Suscriptores de Seguros

Las personas también vieron

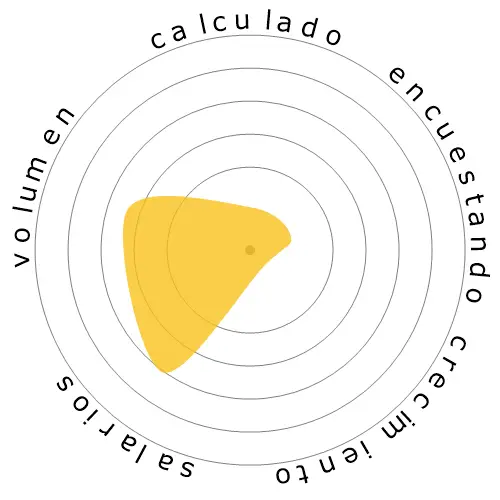

Riesgo de automatización calculado

Riesgo Inminente (81-100%): Las ocupaciones en este nivel tienen una probabilidad extremadamente alta de ser automatizadas en un futuro cercano. Estos trabajos consisten principalmente en tareas repetitivas y predecibles con poca necesidad de juicio humano.

Más información sobre qué es esta puntuación y cómo se calcula está disponible aquí.

Encuesta de usuarios

Nuestros visitantes han votado que es probable que esta ocupación se automatice. Esta evaluación se ve respaldada por el nivel de riesgo de automatización calculado, que estima una posibilidad del 83% de automatización.

¿Cuál crees que es el riesgo de la automatización?

¿Cuál es la probabilidad de que Suscriptores de Seguros sea reemplazado por robots o inteligencia artificial en los próximos 20 años?

Sentimiento

El siguiente gráfico se incluye siempre que haya una cantidad sustancial de votos para generar datos significativos. Estas representaciones visuales muestran los resultados de las encuestas de usuarios a lo largo del tiempo, proporcionando una indicación importante de las tendencias de sentimiento.

Sentimiento a lo largo del tiempo (anualmente)

Crecimiento

Se espera que el número de ofertas de trabajo para 'Insurance Underwriters' disminuya 4,0% para 2033

Empleo total y estimaciones de vacantes laborales

Las proyecciones actualizadas se deben 09-2025.

Salarios

En 2023, el salario anual mediano para 'Insurance Underwriters' fue de 77.860 $, o 37 $ por hora.

'Insurance Underwriters' recibieron un salario 62,0% más alto que el salario medio nacional, que se situó en 48.060 $

Salarios a lo largo del tiempo

Volumen

A partir de 2023, había 101.310 personas empleadas como 'Insurance Underwriters' dentro de los Estados Unidos.

Esto representa alrededor del 0,07% de la fuerza laboral empleada en todo el país.

Dicho de otra manera, alrededor de 1 de cada 1 mil personas están empleadas como 'Insurance Underwriters'.

Descripción del trabajo

Revisar las solicitudes individuales de seguro para evaluar el grado de riesgo involucrado y determinar la aceptación de las solicitudes.

SOC Code: 13-2053.00

Comentarios

I am considering entering insurance underwriting because claims were very bad, I must say.

Would you say that computer automation is taking over all areas of underwriting (commercial underwriting, property & casualty underwriting, etc.)? I do hear that it is taking personal insurance by storm.

Also, I am REALLY trying hard to find similar jobs to underwriting/insurance in case underwriting doesn't work out.

I'm looking at cost estimating (outside of construction), property assessment, and budget analysis. According to the Bureau of Labor Statistics, you don't necessarily need a business or finance degree to go into these fields (I took several traditional/core business classes in school, and I also majored in a field much like "business psychology" - organizational development, which was in the business school).

Do you have any alternatives that you plan to explore in case you have to leave underwriting? Do you think any of the ones that I mentioned are feasible alternatives?

Thank you,

Carl Daniel

There is no doubt automation will transform this job and remove the need for the underwriter defined above. There are two different types of underwriting, staff and line underwriting. Line underwriting is what is defined above, an employee who reviews applications and degree of risk on accounts on an individual basis. Staff underwriters develop guidelines and initiatives to help drive the changes in product performance . Line underwriters then follow these guidelines and initiatives.

Staff underwriting will adapt to automation and use the tools made available by it to make better decisions. You will see some reduction in this field due to ease of decision making and some of these functions will likely transfer to automation.

Another thing to consider is that is the complexity of insurance. Insurance is ever evolving based on the ever changing ways of the world. Especially in commercial insurance, there are way too many unique situations that occur on a daily basis that there is no true basic answer to based on past history, but instead require an instinctive decision by an experienced underwriter. It is highly unlikely automation will be able to adapt to these daily situations. This is how some line underwriting will survive.

Do you mean to say that this definition removes the need for an underwriter? - "Review individual applications for insurance to evaluate the degree of risk involved and determine the acceptance of applications."

Oh, sorry, I just realized that you mentioned that this definition only applies to line underwriting, and that automation will decrease the need for line underwriters.

Thank you for clarifying that there are two types of underwriting - I wasn't aware of that. Underwriting is the only field in insurance that interests me, but I'm not into sales. I've been working in claims (and subrogation) for years, but it's not my cup of tea.

Since I don't have the educational background to be an actuary, underwriting is pretty much the only option left for me.

I've never heard of staff underwriting before - unfortunately, working in claims didn't teach me much about underwriting.

It seems like staff underwriting is the future of employment in underwriting.

You mentioned that commercial insurance/underwriting is hard to predict due to the constantly evolving and complex nature of insurance.

I'm considering getting my Associates in Commercial Underwriting while I search for a job in underwriting.

What do you think about the future of employment in commercial underwriting? Do you think there's any hope for cautious optimism, especially for staff underwriters in commercial underwriting?

Thank you,

Carl Daniel

Deja una respuesta sobre esta ocupación