יועצים פיננסיים אישיים

לאן תרצה ללכת עכשיו?

או, חקור מקצוע זה בפירוט רב יותר...

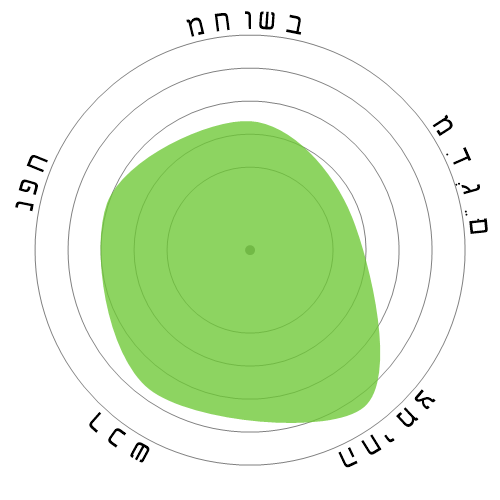

מה מראה פתית השלג הזה?

מה זה?

אנחנו מדרגים משרות באמצעות ארבעה גורמים. אלה הם:

- סיכוי להימכר

- צמיחה במשרה

- שכר

- נפח המשרות הזמינות

אלה הם כמה דברים מרכזיים לחשוב עליהם בעת חיפוש משרה.

אנשים צפו גם

סיכון אוטומציה מחושב

סיכון בינוני (41-60%): מקצועות עם סיכון בינוני לאוטומציה בדרך כלל כוללים משימות שגורתיות אך עדיין דורשים מערכת יחסים אנושית ושיקול דעת.

מידע נוסף על מהו הניקוד הזה, ואיך מחשבים אותו זמין כאן.

סקר משתמשים

המבקרים שלנו הצביעו שהם לא בטוחים אם מקצוע זה ימוטב.

הערכה זו מקבלת תמיכה נוספת מהמפתח של סיכון האוטומציה שנחשב, שמעריך 43% סיכוי לאוטומציה.

מה לדעתך הסיכון של אוטומציה?

מה הסיכוי שיועצים פיננסיים אישיים יוחלף על ידי רובוטים או אינטיליגנציה מלאכותית במהלך ה-20 השנים הבאות?

רגש

הגרף הבא מוצג כאשר יש מספיק הצבעות כדי להפיק נתונים משמעותיים. הוא מציג את תוצאות הסקרים של המשתמשים לאורך זמן, ומספק אינדיקציה ברורה למגמות בתחושות.

רגשות לאורך זמן (שנתי)

צמיחה

מספר המשרות הפנויות בתחום 'Personal Financial Advisors' צפוי לעלות 17.1% עד 2033

תעסוקה כוללת, ומשרות פנויות משוערות

עדכונים לתחזיות משוערות צפויים להתבצע 09-2025.

שכר

ב-2023, השכר השנתי החציוני עבור 'Personal Financial Advisors' היה 99.580 $, או 48 $ לשעה

'Personal Financial Advisors' קיבלו שכר שהיה גבוה 107.2% מאשר השכר החציוני הלאומי, שעמד על 48.060 $

שכר לאורך זמן

נפח

נכון ל-2023 היו 272,190 אנשים שעסקו כ'Personal Financial Advisors' בארצות הברית.

זה מייצג בערך 0.18% מהכוח העובד ברחבי המדינה

במילים אחרות, כאחד מ-557 אנשים מועסקים כ'Personal Financial Advisors'.

תיאור המשרה

ייעץ ללקוחות בתוכניות כלכליות באמצעות היכרות עם אסטרטגיות מס והשקעות, ניירות ערך, ביטוח, תוכניות פנסיה ונדל"ן. התפקיד כולל הערכת נכסי הלקוחות, ההתחייבויות שלהם, זרימת מזומנים, כיסוי ביטוח, מעמד מס, ומטרות כלכליות. עשוי גם לקנות ולמכור נכסים כלכליים בשביל הלקוחות.

SOC Code: 13-2052.00

תגובות (30)

How can one relate to a line of code, or trust that the programmers inherent biases are not skewing the results?

I’m completely on the fence when it comes to which jobs and when AI will replace the human workforce. I don’t underestimate the ambitions of tech producers and the average human being's preference for the quick, easy, and cheaper option to bring about such a situation. And let’s not forget how far technology has come since the Internet, let alone the simple calculator.

All this said we shouldn’t think that the scenario where AI could replace the human workforce is one that’s predetermined. “We” (everyone single one of us) have the collective ability to cause or prevent such an eventuality. We must also consider how viable an AI-dominated society and economy would really be. Every government across the globe would have its hands cut out with a population whose majority is unemployable. Imagine the civil unrest? Another consideration is the damage this could do to the economy; if a massive portion of humanity isn’t working, and isn’t getting a wage like they used to, we would see an unprecedented reduction in the flow of money around the economy. And what happens to money when there is a lack of exchange taking place? Doesn’t the value of money decrease? The financial advisors in this forum would be the best to elaborate on this or to correct my statement.

In conclusion: while I have no doubt that the ambitious tech lords and their acolytes will do what they can to bring about an AI world, the question of whether humans from governments to ordinary citizens will allow it is another thing altogether.

השב לתגובה