة مع القليل من الحاجة للحكم البشري.

مزيد من المعلومات حول ما هذه النتيجة، وكيف يتم حسابها متوفرة هنا.

استطلاع رأي المستخدمين

صوت زوارنا بأنه من المحتمل أن يتم أتمتة هذه المهنة. يدعم هذا التقييم أيضًا بواسطة مستوى خطر الأتمتة المحسوب، الذي يقدر بـ 83٪ فرصة للأتمتة.

ما هو رأيك في مخاطر الأتمتة؟

ما هي احتمالية أن يتم استبدال كتّاب التأمين بالروبوتات أو الذكاء الاصطناعي في غضون العشرين سنة المقبلة؟

المشاعر

يتم تضمين الرسم البياني التالي في أي مكان يوجد فيه عدد كبير من الأصوات لتقديم بيانات ذات مغزى. تعرض هذه التمثيلات المرئية نتائج استطلاعات المستخدمين على مر الزمن، مما يوفر دلالة مهمة على اتجاهات المشاعر.

المشاعر على مر الزمن (سنوياً)

النمو

من المتوقع أن ينخفض 4٫0٪ عدد فرص العمل المتاحة لـ 'Insurance Underwriters' بحلول 2033

التوظيف الكلي، وفتحات الوظائف المقدرة

من المتوقع تحديث التوقعات في 09-2025.

أجور

في 2023، بلغ الأجر السنوي الوسيط لـ 'Insurance Underwriters' 77٬860 $، أو 37 $ في الساعة

تم دفع "Insurance Underwriters" بمقدار 62٫0٪ أعلى من الأجر الوسيط الوطني، الذي بلغ 48٬060 $

الأجور على مر الزمن

الحجم

بحلول 2023 كان هناك 101٬310 شخص يعملون كـ 'Insurance Underwriters' داخل الولايات المتحدة.

هذا يمثل حوالي 0٫07٪ من القوى العاملة الموظفة في جميع أنحاء البلاد

بتعبير آخر، حوالي 1 من كل 1 ألف أشخاص يعملون كـ 'Insurance Underwriters'.

وصف الوظيفة

راجع الطلبات الفردية للتأمين لتقييم درجة المخاطر المترتبة وتحديد قبول الطلبات.

SOC Code: 13-2053.00

تعليقات

I am considering entering insurance underwriting because claims were very bad, I must say.

Would you say that computer automation is taking over all areas of underwriting (commercial underwriting, property & casualty underwriting, etc.)? I do hear that it is taking personal insurance by storm.

Also, I am REALLY trying hard to find similar jobs to underwriting/insurance in case underwriting doesn't work out.

I'm looking at cost estimating (outside of construction), property assessment, and budget analysis. According to the Bureau of Labor Statistics, you don't necessarily need a business or finance degree to go into these fields (I took several traditional/core business classes in school, and I also majored in a field much like "business psychology" - organizational development, which was in the business school).

Do you have any alternatives that you plan to explore in case you have to leave underwriting? Do you think any of the ones that I mentioned are feasible alternatives?

Thank you,

Carl Daniel

There is no doubt automation will transform this job and remove the need for the underwriter defined above. There are two different types of underwriting, staff and line underwriting. Line underwriting is what is defined above, an employee who reviews applications and degree of risk on accounts on an individual basis. Staff underwriters develop guidelines and initiatives to help drive the changes in product performance . Line underwriters then follow these guidelines and initiatives.

Staff underwriting will adapt to automation and use the tools made available by it to make better decisions. You will see some reduction in this field due to ease of decision making and some of these functions will likely transfer to automation.

Another thing to consider is that is the complexity of insurance. Insurance is ever evolving based on the ever changing ways of the world. Especially in commercial insurance, there are way too many unique situations that occur on a daily basis that there is no true basic answer to based on past history, but instead require an instinctive decision by an experienced underwriter. It is highly unlikely automation will be able to adapt to these daily situations. This is how some line underwriting will survive.

Do you mean to say that this definition removes the need for an underwriter? - "Review individual applications for insurance to evaluate the degree of risk involved and determine the acceptance of applications."

Oh, sorry, I just realized that you mentioned that this definition only applies to line underwriting, and that automation will decrease the need for line underwriters.

Thank you for clarifying that there are two types of underwriting - I wasn't aware of that. Underwriting is the only field in insurance that interests me, but I'm not into sales. I've been working in claims (and subrogation) for years, but it's not my cup of tea.

Since I don't have the educational background to be an actuary, underwriting is pretty much the only option left for me.

I've never heard of staff underwriting before - unfortunately, working in claims didn't teach me much about underwriting.

It seems like staff underwriting is the future of employment in underwriting.

You mentioned that commercial insurance/underwriting is hard to predict due to the constantly evolving and complex nature of insurance.

I'm considering getting my Associates in Commercial Underwriting while I search for a job in underwriting.

What do you think about the future of employment in commercial underwriting? Do you think there's any hope for cautious optimism, especially for staff underwriters in commercial underwriting?

Thank you,

Carl Daniel

اترك ردا حول هذه المهنة