סוכני מכירות ביטוחים

אנשים צפו גם

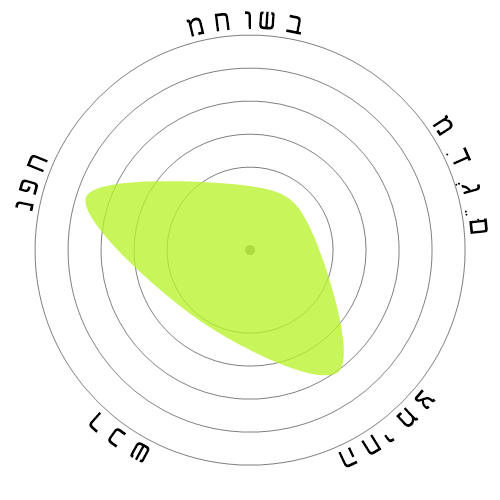

סיכון אוטומציה מחושב

סיכון מיידי (81-100%): מקצועות ברמה זו נמצאים בסיכון גבוה מאוד להיאוטומטים בעתיד הקרוב. מדובר בעיקר במשרות שמכילות משימות חוזרות ונשנות, צפויות, שאין בהן צורך רב בשיקול דעת אנושי.

מידע נוסף על מהו הניקוד הזה, ואיך מחשבים אותו זמין כאן.

סקר משתמשים

המבקרים שלנו הצביעו שהם לא בטוחים אם מקצוע זה ימוטב.

אך, רמת הסיכון של אוטומציה שיצרנו מציינת סיכוי הרבה גבוה יותר לאוטומציה: 80% סיכוי לאוטומציה.

מה לדעתך הסיכון של אוטומציה?

מה הסיכוי שסוכני מכירות ביטוחים יוחלף על ידי רובוטים או אינטיליגנציה מלאכותית במהלך ה-20 השנים הבאות?

רגש

הגרף הבא כלול בכל מקום שבו יש כמות משמעותית של הצבעות כדי להציג נתונים משמעותיים. ייצוגים חזותיים אלה מציגים את תוצאות הסקרים של המשתמשים לאורך זמן, ומספקים אינדיקציה משמעותית למגמות הרגש.

רגשות לאורך זמן (שנתי)

צמיחה

מספר המשרות הפנויות בתחום 'Insurance Sales Agents' צפוי לעלות 6.1% עד 2033

תעסוקה כוללת, ומשרות פנויות משוערות

עדכונים לתחזיות משוערות צפויים להתבצע 09-2025.

שכר

ב-2023, השכר השנתי החציוני עבור 'Insurance Sales Agents' היה 59,080 $, או 28 $ לשעה

'Insurance Sales Agents' קיבלו שכר שהיה גבוה 22.9% מאשר השכר החציוני הלאומי, שעמד על 48,060 $

שכר לאורך זמן

נפח

נכון ל-2023 היו 457,510 אנשים שעסקו כ'Insurance Sales Agents' בארצות הברית.

זה מייצג בערך 0.30% מהכוח העובד ברחבי המדינה

במילים אחרות, כאחד מ-331 אנשים מועסקים כ'Insurance Sales Agents'.

תיאור המשרה

מכירת ביטוח חיים, נכסים, אסונות, בריאות, אוטומובילים או סוגים אחרים של ביטוח. ייתכן ויחפשו לקוחות לסוכנים עצמאיים, יעבדו כסוכנים עצמאיים, או יהיו עובדים בחברת ביטוח.

SOC Code: 41-3021.00

תגובות

Leave a comment

As for the insurance agent, AI can easily understand and sell a product. One could argue that using AI will increase the risk of E&O. That may be true, but 1) AI will improve and the E&O risk will greatly decrease and 2) The cost to use AI, and pay the salary of one or a team of specialists to maintain the AI will save so much on employee salaries (AI +3-5 people can easily replace 100+ agent departments) that the cost for E&O deductibles and possible E&O premium increase is outweighed. 100 agents making $60k/year = $6,000,000 saved.

An AI can do the same. Key in custom values and voila, a carefully crafted plan will be ready for you. And it may even analyse existing clients and suggest the most suitable plan for you. If you feel unsure about their decision and have more spare cash, you can raise the premium and decide to insure more.

Also, yes, you can buy insurance online, but I can't tell you how many times I had to go fix a problem or amend a policy because someone did it online and did not fully understand what they were doing.

Claims are the product we sell. No claims, no need for an Agent or a company for that matter

Si nos quedan 20 años, me quedo contento, con eso. Los que amamos dicha actividad, cuando las empresas en este caso de Argentina, dan un paso para lo virtual, se encuentran con muchos problemas. (El fraude es uno de los principales costos) como tambien el costo operartivo (comisiones estructura de las empresas), pero si la ecuacion es bajar el costo, y esto hace subir los fraudes, no veo la ventaja.

And like another has said referring to Amazon, all Amazon has to do is optimize Alexa so she can talk back to you and ask you all the questions needed to properly underwrite and sell you your policy.

Another company to take a look at is Spixii

https://www.spixii.com/infobot

As a client who has unlimited access to information and reviews online, I can spend an hour's time myself comparing 10+ different companies from my couch and never have to step into an insurance office (which face it is extremely dull no matter who you are).

Big players like TD are disrupting the market in Canada with their self serve online P&C products and another of the big ones in Canada, The Co-operators, is pushing their group plans which are completely self serve and offer steep discounts compared to their regular products (I've seen less than half price). Which they can do because they cut out the middle man.

Amazon has also been speculated to start dabbling in the insurance business. Bezos is a conqueror and once he comes for you, it is only a matter of time.

When companies stand to save millions of dollars per year, it will happen. And it will happen quicker than you think.

Have you worked with AI and algorithms and machine learning before? I can tell you that personal insurance, with as many different factors that there can be, there certainly are solutions for all of the coverage requirements and options. If an insurance company can build in redundancy-proof errors, it wouldn't be a stretch at all to implement those redundancy-proofs to an online, automated, customer-driven platform to purchase insurance.

As soon as a client enters their license number, we can extract their license history, claims history, insurance history and conviction history. AI could easily take out the important information and calculate accordingly.

Who cares if they choose the insurance that isn't the best for them? Is that your personal responsibility to worry about what everyone chooses for every aspect of their life? Caveat emptor. Google it. Read it. Understand it.

There are many, many industries that take advantage of general ignorance. You've made a straw man argument that does not stand up to actual scrutiny. Brokers are on the way out. It is a matter of time, not opinion.

השאירו תגובה לגבי מקצוע זה