Analisti Finanziari e degli Investimenti

Dove Vorresti Andare Prossimamente?

Oppure, esplora questa professione in maggiore dettaglio...

Cosa mostra questo fiocco di neve?

Cos'è questo?

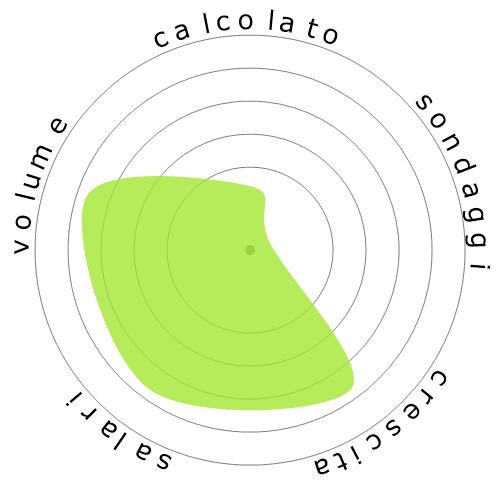

Valutiamo i lavori utilizzando quattro fattori. Questi sono:

- Possibilità di essere automatizzati

- Crescita del lavoro

- Salari

- Volume di posizioni disponibili

Questi sono alcuni aspetti chiave da considerare quando si cerca un lavoro.

Le persone hanno anche visualizzato

Rischio di automazione calcolato

Rischio Alto (61-80%): Le professioni in questa categoria affrontano una minaccia significativa dall'automazione, poiché molte delle loro attività possono essere facilmente automatizzate utilizzando le tecnologie attuali o di prossima generazione.

Ulteriori informazioni su cosa sia questo punteggio e su come viene calcolato sono disponibili qui.

Sondaggio degli utenti

I nostri visitatori hanno votato che è molto probabile che questa professione sarà automatizzata. Questa valutazione è ulteriormente supportata dal livello di rischio di automazione calcolato, che stima una possibilità di automazione del 77%.

Cosa pensi sia il rischio dell'automazione?

Qual è la probabilità che Analisti Finanziari e degli Investimenti venga sostituito da robot o intelligenza artificiale nei prossimi 20 anni?

Sentimento

Il seguente grafico viene mostrato dove ci sono abbastanza voti per produrre dati significativi. Visualizza i risultati dei sondaggi degli utenti nel tempo, fornendo un'indicazione chiara delle tendenze di sentimento.

Sentimento nel tempo (trimestrale)

Sentimento nel tempo (annuale)

Crescita

Il numero di offerte di lavoro per 'Financial and Investment Analysts' dovrebbe aumentare 9,5% entro il 2033

Occupazione totale e stime delle offerte di lavoro

Le previsioni aggiornate sono previste per 09-2025.

Salari

Nel 2023, il salario annuo mediano per 'Financial and Investment Analysts' era di 99.010 $, o 48 $ all'ora.

'Financial and Investment Analysts' hanno ricevuto un salario 106,0% superiore al salario mediano nazionale, che si attestava a 48.060 $

Salari nel tempo

Volume

A partire dal 2023 c'erano 325.220 persone impiegate come 'Financial and Investment Analysts' negli Stati Uniti.

Questo rappresenta circa il 0,21% della forza lavoro impiegata in tutto il paese

In altre parole, circa 1 su 466 persone sono impiegate come 'Financial and Investment Analysts'.

Descrizione del lavoro

Esegui analisi quantitative di informazioni relative a programmi di investimento o dati finanziari di istituzioni pubbliche o private, incluso la valutazione delle imprese.

SOC Code: 13-2051.00

Commenti (34)

It's already been attempted for decades to automate wall street most well known example being Blackrock's Aladdin

Then there's the technical work done by hedge funds most notably Medallion.

Even if the stock market truly was fully automated it would already be priced in and become worthless

A good trading strategy actually requires some subjectivity specifically for preventing arbitrage by quants.

I really don't think AI is going to change much, the innovation that's needed to generate Alpha can't be done by AI

TL;DR it can't be fully automated, if it could it already would have been

Reporting activities are done by Python robots and so on.

Investment activities are being replaced by robots and AI, but we still have the issue of emotions involved. However, since companies don't usually take aggressive approaches to investments, they typically invest in fixed income.

Operational tasks are a thing of the past.

Rispondi al commento