Agentes de Vendas de Seguros

As pessoas também visualizaram

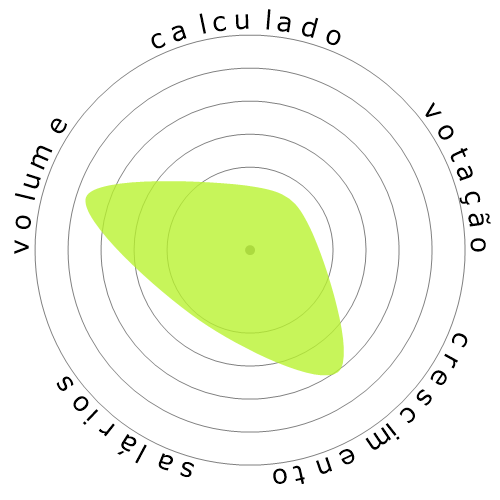

Risco de automação calculado

Risco Iminente (81-100%): Ocupações neste nível têm uma probabilidade extremamente alta de serem automatizadas num futuro próximo. Esses trabalhos consistem principalmente em tarefas repetitivas e previsíveis, com pouca necessidade de julgamento humano.

Mais informações sobre o que é essa pontuação e como ela é calculada estão disponíveis aqui.

Enquete do usuário

Nossos visitantes votaram que estão incertos se esta ocupação será automatizada. No entanto, o nível de risco de automação que geramos sugere uma chance muito maior de automação: 80% chance de automação.

O que você acha que é o risco da automação?

Qual é a probabilidade de que Agentes de Vendas de Seguros seja substituído por robôs ou inteligência artificial nos próximos 20 anos?

Sentimento

O gráfico a seguir é incluído sempre que há uma quantidade substancial de votos para gerar dados significativos. Essas representações visuais mostram os resultados das enquetes dos usuários ao longo do tempo, fornecendo uma indicação importante das tendências de sentimento.

Sentimento ao longo do tempo (anualmente)

Crescimento

Espera-se que o número de vagas de emprego para 'Insurance Sales Agents' aumente 6,1% até 2033

Emprego total e estimativa de vagas de emprego

As projeções atualizadas são devidas 09-2025.

Salários

Em 2023, o salário anual mediano para 'Insurance Sales Agents' foi de $ 59.080, ou $ 28 por hora

'Insurance Sales Agents' receberam 22,9% a mais do que o salário médio nacional, que era de $ 48.060

Salários ao longo do tempo

Volume

A partir de 2023 havia 457.510 pessoas empregadas como 'Insurance Sales Agents' dentro dos Estados Unidos.

Isso representa cerca de 0,30% da força de trabalho empregada em todo o país

Dito de outra maneira, cerca de 1 em 331 pessoas são empregadas como 'Insurance Sales Agents'.

Descrição do trabalho

Venda seguros de vida, propriedade, acidentes, saúde, automóveis ou outros tipos de seguros. Pode encaminhar clientes para corretores independentes, trabalhar como um corretor independente ou ser empregado por uma companhia de seguros.

SOC Code: 41-3021.00

Comentários

Leave a comment

As for the insurance agent, AI can easily understand and sell a product. One could argue that using AI will increase the risk of E&O. That may be true, but 1) AI will improve and the E&O risk will greatly decrease and 2) The cost to use AI, and pay the salary of one or a team of specialists to maintain the AI will save so much on employee salaries (AI +3-5 people can easily replace 100+ agent departments) that the cost for E&O deductibles and possible E&O premium increase is outweighed. 100 agents making $60k/year = $6,000,000 saved.

An AI can do the same. Key in custom values and voila, a carefully crafted plan will be ready for you. And it may even analyse existing clients and suggest the most suitable plan for you. If you feel unsure about their decision and have more spare cash, you can raise the premium and decide to insure more.

Also, yes, you can buy insurance online, but I can't tell you how many times I had to go fix a problem or amend a policy because someone did it online and did not fully understand what they were doing.

Claims are the product we sell. No claims, no need for an Agent or a company for that matter

Si nos quedan 20 años, me quedo contento, con eso. Los que amamos dicha actividad, cuando las empresas en este caso de Argentina, dan un paso para lo virtual, se encuentran con muchos problemas. (El fraude es uno de los principales costos) como tambien el costo operartivo (comisiones estructura de las empresas), pero si la ecuacion es bajar el costo, y esto hace subir los fraudes, no veo la ventaja.

And like another has said referring to Amazon, all Amazon has to do is optimize Alexa so she can talk back to you and ask you all the questions needed to properly underwrite and sell you your policy.

Another company to take a look at is Spixii

https://www.spixii.com/infobot

As a client who has unlimited access to information and reviews online, I can spend an hour's time myself comparing 10+ different companies from my couch and never have to step into an insurance office (which face it is extremely dull no matter who you are).

Big players like TD are disrupting the market in Canada with their self serve online P&C products and another of the big ones in Canada, The Co-operators, is pushing their group plans which are completely self serve and offer steep discounts compared to their regular products (I've seen less than half price). Which they can do because they cut out the middle man.

Amazon has also been speculated to start dabbling in the insurance business. Bezos is a conqueror and once he comes for you, it is only a matter of time.

When companies stand to save millions of dollars per year, it will happen. And it will happen quicker than you think.

Have you worked with AI and algorithms and machine learning before? I can tell you that personal insurance, with as many different factors that there can be, there certainly are solutions for all of the coverage requirements and options. If an insurance company can build in redundancy-proof errors, it wouldn't be a stretch at all to implement those redundancy-proofs to an online, automated, customer-driven platform to purchase insurance.

As soon as a client enters their license number, we can extract their license history, claims history, insurance history and conviction history. AI could easily take out the important information and calculate accordingly.

Who cares if they choose the insurance that isn't the best for them? Is that your personal responsibility to worry about what everyone chooses for every aspect of their life? Caveat emptor. Google it. Read it. Understand it.

There are many, many industries that take advantage of general ignorance. You've made a straw man argument that does not stand up to actual scrutiny. Brokers are on the way out. It is a matter of time, not opinion.

Deixe uma resposta sobre esta ocupação