Finansiella och investeringsanalytiker

Vart vill du åka härnäst?

Eller, utforska detta yrke i större detalj...

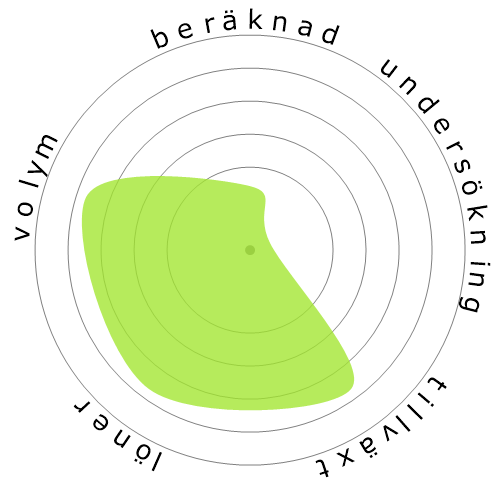

Vad visar denna snöflinga?

Vad är detta?

Vi betygsätter jobb med hjälp av fyra faktorer. Dessa är:

- Risken för att bli automatiserad

- Jobbtillväxt

- Löner

- Volymen av tillgängliga positioner

Dessa är några viktiga saker att tänka på när man söker jobb.

Personer tittade också på

Beräknad automatiseringsrisk

Hög risk (61-80%): Jobb i denna kategori står inför ett betydande hot från automatisering, eftersom många av deras uppgifter lätt kan automatiseras med nuvarande eller nära framtida tekniker.

Mer information om vad detta betyg är, och hur det beräknas finns tillgängligt här.

Användarundersökning

Våra besökare har röstat att det är mycket troligt att detta yrke kommer att automatiseras. Detta bedömning stöds ytterligare av den beräknade automationsrisknivån, som uppskattar 77% chans för automation.

Vad tror du är risken med automatisering?

Vad är sannolikheten att Finansiella och investeringsanalytiker kommer att ersättas av robotar eller artificiell intelligens inom de närmaste 20 åren?

Känsla

Följande graf visas där det finns tillräckligt med röster för att producera meningsfull data. Den visar användaromröstningsresultat över tid och ger en tydlig indikation på sentimenttrender.

Känsla över tid (kvartalsvis)

Känslor över tid (årligen)

Tillväxt

Antalet 'Financial and Investment Analysts' lediga jobb förväntas att öka med 9,5% till 2033

Total sysselsättning och uppskattade jobböppningar

Uppdaterade prognoser beräknas 09-2025.

Löner

I 2023 var den medianårliga lönen för 'Financial and Investment Analysts' 99 010 $, eller 48 $ per timme.

'Financial and Investment Analysts' betalades 106,0% högre än den nationella medianlönen, som låg på 48 060 $

Löner över tid

Volym

Från och med 2023 var det 325 220 personer anställda som 'Financial and Investment Analysts' inom USA.

Detta representerar cirka 0,21% av den anställda arbetskraften i hela landet

Sagt på ett annat sätt, runt 1 av 466 personer är anställda som 'Financial and Investment Analysts'.

Arbetsbeskrivning

Genomför kvantitativa analyser av information som involverar investeringsprogram eller finansiell data från offentliga eller privata institutioner, inklusive värdering av företag.

SOC Code: 13-2051.00

Kommentarer (34)

It's already been attempted for decades to automate wall street most well known example being Blackrock's Aladdin

Then there's the technical work done by hedge funds most notably Medallion.

Even if the stock market truly was fully automated it would already be priced in and become worthless

A good trading strategy actually requires some subjectivity specifically for preventing arbitrage by quants.

I really don't think AI is going to change much, the innovation that's needed to generate Alpha can't be done by AI

TL;DR it can't be fully automated, if it could it already would have been

Reporting activities are done by Python robots and so on.

Investment activities are being replaced by robots and AI, but we still have the issue of emotions involved. However, since companies don't usually take aggressive approaches to investments, they typically invest in fixed income.

Operational tasks are a thing of the past.

Svara på kommentar