Financiële en Investeringsanalisten

Waar Wilt U Hierna Heen Gaan?

Of, verken dit beroep in meer detail...

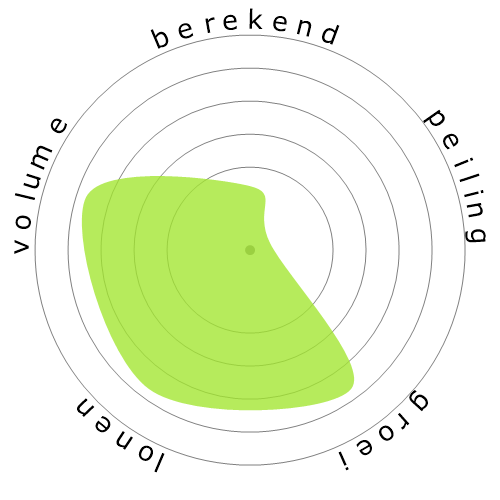

Wat laat deze sneeuwvlok zien?

Wat is dit?

We beoordelen banen op basis van vier factoren. Deze zijn:

- Kans op automatisering

- Banengroei

- Salarissen

- Aantal beschikbare posities

Dit zijn enkele belangrijke zaken om over na te denken bij het zoeken naar een baan.

Mensen bekeken ook

Berekend automatiseringsrisico

Hoge Risico (61-80%): Banen in deze categorie lopen een aanzienlijk risico door automatisering, aangezien veel van hun taken gemakkelijk kunnen worden geautomatiseerd met behulp van huidige of nabije toekomstige technologieën.

Meer informatie over wat deze score is en hoe deze wordt berekend, is beschikbaar hier.

Gebruikerspeiling

Onze bezoekers hebben gestemd dat het zeer waarschijnlijk is dat dit beroep zal worden geautomatiseerd. Deze beoordeling wordt verder ondersteund door het berekende automatiseringsrisiconiveau, dat een schatting geeft van 77% kans op automatisering.

Wat denk je dat het risico van automatisering is?

Wat is de kans dat Financiële en Investeringsanalisten binnen de komende 20 jaar vervangen zal worden door robots of kunstmatige intelligentie?

Gevoel

De volgende grafiek wordt weergegeven waar er voldoende stemmen zijn om betekenisvolle gegevens te produceren. Het toont de resultaten van gebruikerspeilingen in de loop van de tijd en biedt een duidelijk beeld van sentimenttrends.

Sentiment over tijd (per kwartaal)

Gevoel over tijd (jaarlijks)

Groei

Het aantal 'Financial and Investment Analysts' vacatures zal naar verwachting stijgen met 9,5% tegen 2033

Totale werkgelegenheid en geschatte vacatures

Bijgewerkte prognoses zijn verschuldigd 09-2025.

Lonen

In 2023 was het mediane jaarloon voor 'Financial and Investment Analysts' $ 99.010, of $ 48 per uur

'Financial and Investment Analysts' werden 106,0% hoger betaald dan het nationale mediane loon, dat op $ 48.060 stond.

Lonen in de loop van de tijd

Volume

Vanaf 2023 waren er 325.220 mensen in dienst als 'Financial and Investment Analysts' binnen de Verenigde Staten.

Dit vertegenwoordigt ongeveer 0,21% van de werkende bevolking in het hele land.

Anders gezegd, ongeveer 1 op de 466 mensen is werkzaam als 'Financial and Investment Analysts'.

Functieomschrijving

Voer kwantitatieve analyses uit van informatie met betrekking tot investeringsprogramma's of financiële gegevens van openbare of particuliere instellingen, inclusief de waardering van bedrijven.

SOC Code: 13-2051.00

Opmerkingen (34)

It's already been attempted for decades to automate wall street most well known example being Blackrock's Aladdin

Then there's the technical work done by hedge funds most notably Medallion.

Even if the stock market truly was fully automated it would already be priced in and become worthless

A good trading strategy actually requires some subjectivity specifically for preventing arbitrage by quants.

I really don't think AI is going to change much, the innovation that's needed to generate Alpha can't be done by AI

TL;DR it can't be fully automated, if it could it already would have been

Reporting activities are done by Python robots and so on.

Investment activities are being replaced by robots and AI, but we still have the issue of emotions involved. However, since companies don't usually take aggressive approaches to investments, they typically invest in fixed income.

Operational tasks are a thing of the past.

Reageer op reactie