Persoonlijke Financiële Adviseurs

Waar Wilt U Hierna Heen Gaan?

Of, verken dit beroep in meer detail...

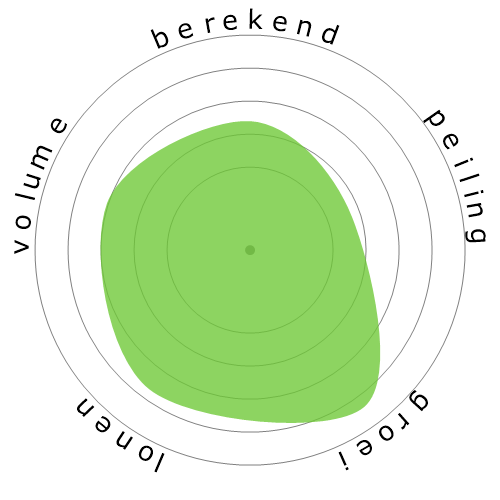

Wat laat deze sneeuwvlok zien?

Wat is dit?

We beoordelen banen op basis van vier factoren. Deze zijn:

- Kans op automatisering

- Banengroei

- Salarissen

- Aantal beschikbare posities

Dit zijn enkele belangrijke zaken om over na te denken bij het zoeken naar een baan.

Mensen bekeken ook

Berekend automatiseringsrisico

Gemiddeld Risico (41-60%): Beroepen met een gemiddeld risico op automatisering omvatten meestal routinetaken, maar vereisen nog steeds enige menselijke beoordeling en interactie.

Meer informatie over wat deze score is en hoe deze wordt berekend, is beschikbaar hier.

Gebruikerspeiling

Onze bezoekers hebben gestemd dat ze niet zeker weten of dit beroep zal worden geautomatiseerd. Deze beoordeling wordt verder ondersteund door het berekende automatiseringsrisiconiveau, dat een schatting geeft van 43% kans op automatisering.

Wat denk je dat het risico van automatisering is?

Wat is de kans dat Persoonlijke Financiële Adviseurs binnen de komende 20 jaar vervangen zal worden door robots of kunstmatige intelligentie?

Gevoel

De volgende grafiek wordt weergegeven waar er voldoende stemmen zijn om betekenisvolle gegevens te produceren. Het toont de resultaten van gebruikerspeilingen in de loop van de tijd en biedt een duidelijk beeld van sentimenttrends.

Gevoel over tijd (jaarlijks)

Groei

Het aantal 'Personal Financial Advisors' vacatures zal naar verwachting stijgen met 17,1% tegen 2033

Totale werkgelegenheid en geschatte vacatures

Bijgewerkte prognoses zijn verschuldigd 09-2025.

Lonen

In 2023 was het mediane jaarloon voor 'Personal Financial Advisors' 99.580 $, of 48 $ per uur

'Personal Financial Advisors' werden 107,2% hoger betaald dan het nationale mediane loon, dat op 48.060 $ stond.

Lonen in de loop van de tijd

Volume

Vanaf 2023 waren er 272.190 mensen in dienst als 'Personal Financial Advisors' binnen de Verenigde Staten.

Dit vertegenwoordigt ongeveer 0,18% van de werkende bevolking in het hele land.

Anders gezegd, ongeveer 1 op de 557 mensen is werkzaam als 'Personal Financial Advisors'.

Functieomschrijving

Adviseer klanten over financiële plannen met behulp van kennis van belasting- en investeringsstrategieën, effecten, verzekeringen, pensioenplannen en onroerend goed. Taken omvatten het beoordelen van klanten' activa, verplichtingen, kasstroom, verzekeringsdekking, belastingstatus en financiële doelstellingen. Kan ook financiële activa voor klanten kopen en verkopen.

SOC Code: 13-2052.00

Opmerkingen (30)

How can one relate to a line of code, or trust that the programmers inherent biases are not skewing the results?

I’m completely on the fence when it comes to which jobs and when AI will replace the human workforce. I don’t underestimate the ambitions of tech producers and the average human being's preference for the quick, easy, and cheaper option to bring about such a situation. And let’s not forget how far technology has come since the Internet, let alone the simple calculator.

All this said we shouldn’t think that the scenario where AI could replace the human workforce is one that’s predetermined. “We” (everyone single one of us) have the collective ability to cause or prevent such an eventuality. We must also consider how viable an AI-dominated society and economy would really be. Every government across the globe would have its hands cut out with a population whose majority is unemployable. Imagine the civil unrest? Another consideration is the damage this could do to the economy; if a massive portion of humanity isn’t working, and isn’t getting a wage like they used to, we would see an unprecedented reduction in the flow of money around the economy. And what happens to money when there is a lack of exchange taking place? Doesn’t the value of money decrease? The financial advisors in this forum would be the best to elaborate on this or to correct my statement.

In conclusion: while I have no doubt that the ambitious tech lords and their acolytes will do what they can to bring about an AI world, the question of whether humans from governments to ordinary citizens will allow it is another thing altogether.

Reageer op reactie